Two Distinct ETFs.

One Powerful Theme.

URNM and URNJ

Pure-Play Exposure to the

Uranium Growth Story

Uranium demand is rising as reliable nuclear power becomes essential for energy security and AI driven electricity needs, while supply remains scarce.

Sprott Uranium Miners ETF (NYSE Arca: URNM) and Sprott Junior

Uranium Miners ETF (Nasdaq: URNJ) are pure-play1 uranium miners ETFs that offer you

direct exposure to the uranium growth story.

| Sprott Uranium Miners ETF | Sprott Junior Uranium Miners ETF | |

|---|---|---|

| Ticker | URNM | URNJ |

| Asset Class | Uranium Mining Equities &Physical Uranium | Junior Uranium Mining Equities |

| Key Feature | Pure-Play Uranium ETF: A U.S.-listed Uranium ETF focused on uranium miners and physical uranium | Pure-Play Junior Uranium ETF: The only2 pure-play ETF focused on small uranium miners, selected for their potential for significant revenue and asset growth |

| Inception Date | 12/3/20193 | 2/1/2023 |

| Total Net Assets (USD)3 | $1.8 Billion | $342.6 Million |

| Management Fee | 0.75% | 0.80% |

| Other Expenses | 0.00% | 0.00% |

| Total Annual Fund Operating Expenses4 | 0.75% | 0.80%5 |

1 The term “pure-play” relates directly to the exposure that the Fund has to the total universe of investable, publicly listed securities in the investment strategy.

2 Based on Morningstar’s universe of Natural Resources Sector Equity ETFs as of 12/31/2025.

3 Inception Date: 12/3/2019. URNM was reorganized from the North Shore Global Uranium Mining ETF into the Sprott Uranium Miners ETF on 4/22/2022. URNM is a continuation of the prior ETF and, therefore, the performance information shown includes the prior ETF’s performance. AUM data as of 12/31/2025.

4 As of the most recent prospectus. Visit sprottetfs.com for the latest prospectus.

5 Reflects Total Annual Operating Expenses as outlined in the most recent prospectus. For the services the Adviser (Sprott Asset Management USA, Inc.) provides to the Fund, the Adviser is entitled to receive an annual advisory fee from the Fund calculated daily and paid monthly at an annual rate of 0.80% of net assets.

Uranium: A Critical Energy Solution

Nuclear power is taking center stage as governments, utilities and big tech turn to nuclear energy to secure reliable, baseload power.

The AI revolution is accelerating global electricity demand. Data centers built by companies like Microsoft, Google and Amazon require massive amounts of reliable power and nuclear is their long-term solution.

Global Nuclear Reactors in Play

Source: World Nuclear Association as of 1/13/2026.

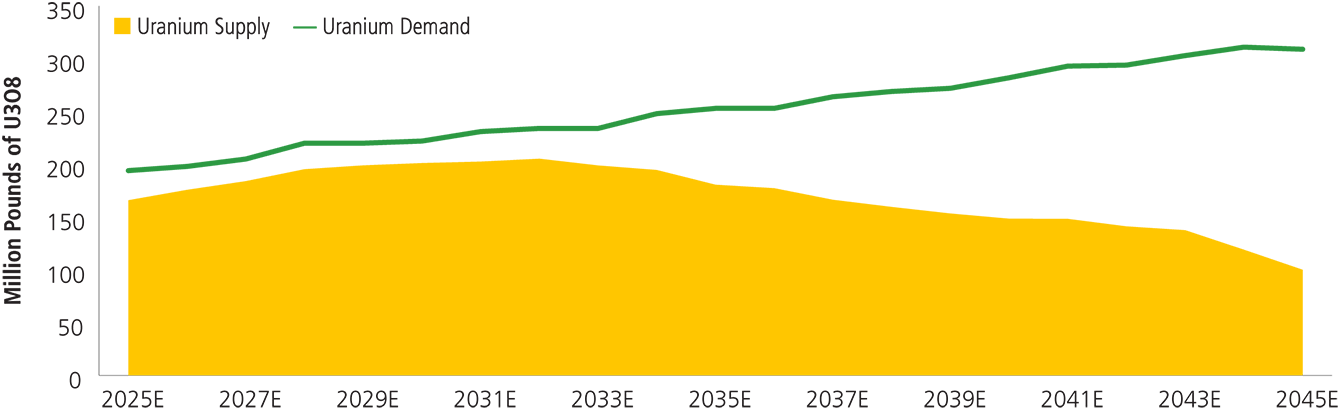

A Growing Supply-Demand Imbalance

Uranium miners are positioned at the heart of a structural supply deficit.

- Demand for uranium may likely outstrip supply, with a 1.4-billion-pound deficit to 2045.

- The pledge to triple global nuclear capacity by 2050, signed by 31 countries, would result in nearly a 3.1-billion-pound deficit.

- Utility contracting has been running below replacement levels for the last 12 years.

Result? Rising demand, tightening supply and the potential for higher uranium prices.

Uranium Supply and Demand Imbalance May Likely Grow

Source: UxC LLC. Data as of Q4 2025.

Harness the Pure-Play, Upstream Opportunity

Focused uranium exposure is the core advantage of a pure-play strategy. We target upstream companies with at least 50% of revenue or assets in uranium mining, development or exploration.

Other strategies often include downstream companies or those with minimal uranium exposure, creating unintended exposure for investors.

The Pure Play Advantage

Because they are focused primarily on producing uranium, pure-play miners are positioned to benefit from:

- Growing structural supply deficit

- Increased investment flows

- Higher expected uranium prices

Explore the Resurgence of Nuclear Energy with

Sprott Uranium Miners ETFs

Sprott offers investors the world’s largest physical uranium fund in the marketplace,* as well as the largest exposure to uranium mining stocks. Learn more about Sprott Uranium Miners ETF and Sprott Junior Uranium Miners ETF.

Explore URNM and URNJ

- Investor Presentation

- URNM Fact Sheet

- URNJ Fact Sheet

- URNM Prospectus

- URNJ Prospectus

- URNM FAQs

- URNJ FAQs

Sprott CEO John Ciampaglia highlights surging uranium demand, tight supply and new mining investment following the 2025 World Nuclear Symposium.

* Based on Morningstar’s universe of listed commodity funds. Data as of 12/31/2025.

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the funds, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.

Important Message

You are now leaving Sprott.com and entering a linked website. Sprott has partnered with ALPS in offering Sprott ETFs. For fact sheets, marketing materials, prospectuses, performance, expense information and other details about the ETFs, you will be directed to the ALPS/Sprott website at SprottETFs.com.

Continue to Sprott Exchange Traded FundsImportant Message

You are now leaving sprott.com and linking to a third-party website. Sprott assumes no liability for the content of this linked site and the material it presents, including without limitation, the accuracy, subject matter, quality or timeliness of the content. The fact that this link has been provided does not constitute an endorsement, authorization, sponsorship by or affiliation with Sprott with respect to the linked site or the material.

Continue