Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Video

Advisor Perspective: How Gold, Silver and Critical Materials Shaped Portfolios in 2025

In this episode of Metals in Motion, Sprott’s Steve Schoffstall and Ed Coyne recap key 2025 performance trends across gold, silver, critical materials and the mining sector. Coyne shares insights from conversations with financial advisors, highlighting the potential advantages of active management and approaches for gaining broader exposure to critical materials.

Interview

ETF Product Development

Steve Schoffstall and Jimmy Connor of Bloor Street Capital discuss Sprott’s hands-on mining expertise and expanding lineup of precious metals and critical materials ETFs. Schoffstall highlights rising investor interest in uranium, lithium, rare earths and other strategic materials as governments move to reshore supply chains and support long-term energy and infrastructure demand.

Interview

Uranium Outlook 2026

John Ciampaglia joins Jimmy Connor of Bloor Street Capital to discuss uranium’s outlook as government support for nuclear energy strengthens. Tightening supply, rising reactor demand and growing institutional involvement are fueling bullish expectations for uranium and related mining equities in 2026.

Sprott Radio Podcast

Uranium Outlook 2026

Host Ed Coyne and Sprott CEO John Ciampaglia recap a surprising 2025 for the uranium market, characterized by flat spot prices that contrasted sharply with strong mining equities and bullish long-term demand signals for nuclear power. Together, Ed and John look ahead to 2026, highlighting the potential for renewed contracting, higher prices and pivotal U.S. policy decisions that are likely to boost demand for uranium and nuclear power.

Insights

Sprott ETFs 2025 Year-End Distributions

This is not intended to be a statement for official tax reporting purposes or any form of tax advice. If you have any questions, please call 888.622.1813 between 9:00 AM and 5:30 PM ET, Monday through Friday.

Interview

Metals & Mining: Year in Review, Future in Focus

Host Ed Coyne speaks to Sprott CEO Whitney George and Senior Portfolio Manager Justin Tolman about the firm's strong performance in 2025, highlighting significant gains across gold, silver, copper and related strategies, driven by resource nationalization and supply disruptions. Looking ahead to 2026, they anticipate continued opportunities, increased investor interest and ongoing M&A activity as the mining and metals space gains broader recognition.

Sprott Uranium Report

Uranium’s Tale of Two Markets

The uranium market's short-term volatility has masked strengthening fundamentals, as long-term prices rise, supply tightens and policy commitments translate into greater demand for nuclear power. With capital flowing into miners, upstream fundamentals improving and policy alignment accelerating, we believe the uranium market is well positioned for a stronger setup in 2026.

Interview

Nasdaq Talk Your Ticker: SETM

Steve Schoffstall joins Nasdaq’s Talk Your Ticker to discuss the Sprott Critical Materials ETF (SETM), highlighting its pure-play exposure to miners of nine essential metals and its role in diversifying portfolios amid rising energy demand and security concerns.

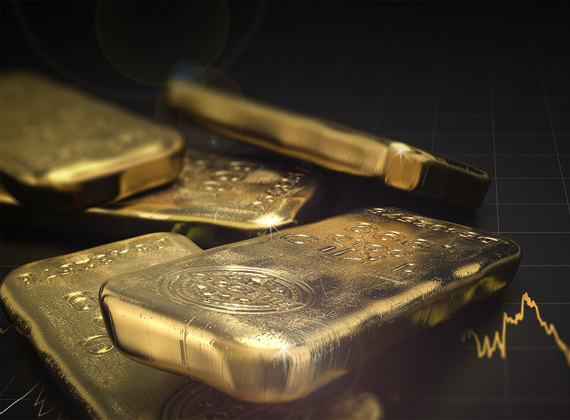

Sprott Precious Metals Report

Gold Holds Gains as Liquidity Stress Emerges

Gold reached its highest monthly close in November 2025, driven by fiscal dominance, rising global debt and the Fed’s pivot to “QE-lite.” We believe gold’s strategic role as a safe haven asset is strengthening amid mounting liquidity stress and shifting global financial dynamics. Silver closed November at an all-time high.

Special Report

Lithium Gains Momentum in 2025

Lithium has entered a renewed bull phase as tightening supply, rising global demand from EVs to data centers, and major strategic investments shift the market from surplus toward potential deficit. Governments, oil majors and tech giants are racing to secure supply, solidifying lithium's essential role in long-term energy security.

Video

National Security, Mining Investment and the Future of Materials: A Critical Crossroads

In this episode of Metals in Motion, Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management, explains how government action and massive private-sector investment are reshaping the critical materials landscape, including rare earth metals. New U.S. equity stakes, global agreements and major nuclear initiatives are accelerating efforts to rebuild secure domestic supply chains amid rising geopolitical tensions.

Video

Sprott on Metals: Today's Opportunities in Gold, Silver, Uranium and Copper

Jacob White meets with Asset TV to discuss Sprott’s focus on precious metals and critical materials, underscoring their rising importance across energy, technology and national security. White notes that 2025 has seen record highs for gold, silver and copper prices, alongside sustained supply deficits that are driving strong investor interest.

Infographic

The Uranium Opportunity

Global uranium mine supply continues to fall short of reactor demand, creating a persistent and widening deficit. With uranium demand expected to double by 2040, these tightening fundamentals underpin a powerful long-term investment case.

Video

Nasdaq Just for Funds: Sprott’s Steve Schoffstall on METL

Sprott’s Steve Schoffstall joins Nasdaq’s Just For Funds to discuss the Sprott Active Metals & Miners ETF (METL) — the only actively managed ETF providing diversified exposure to both critical and traditional metals miners driving the global energy transition.

Sprott Precious Metals Report

The Debasement Trade Broadens Across Precious Metals

In October, gold closed above $4,000 and silver hit record highs amid growing strategic demand, signaling a sustained shift away from fiat-based assets. Major developed economies are increasingly operating under fiscal dominance, driving investors toward hard assets like gold and silver.

Video

Rare Earths and Critical Minerals: The Hidden Engine of Electrification

Sprott’s Steve Schoffstall joins James Connor to discuss the global race for critical materials, from rare earths and uranium to lithium and copper. Schoffstall discusses how investors can gain exposure through Sprott’s suite of innovative ETFs.

Video

Gold Mining Equities: There's Still Room in the Trade

Gold has recently climbed to record highs. In this episode of Metals in Motion, Steve Schoffstall, Director of ETF Product Management at Sprott, joins Thalia Hayden @etfguide to explain why gold is performing well, and why the gold mining trade might still have room for investors to make their move.

Sprott Webcast Replay

Going Beneath the Surface: Active Management in Metals & Mining ETFs

Join Sprott’s expert team for an exclusive webcast replay exploring the powerful forces reshaping the metals and mining landscape, from surging energy demand and AI growth to tightening supply chains. Discover how Sprott’s active, research-driven ETF approach helps investors navigate volatility, and learn more about GBUG and METL.

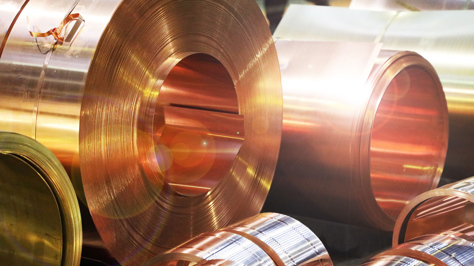

Sprott Copper Report

Catalyzing Copper: Supply Shocks and Betting Billions

Copper markets rallied in September, buoyed by tightening supply and renewed investor confidence. Copper’s supply squeeze is intensifying as mine shutdowns and years of underinvestment drive inventories to historic lows. New U.S. policy tailwinds are providing support, as the world races to secure critical materials.

Sprott Gold Report

Dips: The Rx for Acrophobia

With gold and silver reaching new all-time highs, we believe there is still opportunity in both the physical and miners markets. We see structural drivers (central bank demand, inflation resilience and declining trust in fiat currencies) that continue to support long-term allocations to gold and silver.

Sprott Precious Metals Report

Gold Leads as Faith in Fiat Falters

Gold surged to record highs as fading confidence in fiscal and monetary policy drove investors toward hard assets. With long-term yields rising and central banks turning increasingly accommodative, markets are signaling a loss of faith in fiat currencies, fueling gold’s breakout and silver’s potential squeeze.

Sprott Uranium Report

Investors Act with Conviction

Uranium prices and miners surged in September, fueled by tight supply and strong utility demand. The rally drew renewed investor interest, with capital flows into uranium equities and ETFs reinforcing confidence in the sector’s momentum.

Sprott Radio Podcast

The Metals that Make the World

Sprott economic geologist and Senior Portfolio Manager Justin Tolman joins Ed Coyne for a deep dive on demand trends for steel, copper and silver and what it might take to successfully invest in the metals that build the world.

Interview

Where Is Spot Uranium Going?

John Ciampaglia, CEO of Sprott Asset Management, joins Jimmy Connor of Bloor Street Capital at the World Nuclear Symposium 2025. Ciampaglia highlights strong global investor interest in uranium, with both specialist and generalist funds viewing nuclear as a long-term growth story. He notes stabilizing uranium prices, lingering supply challenges and growing demand from utilities, AI and data centers.

Interview

Uranium: At the Fulcrum of AI, National Security and Global Energy Demand

John Ciampaglia, CEO of Sprott Asset Management, highlights takeaways from the September 2025 World Nuclear Symposium: surging uranium demand from electricity, AI and energy security, tech ties like Microsoft and constrained supply supporting higher prices and new mining.

Special Report

Steel Meets Rising Global Electricity Demand

Steel is emerging as a strategic material in meeting global electricity demands, underpinning everything from power generation and transmission to electric vehicles and grid modernization. Demand for green steel is accelerating with market forecasts projecting rapid growth relative to traditional steel.

Video

Active Edge: Why Experience Matters in Metals and Mining Investing

Sprott's Steve Schoffstall and Justin Tolman discuss the newly launched Sprott Active Metals & Miners ETF (METL), which provides active exposure to a broad range of metals. Tolman highlights the team’s rigorous investment process combining top-down sector analysis and bottom-up stock selection, and the importance of site visits in evaluating projects.

Sprott Copper Report

Copper Fundamentals Prevail After Tariff Turmoil

Copper rallied in August, with junior copper miners taking top performance honors. Policy momentum is accelerating as copper gains critical minerals status and attracts major investment. Copper miners are enjoying strong margins as copper demand rises to support electrification, AI and defense.

Sprott Precious Metals Report

Challenges to Fed Autonomy Strengthen Case for Gold

Gold has topped another all-time high above $3,600 per ounce, while silver has reached $41, its highest level since 2011. Both metals may be among the strongest-performing asset classes for the year. We explore how erosion of Fed independence heightens policy risk, reinforcing the strategic role of gold and silver.

Sprott Critical Materials Report

Critical Materials Breakout into a New Bullish Phase

The convergence of national security imperatives, energy transition policies and evolving trade dynamics is fundamentally redefining the role of critical minerals. The breakout in the Nasdaq Sprott Critical Materials Index™ is an early signal of this shift, reflecting technical strength and deep structural drivers.

Video

Copper Clash: Tariffs, Trade Shifts and Opportunity

U.S. copper tariffs are reshaping global markets. In this episode of Metals in Motion, Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management, discusses how copper prices are realigning as fundamentals point to long-term shortages and surging demand from the energy transition.

Video

The Key Drivers of Demand and Volatility in the Precious Metals Space

Nasdaq Trade Talks features Sprott’s Steven Schoffstall and the World Gold Council’s Joe Cavatoni on the key forces driving gold, silver and critical materials, from central bank demand to industrial growth and their role in portfolio diversification.

Sprott Gold Report

A Cure for Financial Dementia

In our view, market euphoria and collective amnesia have left gold miners overlooked despite record profits, soaring margins and aggressive shareholder returns. Gold mining equities are still stuck at bargain basement valuations, and we unabashedly continue to pound the table for precious metals equities and bullion alike.

Sprott Precious Metals Report

Gold Miners Shine in 2025

Gold and silver are up over 25% in 2025, with mining stocks surging more than 50%, yet still undervalued. We see continued upside amid inflation, geopolitical risks and strong fundamentals.

Sprott Copper Report

The Emerging Copper Premium: Policy Risk Meets Physical Scarcity

Copper is being redefined as a national security asset, not just an industrial metal. U.S. tariffs and geopolitical shifts have fractured global pricing and exposed deep supply vulnerabilities.

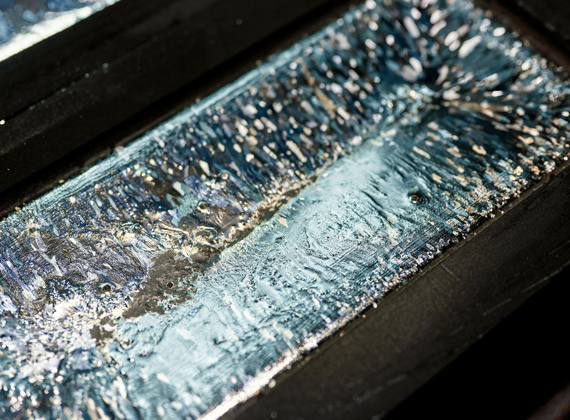

Silver Report

Silver Investment Outlook Mid-Year 2025

Silver gained nearly 25% through mid-year, and continues to rise in July, as supply remains tight and demand accelerates. With silver crucial to new technologies, the metal is benefiting from powerful structural tailwinds and renewed interest from investors.

Sprott Uranium Report

Uranium’s Mid-Year Momentum

Uranium spot prices jumped nearly 10% in June and uranium miners surged, supported by renewed inflows and global pro-nuclear policy momentum. With AI data centers adding a long-term demand driver, we believe uranium’s structural bull case remains intact.

Video

Copper’s Potential Power Surge: Energy, AI and Beyond

In this episode of Metals in Motion, Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management, discusses copper’s importance to energy and technology, and the associated structural supply deficit resulting from growing demand.

Sprott Precious Metals Report

Gold and Silver Bull Run Continues

Gold and silver have been strong performers in 2025, with both metals up over 25% YTD as global instability drives demand for safe haven assets. Central banks are shifting away from the U.S. dollar, while silver’s breakout suggests a potential supply squeeze ahead.

Interview

Uranium Outlook Mid-Year 2025

John Ciampaglia, CEO of Sprott Asset Management, joins James Connor at the Bloor Street Capital Virtual Uranium Conference to examine the current state of the uranium market. Ciampaglia highlights the market's V-shaped recovery since April and the improved investor sentiment following the absence of tariffs on uranium.

Sprott Copper Report

Copper’s Bullish Setup Strengthens

Copper is surging toward $10,000 per ton as plunging inventories and unexpected supply disruptions expose the market’s tightness. Easing tariff tensions and rising electrification demand are driving bullish sentiment. We believe copper may be heading toward a structural repricing.

Video

COPP Invests in Both Miners and Physical Copper

Beginning June 23, 2025, Sprott Copper Miners ETF (COPP) will provide investors with exposure to physical copper, in addition to pure-play copper miners.

Special Report

Building an Electrified World: The Strategic Role of Critical Materials

As the world races to electrify, demand for critical materials like uranium, copper, silver, lithium and nickel is climbing. These metals are foundational to nuclear power, consumer electronics and high-performance batteries — making them indispensable to meeting rising global energy demand.

Sprott Uranium Report

Uranium’s Bull Market Reawakens

Uranium is back in focus as U.S. nuclear policy accelerates and AI-driven energy demand sparks renewed investor interest. With uranium prices and miners showing strength in May, our outlook remains bullish as fundamentals tighten and sentiment shifts.

Sprott Precious Metals Report

Gold Gains Ground as Faith in the Dollar Erodes

Gold continues its rally as fading confidence in U.S. fiscal policy and the U.S. dollar drives demand for real assets. As we publish, silver is breaking out above $35, supported by structural supply deficits, renewed investor interest and mounting macroeconomic pressures.

Shifting Energy

The White House’s Nuclear Push: What It Means for Uranium Opportunities

In this episode of Shifting Energy (Season 2), John Ciampaglia discusses the major policy shift under President Trump’s new executive orders, which aim to fast-track advanced nuclear technologies and revitalize the entire U.S. nuclear fuel cycle.

Video

Trump’s Executive Orders Set Stage for U.S. Nuclear Expansion

Uranium is back in the spotlight. Steve Schoffstall discusses President Trump's sweeping executive orders to jumpstart America’s nuclear energy industry by streamlining reactor approvals, boosting domestic uranium production and declaring a national emergency over reliance on Russian and Chinese nuclear fuel. With global support for nuclear power building, investors are watching this space closely.

Webcast Replay

Could Silver and Its Miners Shine in Today’s Markets?

In our webcast with Nasdaq, Steve Schoffstall, Director of ETF Product Management, joins Nasdaq’s Jillian DelSignore to discuss silver and silver equity markets, silver’s historic performance during periods of market turmoil, and why the metal and its miners may be a valuable addition to portfolios.

Sprott Uranium Report

Uranium Regains Momentum

Uranium is regaining strength, with spot prices rebounding and momentum returning thanks to renewed utility contracting, tariff clarity and strong long-term fundamentals. The resurgence of the carry trade, rising AI-driven energy demand and China’s ongoing nuclear buildout are reinforcing uranium’s role as a strategic, supply-constrained asset.

Sprott Precious Metals Commentary

A Shaky U.S. Dollar Boosts Gold’s Role as an Alternative Reserve Asset

Gold is gaining prominence as a reserve asset due to a weak U.S. dollar and declining U.S. financials, reaching record highs while equities and bonds fell. We believe this positions gold as a potential anchor for a multi-asset reserve system. Given silver’s correlation to gold, we believe its monetary value will reassert itself in time.

Interview

Sprott CIO on Gold/Silver Miner Selection and Silver Outlook

James Connor of Bloor Street Capital speaks with Maria Smirnova, Sprott CIO, about the firm’s approach to gold and silver miner selection. Smirnova remains bullish on silver, citing a deep supply deficit and its essential role in electrification, despite prices lagging gold due to weak central bank demand and stagnant supply.

Video

Nasdaq’s Just for Funds: Introducing the Sprott Active Gold & Silver Miners ETF (GBUG)

Steve Schoffstall recently joined Nasdaq’s Just for Funds to discuss the launch of the Sprott Active Gold & Silver Miners ETF (GBUG), the only actively managed ETF focusing on gold and silver mining companies. Given current market volatility, gold is proving its value as a portfolio stabilizer, while investors may benefit from diversification and the flexibility of an active strategy to navigate the complexities of the mining sector.

Video

Why Does a Pure-Play Strategy Matter in Silver Miners?

SLVR is a silver mining and physical silver ETF that offers a pure-play strategy that allocates approximately 70% to silver-focused companies. SLVR offers investors a targeted and differentiated way to gain meaningful exposure to silver.

Shifting Energy

Safe Havens: The Enduring Stability of Precious Metals in Turbulent Times

In this episode of Shifting Energy (Season 2), Steve Schoffstall, Director, ETF Product Management and John Kinnane, Director, Key Accounts at Sprott Asset Management, chat about how investors are navigating bumpy markets and global trade wars with assets like gold and silver.

Sprott Uranium Report

Is Uranium’s Bull Market Over?

Recent market events have put pressure on uranium, but we continue to believe in the resilience and long-term bullish outlook for physical uranium and uranium mining equities. Our positive outlook is supported by uranium's growing structural supply deficit and global policy support for nuclear power.

Sprott Gold Report

The Return of Exter’s Inverted Pyramid

Gold has been rising on strong official sector demand, fueled by concerns over the U.S. dollar and global instability. While Western investors have focused on potentially overvalued stocks, gold and mining equities offer potential upside as other assets struggle.

Sprott Copper Report

Copper’s Record-Setting Rally and Reversal on U.S. Tariffs

Copper prices reached record highs in March, driven by tariff fears and U.S. demand. Despite recent market volatility, copper remains a strategic asset with strong long-term fundamentals, supported by rising global energy demands and U.S. policy shifts.

Sprott Q1 Precious Metals Report

Gold's Strength Amid a Crisis of Confidence

Gold's record-breaking rally in Q1 2025 reflects mounting investor anxiety over stagflation, policy volatility and a fraying global economic order. U.S. tariffs and policy unpredictability have elevated the risk of stagflation, fueling demand for gold as the lone liquid safe-haven asset. We also believe silver is potentially poised to break out.

Sprott Webcast Replay

A Closer Look at Gold and Silver, Metals and Miners

Gold and silver provide a powerful blend of potential wealth preservation, inflation mitigation and portfolio diversification. This webcast provides insights from John Hathaway and Maria Smirnova on the key technical drivers influencing gold, silver and precious metals mining equities.

Shifting Energy

Global Trade Wars: Unraveling the Impact on Critical Materials Markets

In this episode of Shifting Energy, Thalia Hayden interviews Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management about how the global energy shift and market volatility are impacting precious metals and critical materials. Schoffstall provides valuable insights into what's happening with gold, silver, uranium and copper.

Video

Introducing Sprott Active Gold & Silver Miners ETF (GBUG)

Sprott’s Steve Schoffstall introduces GBUG, an actively managed ETF focused on gold and silver miners, using a team with deep industry expertise to identify investments. With a long-term, value-driven approach, it aims to provide exposure to precious metals while navigating market shifts.

Interview

Trump Tariffs: Disruption or Opportunity?

Are tariffs set to disrupt gold, silver and uranium markets? Find out how potential trade barriers could impact prices and create arbitrage opportunities. Kitco’s Senior Mining Editor and Anchor Paul Harris interviews John Ciampaglia, CEO of Sprott Asset Management, at the 2025 BMO Global Metals, Mining & Critical Minerals Conference.

Sprott Uranium Report

Tariffs, Tensions and the Uranium Opportunity

We see market volatility as an opportunity, with uranium’s spot price offering an attractive entry point for investors. Despite Trump tariff policy and geopolitical uncertainties, uranium’s strong long-term fundamentals—supply deficits and rising nuclear demand—remain intact.

Educational Video

The Era of Critical Materials: Powering Our Planet Toward a Brighter Future

We explore the essential minerals driving the energy revolution, from copper's role in electrification to uranium's impact on nuclear power, and the rise of battery storage technology. Join us on a journey through the periodic table to understand how these critical materials are needed to meet the rising global demand for energy.

Special Report

GBUG and The Case for Active Management

Sprott Asset Management has launched GBUG which seeks long-term appreciation through value-oriented, contrarian investing. Sprott's active management team looks to capitalize on the wide dispersion of returns within the mining sector and the potential for silver to catch up to gold's rise.

Sprott Critical Materials Monthly

Critical Materials Markets Shake Off DeepSeek Disruption and U.S. Policy Rollbacks

Critical materials showed resilience in January amid global volatility. We take a deep dive into China's growing leadership in clean technology investments, the disruptive impact of DeepSeek's AI model and the implications of U.S. policy changes on the energy transition and critical materials supply chains.

Video

Introducing Sprott Silver Miners & Physical Silver ETF (Nasdaq: SLVR)

Discover the unique advantages of Sprott Silver Miners & Physical Silver ETF (SLVR), a new ETF offering exposure to both silver miners and physical silver. With rising industrial demand and a tightening supply, SLVR provides investors with a strategic opportunity to benefit from silver’s dual role as a precious and industrial metal.

Sprott Uranium Report

Uranium Markets Trumped by Uncertainty

The uranium markets experienced volatility in January, with prices dipping despite strong miner performance. Key factors included the emergence of the Chinese AI model DeepSeek and the return of the Trump administration.

Shifting Energy

Energy’s Silver Lining: A Precious Metal Powering the Future

In this episode of Shifting Energy (Season 2), Thalia Hayden chats with Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management about silver miners, investing in silver and how the silver market is tied to the global energy shift.

Interview

Uranium Outlook for 2025

Sprott CEO John Ciampaglia remains bullish on the uranium markets, citing rising term prices, increased utility interest and the global nuclear renaissance fueled by clean energy needs and AI-driven power demands. Ciampaglia expects uranium prices to strengthen as pent-up demand grows, driven by reactor life extensions, new builds and geopolitical supply disruptions.

Sprott Radio Podcast

Silver 2025

Pinch point is the term Sprott’s Maria Smirnova uses to describe the current supply-demand picture for silver in 2025. Smirnova joins host Ed Coyne to walk us through how silver’s growing demand is coming up against a static supply pipeline.

Special Report

Top 10 Themes for 2025

What forces will shape the markets in critical materials and precious metals in 2025 and beyond? We identify 10 critical macro and market themes investors should watch in the coming year.

Sprott Gold Report

Recalibrating Our Crystal Ball

Gold was a strong performer in 2024, gaining 27.22% to end the year at $2,624.50, fueled by geopolitical tensions, central bank purchases and bond market struggles. These strong gains occurred with negligible participation or interest from investors in North America or Europe. Key catalysts for a gold rally could include stock or cryptocurrency downturns, bond market disruptions or a U.S. dollar reset.

Shifting Energy

Uranium Unleashed: How Mining Stocks Fuel the Nuclear Comeback

Sprott's John Kinnane and Steve Schoffstall explore the growing opportunities in the uranium and nuclear energy markets. They discuss how pure-play uranium miners, supply-demand dynamics and shifting geopolitical policies are positioning this sector as a promising investment frontier for 2025 and beyond.

Silver Report

Silver's Impressive Strength in 2024

We believe that silver continues to offer a compelling investment opportunity due to its unique market dynamics. For investors, a diversified portfolio that balances physical assets and mining equities may offer exposure to silver's stability as a store of value and its growth potential as a critical industrial metal.

Special Report

The Uranium Miners Opportunity

We believe uranium mining equities are poised for growth as demand for nuclear power increases, driven by AI data center needs and electricity demand. Geopolitical shifts, such as Russia’s export restrictions, and global pledges to triple nuclear capacity by 2050 highlight supply chain importance. This creates a compelling case for uranium miners, which are supported by strong market fundamentals.

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.