Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Sprott Uranium Report

Uranium Markets Impacted by Market Signals and Uncertainty

The uranium market remains strong despite recent spot price declines, with tight supply, rising demand and long-term fundamentals driving a bullish outlook. Global support for nuclear energy is growing, with ambitious commitments to triple capacity and junior miners playing a key role in addressing supply deficits.

Interview

Nuclear Power and Critical Materials: A Post-Election Outlook

What’s the potential impact of the incoming Trump administration on nuclear power, clean energy and critical materials? Thalia Hayden of ETFguide talks with John Ciampaglia about what potential changes may be on the horizon for U.S. energy policies and some strategies for investment portfolios.

Interview

Real Assets in Focus: Gold, Silver, Copper and Uranium

Unlock the power of real assets investing with Sprott’s Masterclass video. Dive into gold, silver, copper and uranium with industry experts Ed Coyne, Ryan McIntyre and Steve Schoffstall as they reveal strategies to navigate global uncertainties and identify opportunities. Discover how to leverage precious metals and critical materials to potentially build a resilient, future-ready portfolio.

Sprott Critical Materials Monthly

Batteries and Minerals Driving Global Electrification

Batteries and energy storage continue to underpin electrification trends, solidifying their role as a cornerstone in the global shift toward sustainable energy. Support is being strengthened by strategic investments from governments and corporations, and resilient demand for critical minerals like lithium, copper and nickel.

Shifting Energy

The New Power Play: How Tech Giants Are Embracing Nuclear Energy for Data Centers

Nuclear power is creating a buzz in media circles. Thalia Hayden of @etfguide talks with John Ciampaglia about the powerful comeback of nuclear energy and how tech giants are embracing nuclear energy for data centers.

Sprott Uranium Report

Big Tech Targets Nuclear Energy to Support AI Ambitions

Big tech is turning to nuclear energy to fuel the massive power needs of AI-driven data centers. They're striking bold deals to develop small modular reactors (SMRs), sparking a surge in uranium demand and helping to support clean energy innovation. At the same time, global uranium supply remains inadequate to meet both current and future reactor requirements.

Sprott Critical Materials Monthly

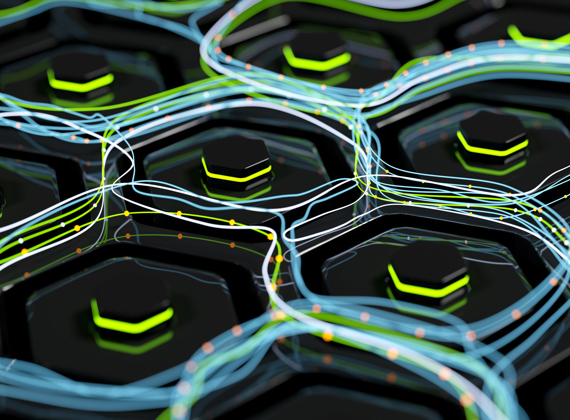

U.S. Electricity Grid Remakes Itself to Meet Surging AI-Led Power Demand

Demand for electricity over the next decade will put pressure on the U.S. power grid to keep pace. New investment in power-hungry industrial facilities is driving demand, especially the data centers that support artificial intelligence (AI), U.S. reshoring initiatives and the steady electrification of the transport sector.

Sprott Uranium Report

Uranium Markets Shake Off Summer Doldrums

The uranium market has faced short-term volatility, including price declines driven by geopolitical tensions and economic concerns. Despite these challenges, the long-term outlook remains strong. Supply uncertainties from key producers like Kazakhstan and Russia are contributing to this volatility, but the fundamental supply-demand imbalance suggests further growth potential.

Shifting Energy

The Fourth Industrial Revolution: Reshaping Global Energy Markets

Sprott's Steve Schoffstall discusses how AI, robotics and quantum computing are integrating into the overall global economy and how these developments will reshape the global energy landscape. Learn about electricity production and technological innovation and how to invest in the opportunities they provide.

Shifting Energy

An Inside Look at the Global War for Lithium, Copper and Critical Minerals with Author Ernest Scheyder

Author and acclaimed Reuters journalist Ernest Scheyder discusses his book, The War Below: Lithium, Copper, and the Global Battle to Power Our Lives, with Sprott's Steve Schoffstall in this exclusive interview.

Sprott Critical Materials Monthly

The Unstoppable Rise of Renewable Energy

Renewable energy is rapidly replacing fossil fuels as costs decrease and efficiencies improve with increased deployment, making it much cheaper than traditional energy sources. This shift, driven by the exponential growth of renewables, electrification, and efficiency, is expected to significantly alter global power dynamics as fossil fuels are phased out.

Special Report

The AI Revolution and Data Centers: A New Frontier in Energy Demand

Significant investments in AI-related tech stocks have helped push the S&P 500 Index to record highs this year. The rapid growth of AI is significantly increasing the energy demands of data centers, which is likely to lead to a surge in demand for critical materials.

Special Report

Lithium: Short-Term Opportunities for a Long-Term Trend

This might be an ideal moment to re-evaluate lithium miners given their potential to benefit as the global energy transition continues. The current dip in the price of lithium miners presents a potential short-term opportunity, given the strong future demand and supply imbalance.

Sprott Critical Materials Monthly

Fourth Industrial Revolution Fuels Global Competition for Critical Minerals

The world is in the midst of a fourth industrial revolution (4IR) as technological developments like artificial intelligence (AI), robotics, IoT, genetic engineering and quantum computing bring about an unprecedented integration of the digital, physical and biological realms. Electrification and energy are pivotal to advancing 4IR technologies, and the resulting demand pressures on critical minerals like copper, lithium and uranium are supporting a new commodity supercycle.

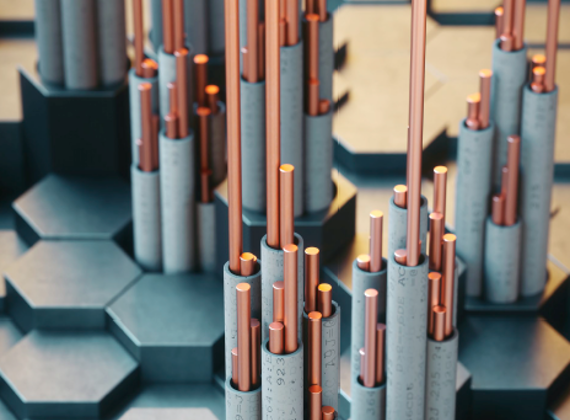

Sprott Critical Materials Monthly

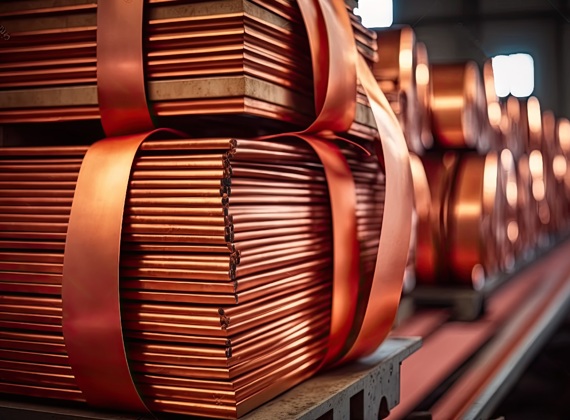

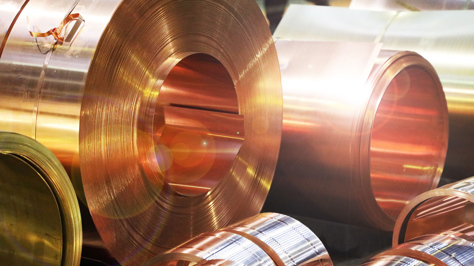

A New Copper Supercycle Is Emerging

The copper market is entering a new supercycle, built on several rising geopolitical and market trends contributing to a strong bullish outlook. Demand is surging as countries invest in clean energy and protect their access to copper, while supply is constrained by a lack of new mine development.

Sprott Silver Report

Silver’s Critical Role in the Clean Energy Transition

Silver is a critical player in the global shift toward cleaner energy. Solar panels and EVs, both essential for curbing greenhouse gas emissions, rely heavily on silver. Other new technologies, including AI, have also sparked demand for silver, while overall silver supply has declined.

Sprott Webcast Replay

Gold and Silver: Precious Metals On the Move

Replay our webcast, focused on gold and silver, and featuring John Hathaway and Maria Smirnova. Gold is enjoying strong support from central bank buyers like China, and silver is benefitting from increased demand for PV solar panels.

Sprott Critical Materials Monthly

AI's Critical Impact on Electricity and Energy Demand

The rise of AI and data centers is likely to significantly increase global electricity demand, creating challenges for power grids but also opportunities for stable, clean energy sources like nuclear power. AI data centers are also likely to support increased demand for copper.

Special Report

The Case for Investing in Nickel Miners

Nickel's future looks promising due to its role in achieving net-zero emission goals. Stricter regulations and government support for electric vehicles are driving up demand for nickel, which will benefit nickel mining companies in the long run. Nickel-intensive batteries are also increasingly being used in large-scale energy storage systems that employ thousands of NMC batteries to power renewable energy projects.

Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Rising global commitments to nuclear energy are helping to make uranium a compelling investment. While spot uranium prices have come down slightly after a significant rise, we believe there is room for growth given that demand is expected to climb as the need for low-carbon energy sources intensifies. We believe that uranium miners can add growth potential and diversification to investor portfolios.

Sprott Uranium Report

Miners Ignore Softer Uranium Price

The uranium market showed mixed performance in March: the spot uranium price fell but miners' stocks rose due to long-term positive outlook for uranium demand. With no meaningful new supply on the horizon for three to five years, we believe the uranium bull market has further room to run.

Sprott Critical Materials Monthly

Battery Storage Is the Technological Cornerstone for a Sustainable Energy Future

The energy sector has experienced a remarkable transformation, primarily driven by the rapid growth and integration of renewable energy sources. Central to this transition is the advancement of battery storage technology, a critical enabler that promises to reshape how we generate, distribute and consume electricity. As we examine this evolving landscape, it becomes evident that battery storage is a technological cornerstone for a sustainable energy future.

Shifting Energy

The Copper Growth Story

In this episode of Shifting Energy (Season 1), Thalia Hayden @etfguide talks with Ed Coyne, Senior Managing Partner and Steve Schoffstall, Director of ETF Product Management at Sprott Asset Management about the copper growth story, what's driving it and the investment opportunities now and ahead.

Interview

The Elements of Energy: Uranium and Copper

Learn how renewed interest in nuclear power, rising global energy demands, and the transition to clean energy are driving investment opportunities in uranium, copper and their miners.

Sprott Uranium Report

Uranium Bull Market Takes a Healthy Pause

Uranium markets pulled back in February after a rapid rise—in our view, this is a healthy pause in the ongoing uranium bull market. Announcements from Kazatomprom and Cameco underscored the uranium markets' structural supply deficit, while global governments continued to champion the benefits of nuclear energy.

Interview

Nasdaq TradeTalks: How the Demand for Copper Could be Impacted by the Transition to Cleaner Energy

Steve Schoffstall visits Nasdaq TradeTalks to talk about Sprott’s continued expansion in the critical minerals sector, including the launch of Sprott Copper Miners ETF (COPP). Steve touches on the demand for copper in the ongoing global energy transition and what it means for the copper market overall.

Interview

Nasdaq Investment News: Copper and its Role in the Transition to Cleaner Energy

Ed Coyne stops by Nasdaq Investment News to discuss copper’s role in the energy transition, its current status in the market and how Sprott is capturing the potential opportunity with the Sprott Copper Miners ETF (COPP) and the Sprott Junior Copper Miners ETF (COPJ).

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was a lackluster month for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment in energy transition surged to an unprecedented $1.77 trillion, led by electrified transport. Over the past 10 years, investment in global energy transition has grown at a 24% compound annual rate, several times the global GDP growth rate.

Shifting Energy

The Nuclear Energy Comeback and Uranium Powering It

John Ciampaglia, CEO of Sprott Asset Management, joins Thalia Hayden on Sprott’s new video series, Shifting Energy. They discuss surging uranium prices, the latest nuclear renaissance and potential investment opportunities. The series was created in partnership with ETF Guide to keep viewers on top of energy transition investment opportunities.

Special Report

Copper: Wired for the Future

The demand for copper in energy grids, electric vehicles and clean energy technologies, combined with diminishing ore grades and limited inventories, underscores copper's growing importance. We believe copper prices and miners are likely to benefit from the growing supply-demand gap.

White Paper

Copper: The Red Metal's Central Role in Powering Our Net-Zero Carbon Future

Today, in the United States alone, copper is a crucial element in nearly 7 million miles of electrical transmission and distribution wires. This white paper introduces the trends that are driving copper markets and copper miners, and explains our positive outlook for growth.

Sprott Uranium Report

Uranium Price Returns to Triple Digits

Uranium price surged 11% in January to $101 per pound, fueled in part by Kazatomprom's cut in guidance for 2024 production by ~14%. Junior uranium miners were top performers for the month, climbing 18.78%. Supply uncertainties continue to dominate markets, given the situation in Niger and possible bans on Russian uranium.

Sprott Critical Materials Monthly

The Emerging Renewable Energy Economy

A significant transition is underway in global energy production. The era of renewable energy is emerging and beginning to reshape power generation. Recent trends suggest that this shift is no fleeting phenomenon but a fundamental transformation powered by the relentless fall in renewable energy costs. The world is investing heavily in renewables. Some 62% of total global energy investment is now directed to clean energy.

Interview

Sprott is Bullish on Uranium as Governments Shift to the Energy Source

John Ciampaglia, CEO of Sprott Asset Management, sits down with Andrew Bell of BNN Bloomberg to discuss the uranium market and Sprott’s growth in the space. Campaglia: "We’ve been very active in educating the market and investors about the uranium thesis since we acquired the Uranium Participation Corporation in July of 2021."

Special Report

Top 10 Themes for 2024

What forces are likely to drive energy transition materials and precious metals markets in 2024 and over the next decade? We discuss 10 critical macroeconomic and market-specific themes ranging from deglobalization and climate policy to the new commodity supercycle and a potential silver price breakout.

Educational Video

Nuclear Waste: Dispelling Fears and Myths

Nuclear waste is not something to be feared. The care with which it is handled and stored contributes to the fact that nuclear power is one of the safest forms of baseload energy generation known to humanity. In this video, we dispel the many fears and concerns about spent nuclear fuel.

Sprott Outlook

What a Year for Uranium and Nuclear Energy

2023 provided the long-awaited inflection point for the uranium contracting cycle whereby we have finally achieved replacement rate levels. We believe the era of uranium inventory destocking and utility complacency is over. Long-term security of supply concerns, fanned by lingering geopolitical risks and the challenges of expanding primary production, are likely the key themes to watch.

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.