Sprott Critical Materials Monthly

The Emerging Renewable Energy Economy

View Critical Materials January 31, 2024 Performance Table

Key Takeaways

- A significant transition is underway in global energy production as the era of renewable energy emerges and reshapes power generation.

- This looks to be no fleeting phenomenon but a fundamental transformation powered by the relentless decline in renewable energy costs.

- The shift is driven by a combination of forces, including policy pressures, geopolitics, the traditional s-curve of technological revolution, and the virtuous cycle of rising skills and falling costs.

- While the growth of renewable energy seems unstoppable, it will require coordinated policy and other efforts to address multiple challenges.

- The Nasdaq Sprott Energy Transition Index declined in January. Spot uranium prices made new cycle highs on supply-demand pressures, while lithium and nickel were somewhat soft.

January in Review

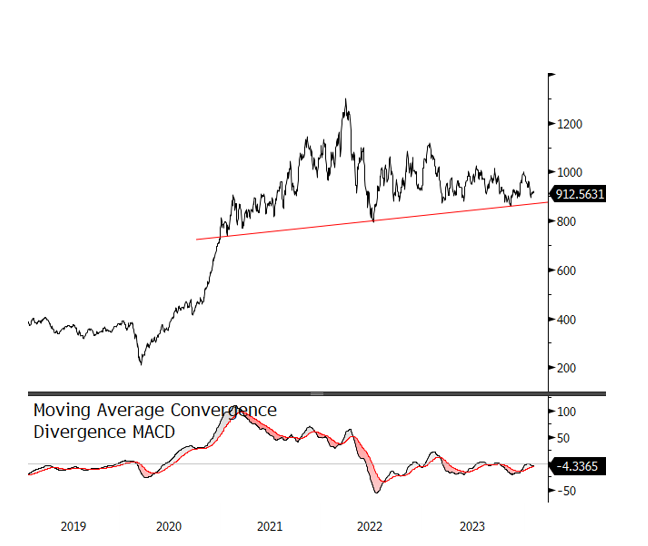

The Nasdaq Sprott Energy Transition Materials Index fell 7.44% in January to close the month at 912.56. Spot uranium prices made new cycle highs in the month as the fundamental picture of supply-demand continues to tighten with announced production shortfalls from Kazatomprom. Uranium miners continued to catch up to the remarkable surge in uranium prices, while lithium miners fell sharply as they lowered their estimates on weak lithium carbonate prices. Despite ongoing stimulus measures, continuing weakness in China has cast a pall over most metal miners despite signs of a soft landing in the U.S. and, possibly, globally.

62% of total global energy investment is now directed to clean energy.

As measured by the S&P 500 Index, the broad equity market made all-time highs in January, led by growing expectations of a soft landing, upcoming Federal Reserve (Fed) rate cuts, and the performance of the "Magnificent 7".16 The U.S. dollar and bond yields rebounded from their year-end oversold readings, creating an overall drag on financial conditions for most other assets. Oil prices have recovered due to escalating Middle East tensions in the broad commodity complex. Deteriorating economic data from China continues to weigh on metal markets as various stimulus measures have not been effective in boosting domestic demand, revitalizing the property market, or slowing the deflationary trend.

Figure 1. Nasdaq Sprott Index Continues to Consolidate (2019-2024)

Source: Bloomberg. Nasdaq Sprott Energy Transition Materials Index. Data as of 1/31/2024. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. Past performance is no guarantee of future results.

Updates on Critical Materials

Copper: Price Support from Energy Transition

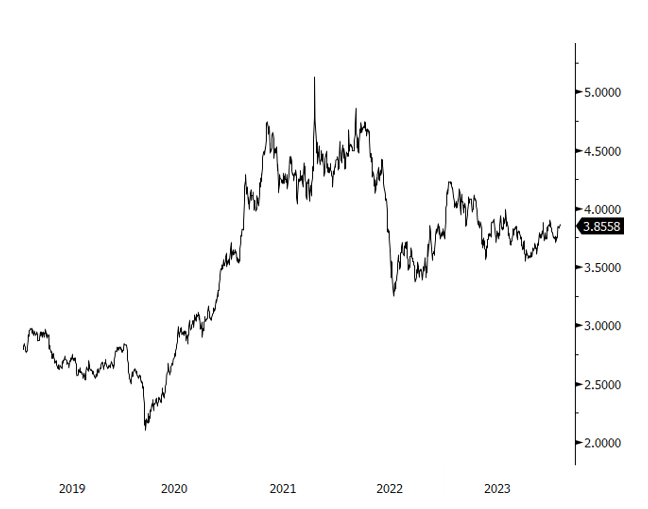

The copper spot price rose slightly by 0.43% to $3.86 per pound in January (see Figure 3), while shares of senior copper miners fell by 1.52% and shares of copper juniors fell by 3.69%. Increasing expectations of U.S. rate cuts had benefitted copper in recent months, but prices remained relatively flat in January despite the market still pricing in six Fed rate cuts in 2024. The copper spot price has also been fluctuating along with investors' expectations regarding Chinese economic data. The copper price was impacted by China’s December 2023 CPI release, which marked three months of declining prices, the longest deflationary streak in 14 years, and increased hopes for Chinese stimulus.17

Despite China facing deflation, copper has shown resilience compared to other critical minerals. Demand from China’s construction and manufacturing industries has weakened, but this has been more than offset by demand from the energy transition complex. Overall, Chinese demand for copper rose 5% in 2023. China accounts for approximately half of global copper consumption and has a sizeable impact on the market.

The pace of China’s energy transition has been remarkable. In 2023, China’s installed new solar capacity increased by 146% (greater than the amount installed in the last four years combined). New wind capacity rose 96% and electric vehicle (EV) sales climbed by 37.5%.18

Outside of China, the energy transition is also ramping up. At the COP28 UN Climate Change Conference held in December 2023, the declaration to triple global renewable capacity by 2030 will require significant investments from the West, and copper demand is likely to grow significantly to achieve that energy goal.

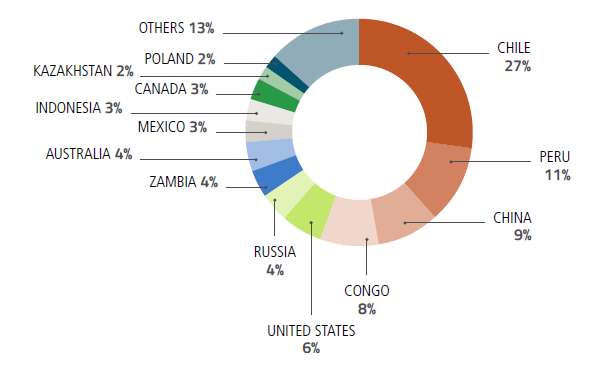

Supply disruptions have flipped many forecasters' 2024 copper market balances from surplus to deficit. These disruptions include strikes, slow ramp-ups, poor ore grades, bad weather, technical issues and more. For supply growth in 2024, the world is most heavily reliant on the Democratic Republic of the Congo and Chile. Chile’s supply increase, in particular, may prove to be susceptible to further disruption given that in January its state-owned copper miner Codelco indicated that copper output declined year-over-year in Q4 2023.19 This is significant because it means that Codelco’s copper production is at its lowest level in 25 years. However, the industry is likely to remain reliant on Codelco. On the back of rising taxes and regulatory uncertainty, projected private investment in copper mining globally has fallen 36% from 2019, when the price of copper has increased by 42%.20

Figure 2. Chile is the Largest Copper Producing Country

Source: U.S. Geological Survey, Mineral Commodity Summaries, January 2023.

Copper supply troubles threaten the industry's ability to meet astonishing projected long-term demand. The cumulative demand for copper estimated through 2050 is greater than the total amount produced in all of human history. Meeting this demand will require massive upfront investment. Although copper miners are healthily profitable at the current price, a higher incentive price will be needed for the next generation of new mines. Improving copper market fundamentals and a more supportive traditional economy may likely be bullish for both the copper spot price and copper miners.

In the shorter term, copper inventories are critically low. At the end of January, the inventory level was three days versus a long-term average of 13 days. Limited inventories raise the risk of a sudden price increase if buyers make large drawdowns to secure supplies. Further, treatment charges have plunged to their lowest level since 2021, when the copper spot price was trading at a higher range. (Treatment charges are the fees smelters charge miners — a lower fee means a smaller margin for the smelter and tighter mine supply.]

Figure 3. Copper Price Treads Water (2019-2024)

Source: Bloomberg. Copper spot price, $/lb. Data as of 1/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

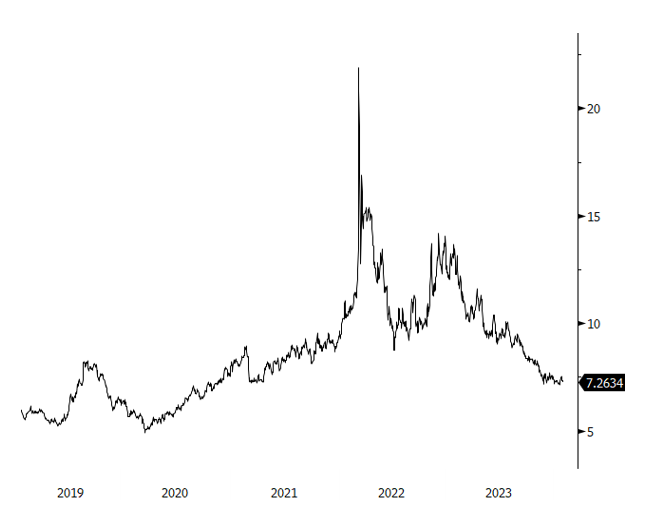

Lithium: Destocking Eases

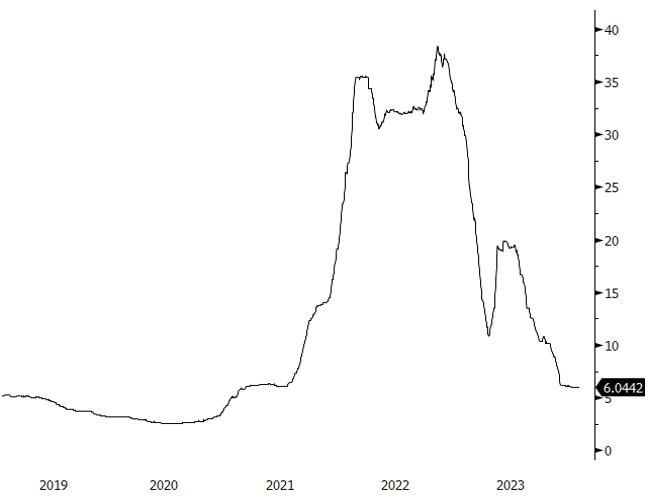

The lithium carbonate spot price fell by 1.97% to $6.04 per pound in January (see Figure 4), and shares of lithium miners fell by 26.14%. Inventory destocking pressures have been subdued thus far in 2024, stabilizing the price. This comes after an 81.95% price decline in 2023, preceded by a 72.49% rise in 2022 and a 442.80% jump in 2021.

Lithium prices are now supported by supply cuts in high-cost operations and delays or pauses in expansions and new projects. As the lithium price skyrocketed in previous years, China turned on supply from lepidolite, a lower-grade and higher-cost source of lithium. Much of this supply is no longer profitable in the current market environment. Further, the current low lithium spot price is also leading miners to reduce capital expenditures and cut workforces, hence the decline in lithium miner stocks in January.

As a result of this downturn, lithium miners' prices are now at levels last seen at the beginning of 2021. This significant sell-off reflects the immaturity of the lithium market. The recent lows in this cycle may likely be unsustainable, given that the current lithium pricing environment is not incentivizing future supply to meet forecast deficits and is constraining the supply response further. Research firm Benchmark Mineral Intelligence estimated in January that an incentive price of $28/kg would be required to close the projected 2030 lithium supply-demand deficit. This is $12.70 per pound, or 110.19%, higher than the January 2024 month-end price.

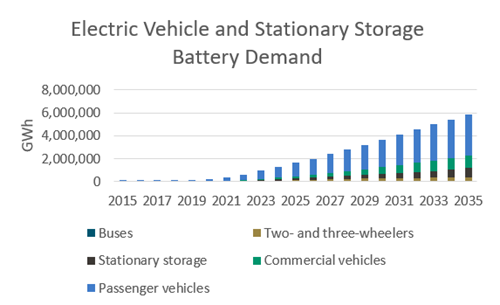

There is no real alternative for lithium in EVs and energy storage systems. Despite a perceived slowdown in EV sales, global electric vehicle sales increased from 10.5 million in 2022 to 14 million in 2023. Sales are further forecast to increase to 16.7 million in 2024. Ultimately, we believe EV penetration rates are likely to continue to rise, thereby likely increasing the demand potential for lithium to the benefit of lithium miners.

Figure 4. Lithium Carbonate Spot Price USD $/lb (2019-2024)

Source: Bloomberg. Lithium carbonate spot price, $/lb. Data as of 1/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

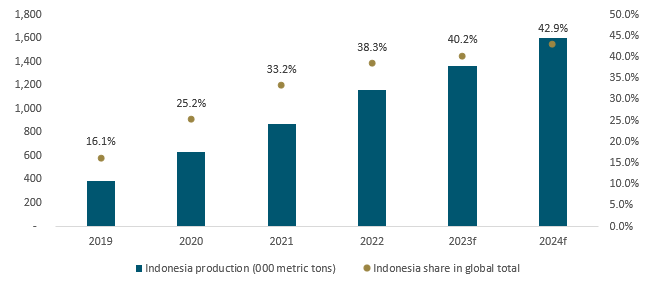

Nickel: Mine Suspensions Ramp Up

The nickel spot price fell slightly by 2.21% to $7.26 per pound in January (see Figure 5) and shares of nickel miners fell by 6.64%. The nickel price is now at a cyclical low as the industry goes through structural changes. The price drawdown comes as lower-cost Indonesian nickel supply ramps up and gains global market share (see Figure 6). Outside of Indonesia, the low nickel price is intersecting further down the cost curve and has led to multiple mine suspensions. Mine suspensions announced in 2024 so far total 2% of the 2023 nickel mine capacity.21 This may bring the market closer to balance and help stabilize the nickel price.

Figure 5. Nickel at Cyclical Low (2019-2024)

Source: Bloomberg. Data as of 01/31/2024. Included for illustrative purposes only. Past performance is no guarantee of future results.

Figure 6. Indonesia’s Annual Primary Nickel Production (2019-2024)

Source: S&P Global Market Intelligence. 22 Data as of 12/31/2023.

The Emerging Economics of Renewable Energy

A significant transition is underway in global energy production. The era of renewable energy is emerging and beginning to reshape power generation. Recent trends suggest that this shift is no fleeting phenomenon but a fundamental transformation powered by the relentless fall in renewable energy costs. The world is investing heavily in renewables. Some 62% of total global energy investment is now directed to clean energy.23

The impetus for this shift is multifaceted. Events like the Russia-Ukraine war exposed the vulnerabilities of dependence on fossil fuels and the need for energy security. Policy initiatives like the Investment Reduction Act (IRA) in the U.S. and the REPowerEU plan in Europe accelerate this transition, signaling the commitment to a sustainable energy future.

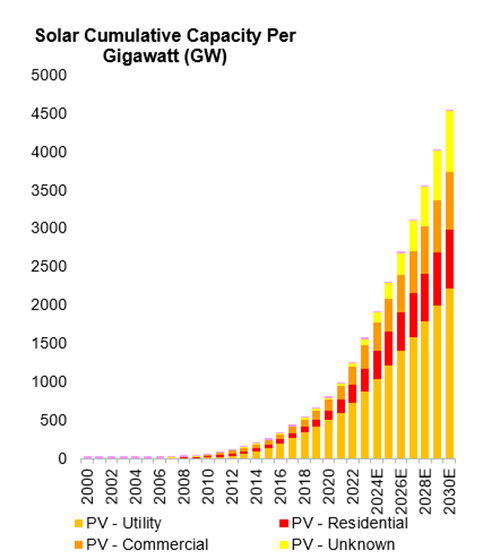

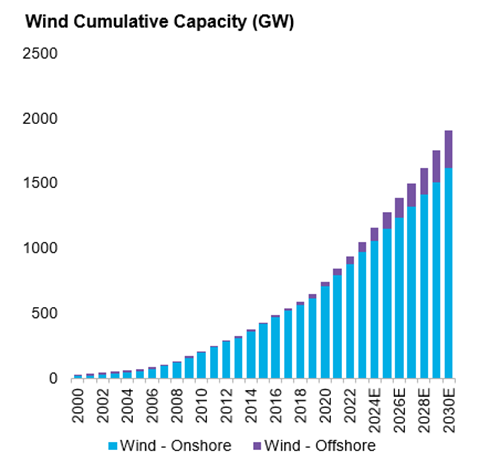

The narrative of renewable energy's growth is now one of exponential acceleration.

Renewable energy is no longer the higher-cost alternative option. Solar and wind have transitioned from subsidy-reliant nascent industries to the most cost-effective sources of new electricity. This leap forward is due to technological breakthroughs that have addressed challenges like grid variability and economic viability. Private sector investments have played a crucial role.

The narrative of renewable energy's growth is now one of exponential acceleration. Solar, wind and battery storage deployment has skyrocketed in the past decade, driven by a mix of policy directives, technological breakthroughs, economic incentives, falling prices and rising technology solutions.

The Macro Drivers and Factors of Cost Reduction:

Macro forces driving the acceleration of renewable energy include:

- S-Curve: Wind and solar are following the classic S-curve trajectory in technological revolutions. Initially, growth is slow as the technologies are nascent and expensive. However, as efficiencies improve and costs decrease, adoption rates rise dramatically, leading to a steep upward curve in deployment.

- Policy Pressure: Since 2013, nations accounting for 90% of the global economy have set ambitious net-zero targets. These policy commitments have created a robust framework for renewable energy deployment. The European Union’s REPowerEU plan and the U.S. Inflation Reduction Act, in particular, have provided significant impetus. Worsening climate data and rising temperatures continue to pressure politicians to pursue measures to accelerate the energy transition.

- Geopolitics: Geopolitical events, especially Russia's invasion of Ukraine, have highlighted the risks of relying on fossil fuels. The Russia-Ukraine war accelerated a policy shift, making renewable energy not just an environmental choice but a strategic imperative for energy security. It highlighted European dependency on Russian fossil fuel energy and reminded the West of its dependence on Chinese renewable energy technology. Energy security concerns are prompting countries to produce their own renewable electricity and reduce their dependency on other nations.

- Rapid Deployment: The deployment of solar, wind and battery storage technologies is growing at an unprecedented rate. According to the International Energy Agency, a substantial majority of capital investment in electricity generation in 2023 is expected to be in low-carbon technologies, predominantly solar and wind (see Figure 7).

Figure 7. Exponential Growth in Solar, Wind, and Battery Storage

Source: Bloomberg NEF. Data as of 12/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

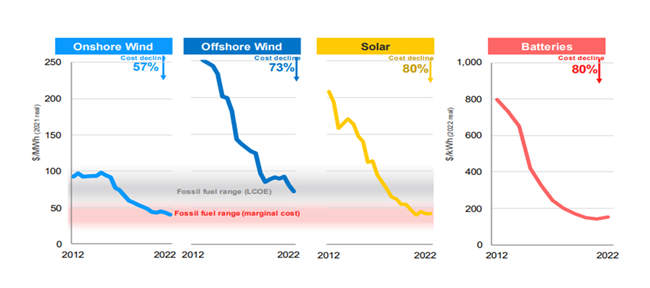

No Longer the High-Priced Alternative

Falling costs are a major driver of renewable energy’s remarkable growth trajectory. Between 2012 and 2022, solar and onshore wind power costs plummeted by 80% and 57%, respectively. This trend is not slowing down; solar energy costs are expected to halve again by 2030.9 These spectacular cost reductions have shifted solar and wind from being high-priced alternatives to among the cheapest energy sources in many parts of the world (see Figure 8).

Figure 8. The Collapsing Cost of Renewables

Source: Bloomberg NEF. Data as of 12/31/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Key drivers of cost reduction include:

- Technological Advancements: Continuous technological improvements have increased the efficiency and lifespan of renewable energy installations.

- Learning Curve Effects: The more solar and wind projects are deployed, the more experience the industry gains, leading to greater efficiencies that further reduce costs.

- Economies of Scale: As the market for renewables has grown, so have economies of scale, lowering the cost of production and deployment.

- Knowledge-Sharing: The global nature of the renewable energy industry means that advances and cost reductions in one part of the world quickly spread, benefiting the entire industry.

- Government Policy: Governments worldwide have significantly reduced renewable energy costs through various policies and incentives. These include tax credits, subsidies, feed-in tariffs and renewable energy targets. Such measures have reduced the financial risk for renewable energy projects and encouraged investment in research and development.

- Global Competition: The international nature of the renewable energy market has fostered competition among manufacturers and developers, further driving down costs. Companies compete for market share in different regions of the world, so are incentivized to innovate and reduce costs to remain competitive.

- Increased Investment: As renewable energy technologies have proven their reliability and profitability, there has been a significant increase in investment from both the public and private sectors. This influx of capital has improved the financing conditions for renewable energy projects, reducing the cost of capital and, consequently, the overall cost of energy production.

- Falling Soft Costs: Alongside hardware costs, soft costs like permitting, financing and customer acquisition have also decreased over time. Streamlined regulatory processes and increased market familiarity with renewable energy systems have contributed to these reductions.

The decline in renewable energy costs is expected to continue. Technological innovation is ongoing, economies of scale may likely to increase as global demand grows, and policy support remains strong in many regions of the world. This trend bodes well for the continued expansion of renewable energy, making it an increasingly central pillar of the global energy system.

Overcoming Barriers and Accelerating Change

Renewable energy is experiencing an accelerated transformation driven by technological advancements, economic factors, and a global commitment to sustainable development. This shift appears to be unstoppable and is already happening at a pace that promises a future that is cleaner, more sustainable, and more equitable.

In 2023, the renewable electricity sector hit new capacity peaks, with solar energy at the forefront. This growth was driven by significant contributions from China, the EU and the U.S., marking a worldwide commitment to a cleaner energy future. The transportation sector is also transforming as EVs become increasingly prevalent. Cheaper renewable energy makes EV charging significantly more cost-effective than gasoline, marking another pivotal step in the broader energy transition.

While seemingly economically unavoidable, the shift to renewable energy still requires coordinated policy and other efforts to address multiple challenges, including energy variability, grid infrastructure, mineral availability, legislative and land use issues, and capital requirements. Actions taken now will facilitate the transition and enable further advancements in a cycle where each successful step generates further progress.

Critical Materials: January 31, 2024 Performance

| Metric | 1/31/2024 | 12/31/2023 | Change | % Chg | YTD Chg | Monthly Comment |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 912.56 | 985.91 | (73.35) | (7.44)% | (7.44)% |

Spot uranium hit new recent highs due to supply-demand tightening on production shortfalls from Kazatomprom. Uranium miners are catching up with these price surges, and lithium miners are sharply falling due to weak lithium carbonate. Despite stimulus measures, China’s economic weakness is affecting metal miners, notwithstanding potential soft landings in the US and globally. |

| Nasdaq Sprott Lithium Miners™ Index2 | 543.98 | 736.47 | (192.49) | (26.14)% | (26.14)% | |

| North Shore Global Uranium Mining Index3 | 4,340.95 | 3,846.25 |

494.70 |

12.86% | 12.86% | |

| Nasdaq Sprott Copper Miners Index4 | 1,030.40 | 1,046.28 | (15.88) | (1.52)% | (1.52)% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 617.09 | 661.01 | (43.92) | (6.64)% | (6.64)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 931.68 | 967.43 | (35.75) | (3.69)% | (3.69)% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 |

1,728.96 |

1,454.75 |

274.21 | 18.85% | 18.85% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 6.04 | 6.16 | (0.12) | (1.97)% | (1.97)% |

Descent decelerating |

| U3O8 Uranium Spot Price $/lb9 | 101.08 | 91.09 | 9.99 | 10.96% | 10.96% |

Jumps on strengthening fundamentals |

| LME Copper Spot Price $/lb10 | 3.86 | 3.84 | 0.02 | 0.43% | 0.43% |

Continues to show resilience |

| LME Nickel Spot Price $/lb11 | 7.26 | 7.43 | (0.16) | (2.21)% | (2.21)% |

Indonesian supply weighing on the market |

| Benchmarks | ||||||

| S&P 500 Index12 | 4,845.65 | 4,769.83 | 75.82 | 1.59% | 1.59% |

The S&P 500 Index is at record highs due to anticipated soft landing, Fed rate cuts and the Magnificent 7. However, the U.S. dollar and bond yield rebound have negatively impacted other assets. While Middle East tensions boost oil prices, poor economic data from China pressures metal markets as stimulus measures fail to improve domestic demand or slow deflation. |

| DXY US Dollar Index13 | 103.27 | 101.33 | 1.94 | 1.92% | 1.92% | |

| BBG Commodity Index14 | 98.56 | 98.65 | (0.09) | (0.09)% | (0.09)% | |

| S&P Metals & Mining Index15 | 2,927.81 | 3,063.68 | (135.87) | (4.43)% | (4.43)% | |

*Mo % Chg and YTD % Chg for this Index are calculated as the difference between the month end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points.

For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Footnotes

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry, and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members. The calculation is done in USD as a total return index. Index adjustments are carried out semi-annually. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of a selection of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and to USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS metals & mining sub-industry. |

| 16 | Seven mega-cap growth companies in the S&P 500 Index regarded as market leaders, namely Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA). |

| 17 | Financial Post, “China's Worst Deflation Streak in 14 Years Puts Pressure on PBOC”, January 11, 2024 |

| 18 | BMO Equity Research |

| 19 | BNN Bloomberg, “Codelco Caps Worst Year in Quarter Century With Copper Production Drop, January 12, 2024 |

| 20 | Bloomberg NEF (behind paywall) |

| 21 | Bloomberg NEF (behind paywall) |

| 22 | S&P Global Market Intelligence, “Indonesian nickel production dominates commodity market” February 6, 2024 |

| 23 | World Economic Forum, “Renewables were the world’s cheapest source of energy in 2020”, July 5, 2021 |

| 24 | World Economic Forum, Global Future Council on Energy Technologies, Community Report August 2020 |

Important Disclosures

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only market makers or “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.