Opportunities Forged in Metals

Sprott Active Metals & Miners ETF (METL)

Sprott Active Metals & Miners ETF (Nasdaq: METL) is an actively managed ETF that seeks long-term capital appreciation by investing in companies across the metals and mining industry lifecycle. METL’s investment strategy is value-oriented and contrarian. METL combines the daily transparency, liquidity and potential tax efficiency of an ETF with the expertise of active management.

A Dynamic Portfolio of Metals

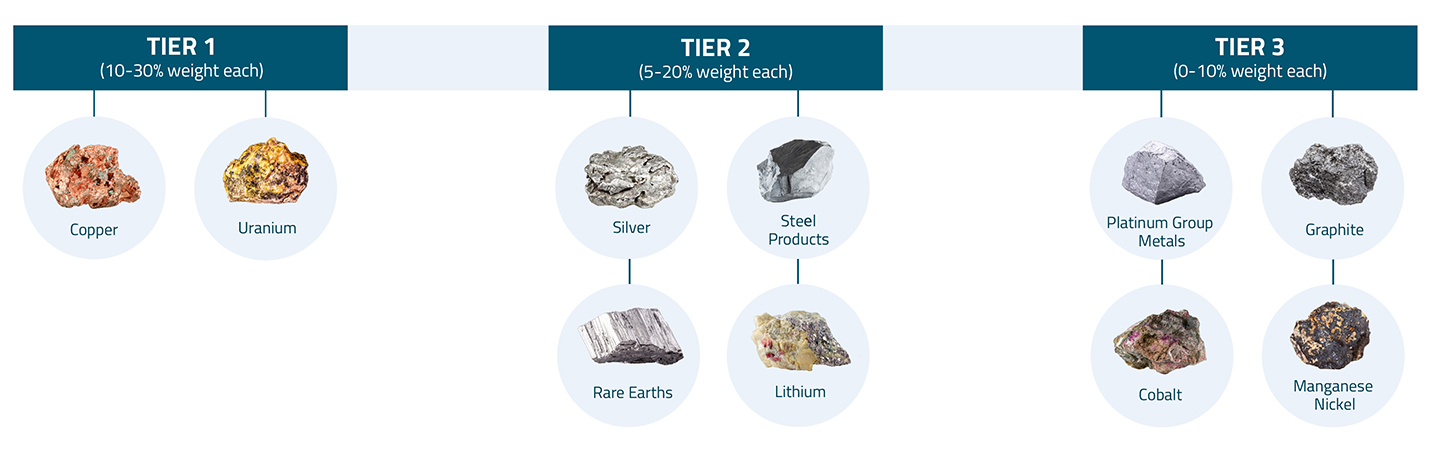

METL’s active portfolio managers blend top-down sector analysis with bottom-up stock selection, using allocation tiers* determined by ongoing analysis of structural demand for metals across key growth sectors.

*Allocation tiers are illustrative only and subject to change, notwithstanding the weight parameters listed for each.

Our Boots on the Ground Difference

Our multidisciplinary investment team has worked in and conducted due diligence on mining projects spanning more than 40 countries. The technical reviews we conduct on site visits assess asset potential, identify challenges and explore geologic opportunities.

-

Selective Stock Picking

We seek to identify miners with the strongest fundamentals, management teams and growth prospects.

-

Deep Industry Knowledge

From geology to corporate strategy, our team understands the full mining value chain.

-

Global Access

Strong relationships across the mining sector allow us to uncover opportunities others may miss.

Justin Tolman, BSc (Hons), MBA, Senior Portfolio Manager and Economic Geologist, explores the Los Ricos South project, a gold-silver-copper mine, located near the village of Cinco Minas in Jalisco, Mexico.

Maria Smirnova, MBA, CFA, Senior Portfolio Manager & Chief Investment Officer, conducts on-site due diligence at a leading mining operation in Mexico, holding a freshly cast silver doré bar, which represents unrefined semi-pure silver.

METL Snapshot & Portfolio Management Team

Guided by over four decades of sector expertise, METL's multidisciplinary management team seeks to navigate mining complexity and the cyclical nature of commodities through disciplined research.

Sprott Active Metals & Miners ETF

-

Ticker: METL

-

Focus: Metals and Mining Equities

-

Listing Exchange: Nasdaq®

-

Inception Date: 9/9/2025

-

Total Annual Fund Operating Expenses: 0.89%

-

Holdings: 36

-

Fund AUM: $45.1 million

Data as of 12/31/2025. Please refer to the most recent prospectus for more information or click here.

Why Active Management Makes a Difference

Sprott’s active portfolio managers have the potential to add value through selective stock picking and thoughtful portfolio construction. The 729% average performance spread between top- and bottom-tier mining companies over the past five years underscores the potential advantage of active management.

Source: Bloomberg and FactSet as of 12/31/2025. Miners represents the MSCI ACWI Select Metals & Mining Producers Ex Gold & Silver Investable Market Index (M1WDS1PI Index) and the constituents of PICK US Equity, which tracks the M1WDS1PI Index. In 2025, there were 258 constituents. You cannot invest directly in an index. Past performance is no guarantee of future results.

Explore METL

Visit our Sprott Active Metals & Miners ETF Fund page for the latest performance.

Stay current. Join our Insights mailing list.Sprott’s Steve Schoffstall joins Nasdaq’s Just For Funds to discuss the Sprott Active Metals & Miners ETF (METL) — the only actively managed ETF providing diversified exposure to both critical and traditional metals miners driving the global energy transition.

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the funds, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.

Important Message

You are now leaving Sprott.com and entering a linked website. Sprott has partnered with ALPS in offering Sprott ETFs. For fact sheets, marketing materials, prospectuses, performance, expense information and other details about the ETFs, you will be directed to the ALPS/Sprott website at SprottETFs.com.

Continue to Sprott Exchange Traded FundsImportant Message

You are now leaving sprott.com and linking to a third-party website. Sprott assumes no liability for the content of this linked site and the material it presents, including without limitation, the accuracy, subject matter, quality or timeliness of the content. The fact that this link has been provided does not constitute an endorsement, authorization, sponsorship by or affiliation with Sprott with respect to the linked site or the material.

Continue