Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Special Report

Top 10 Themes for 2026

What are the 10 most important themes impacting global markets in 2026? We explore issues from deglobalization and fiscal dominance to the surge in gold, silver and critical materials, and provide our view of where opportunities and risks may be emerging.

Sprott Precious Metals Report

Gold Holds Gains as Liquidity Stress Emerges

Gold reached its highest monthly close in November 2025, driven by fiscal dominance, rising global debt and the Fed’s pivot to “QE-lite.” We believe gold’s strategic role as a safe haven asset is strengthening amid mounting liquidity stress and shifting global financial dynamics. Silver closed November at an all-time high.

Sprott Precious Metals Report

The Debasement Trade Broadens Across Precious Metals

In October, gold closed above $4,000 and silver hit record highs amid growing strategic demand, signaling a sustained shift away from fiat-based assets. Major developed economies are increasingly operating under fiscal dominance, driving investors toward hard assets like gold and silver.

Sprott Precious Metals Report

Gold Leads as Faith in Fiat Falters

Gold surged to record highs as fading confidence in fiscal and monetary policy drove investors toward hard assets. With long-term yields rising and central banks turning increasingly accommodative, markets are signaling a loss of faith in fiat currencies, fueling gold’s breakout and silver’s potential squeeze.

Sprott Precious Metals Report

Challenges to Fed Autonomy Strengthen Case for Gold

Gold has topped another all-time high above $3,600 per ounce, while silver has reached $41, its highest level since 2011. Both metals may be among the strongest-performing asset classes for the year. We explore how erosion of Fed independence heightens policy risk, reinforcing the strategic role of gold and silver.

Sprott Critical Materials Report

Critical Materials Breakout into a New Bullish Phase

The convergence of national security imperatives, energy transition policies and evolving trade dynamics is fundamentally redefining the role of critical minerals. The breakout in the Nasdaq Sprott Critical Materials Index™ is an early signal of this shift, reflecting technical strength and deep structural drivers.

Sprott Precious Metals Report

Gold and Silver Bull Run Continues

Gold and silver have been strong performers in 2025, with both metals up over 25% YTD as global instability drives demand for safe haven assets. Central banks are shifting away from the U.S. dollar, while silver’s breakout suggests a potential supply squeeze ahead.

Sprott Precious Metals Report

Gold Gains Ground as Faith in the Dollar Erodes

Gold continues its rally as fading confidence in U.S. fiscal policy and the U.S. dollar drives demand for real assets. As we publish, silver is breaking out above $35, supported by structural supply deficits, renewed investor interest and mounting macroeconomic pressures.

Sprott Precious Metals Commentary

A Shaky U.S. Dollar Boosts Gold’s Role as an Alternative Reserve Asset

Gold is gaining prominence as a reserve asset due to a weak U.S. dollar and declining U.S. financials, reaching record highs while equities and bonds fell. We believe this positions gold as a potential anchor for a multi-asset reserve system. Given silver’s correlation to gold, we believe its monetary value will reassert itself in time.

Sprott Q1 Precious Metals Report

Gold's Strength Amid a Crisis of Confidence

Gold's record-breaking rally in Q1 2025 reflects mounting investor anxiety over stagflation, policy volatility and a fraying global economic order. U.S. tariffs and policy unpredictability have elevated the risk of stagflation, fueling demand for gold as the lone liquid safe-haven asset. We also believe silver is potentially poised to break out.

Sprott Critical Materials Monthly

Critical Materials Markets Shake Off DeepSeek Disruption and U.S. Policy Rollbacks

Critical materials showed resilience in January amid global volatility. We take a deep dive into China's growing leadership in clean technology investments, the disruptive impact of DeepSeek's AI model and the implications of U.S. policy changes on the energy transition and critical materials supply chains.

Sprott Critical Materials Monthly

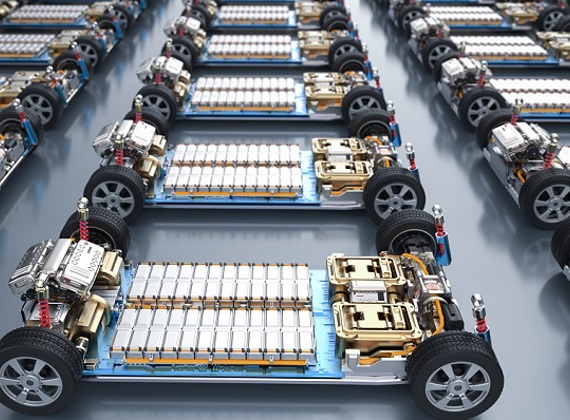

Batteries and Minerals Driving Global Electrification

Batteries and energy storage continue to underpin electrification trends, solidifying their role as a cornerstone in the global shift toward sustainable energy. Support is being strengthened by strategic investments from governments and corporations, and resilient demand for critical minerals like lithium, copper and nickel.

Sprott Q3 Precious Metals Report

Gold and Silver Enjoy Continued Rally

Gold and silver prices surged in Q3 2024, driven by central bank buying and macroeconomic factors. While gold experienced a historic price increase, silver's price was influenced by both its precious metal value and industrial demand. YTD through September 30, gold is up 27.71% and silver has gained 30.95%.

Sprott Critical Materials Monthly

U.S. Electricity Grid Remakes Itself to Meet Surging AI-Led Power Demand

Demand for electricity over the next decade will put pressure on the U.S. power grid to keep pace. New investment in power-hungry industrial facilities is driving demand, especially the data centers that support artificial intelligence (AI), U.S. reshoring initiatives and the steady electrification of the transport sector.

Sprott Critical Materials Monthly

The Unstoppable Rise of Renewable Energy

Renewable energy is rapidly replacing fossil fuels as costs decrease and efficiencies improve with increased deployment, making it much cheaper than traditional energy sources. This shift, driven by the exponential growth of renewables, electrification, and efficiency, is expected to significantly alter global power dynamics as fossil fuels are phased out.

Sprott Q2 Precious Metals Report

Gold’s Record-Setting Quarter and Silver’s Resurgence

Gold has been on the move since Q2 ended, after having gained 12.79% year-to-date as of June 30, gold's best six-month start since 2020. Gold enjoyed strong support from central bank buying. Silver closed Q2 at $29.14, its highest quarterly close since Q3 2012. Silver was supported by the gold breakout and global monetary expansion policies.

Sprott Critical Materials Monthly

Fourth Industrial Revolution Fuels Global Competition for Critical Minerals

The world is in the midst of a fourth industrial revolution (4IR) as technological developments like artificial intelligence (AI), robotics, IoT, genetic engineering and quantum computing bring about an unprecedented integration of the digital, physical and biological realms. Electrification and energy are pivotal to advancing 4IR technologies, and the resulting demand pressures on critical minerals like copper, lithium and uranium are supporting a new commodity supercycle.

Sprott Critical Materials Monthly

A New Copper Supercycle Is Emerging

The copper market is entering a new supercycle, built on several rising geopolitical and market trends contributing to a strong bullish outlook. Demand is surging as countries invest in clean energy and protect their access to copper, while supply is constrained by a lack of new mine development.

Sprott Critical Materials Monthly

AI's Critical Impact on Electricity and Energy Demand

The rise of AI and data centers is likely to significantly increase global electricity demand, creating challenges for power grids but also opportunities for stable, clean energy sources like nuclear power. AI data centers are also likely to support increased demand for copper.

Sprott Critical Materials Monthly

Battery Storage Is the Technological Cornerstone for a Sustainable Energy Future

The energy sector has experienced a remarkable transformation, primarily driven by the rapid growth and integration of renewable energy sources. Central to this transition is the advancement of battery storage technology, a critical enabler that promises to reshape how we generate, distribute and consume electricity. As we examine this evolving landscape, it becomes evident that battery storage is a technological cornerstone for a sustainable energy future.

Sprott Q1 Precious Metals Report

Gold Is on the Rise and Reaches All-Time High

Gold reached an all-time closing high and is up 8.09% YTD (as of 3/31/2024) after rising 13.10% in 2023. We believe several fundamental factors are in place for gold to move higher, in particular, strong central bank buying. We also see three drivers for a higher silver price: 1) silver tracks rising gold due to central bank buying, 2) reflation trade and 3) increased solar panel demand.

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was a lackluster month for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment in energy transition surged to an unprecedented $1.77 trillion, led by electrified transport. Over the past 10 years, investment in global energy transition has grown at a 24% compound annual rate, several times the global GDP growth rate.

Sprott Critical Materials Monthly

The Emerging Renewable Energy Economy

A significant transition is underway in global energy production. The era of renewable energy is emerging and beginning to reshape power generation. Recent trends suggest that this shift is no fleeting phenomenon but a fundamental transformation powered by the relentless fall in renewable energy costs. The world is investing heavily in renewables. Some 62% of total global energy investment is now directed to clean energy.

Special Report

Top 10 Themes for 2024

What forces are likely to drive energy transition materials and precious metals markets in 2024 and over the next decade? We discuss 10 critical macroeconomic and market-specific themes ranging from deglobalization and climate policy to the new commodity supercycle and a potential silver price breakout.

Sprott Critical Materials Monthly

Lithium-Ion Technology Solidifies Lead in EV Battery Stakes

The long-term trajectory for EVs is positive despite the recent slowdown. The EV industry is navigating the typical challenges of early technology adoption, with continuous investments and technological advancements driving the transition to electrification. Lithium-ion batteries (LIBs) are the preferred battery technology for EVs, thanks to their superior technical properties and significant investment in their development and infrastructure.

Sprott Critical Materials Monthly

Energy Security and the Shifting Focus from Oil to Critical Minerals

As the United States advances in its pursuit of clean energy, it is strategically redirecting its energy security emphasis from oil to critical minerals. This dynamic shift is designed to decrease reliance on oil, and diminish the influence of oil geopolitics and the sway of petrostates such as Russia.

Sprott Critical Materials Monthly

Silver Demand Grows as Solar Leads Renewables

Uranium's performance helped the energy transition complex close higher in September. From a macro outlook, solar panels are emerging as a critical player in the global energy transition. Evolving technologies in renewable energy, especially in the solar space, are driving a surge in silver demand which may likely outpace supply over the next decade.

Sprott Critical Materials Monthly

U.S. Taking Center Stage in Cleantech Investment

Uranium had a strong month in August, contrasting with the decline of most energy transition metals due to China's economic troubles and shadow banking woes. The investment capital spurred by the U.S. Inflation Reduction Act (IRA) is turning the U.S. into a cleantech powerhouse, reshaping global economics. The old China-led commodity supercycle is giving way to a new U.S.-based supercycle focusing on clean energy and innovation.

Sprott Energy Transition Materials Monthly

Growing Urgency to Modernize U.S. Power Grid

Given increased electricity demand and the risks posed by climate change, the U.S. power grid desperately needs modernization. There is an immediate need to expand the grid’s capacity, increase its resilience and support its most vulnerable components – the transmission and distribution lines. This is driving the development of energy storage systems and V2G (vehicle-to-grid) technology and is a major copper demand driver.

Sprott Precious Metals Report

Central Banks Flex Gold Market Muscle

In the first half of 2023, the gold bullion price rose by 5.23% despite competition from a euphoric equity market. Even with contrasting approaches, central banks and investment funds became the main players shaping the gold market in the first half of the year. Central bank buying drove demand, and gold is reverting to its historical role as a significant reserve asset as central banks seek to diversify amid geopolitical uncertainties.

Sprott Critical Materials Monthly

EV Battery Independence and the New U.S. Manufacturing Supercycle

Energy transition metals miners posted strong results in June, with uranium mining equities leading the group. The U.S. is entering the early stages of a manufacturing supercycle driven by massive energy transition investment, which includes building a secure and resilient domestic EV battery supply chain. The U.S. and EU are likely to replace China as the primary drivers of future metals demand, as China's two-decades-long commodities dominance has likely crested.

Sprott Precious Metals Report

Geopolitical Risks Enhance Gold’s Role as a Reserve Asset

Gold attempted to breakout above $2,050 in early May before drifting lower as the U.S. debt-ceiling drama deepened and the U.S. dollar strengthened. At the same time, global central banks have been accumulating gold at a record pace. This highlights gold's role as a neutral reserve asset that has the potential to mitigate increasing counterparty risks amid escalating geopolitical tensions.

Sprott Critical Materials Monthly

The West Moves to Weaken China's Hold

Lithium and lithium miners staged a sharp rebound rally in May and were the positive exception among critical minerals. The sector was weighed down by China's faltering recovery, ongoing global growth concerns and the U.S. debt ceiling drama. China’s dominance in critical minerals poses risks to the West’s manufacturing base and national security, highlighting the need for onshoring and friend-shoring energy transition supply chains.

Sprott Precious Metals Report

Gold Rides Higher on Recession Fears

The gold market continues to be bullish as the probability of a recession rises, regional banking stress resurfaces and the Fed seems determined "get inflation down to 2%, over time". Globally, we are entering a more challenging period featuring subpar economic growth, increasing risks to systematic financial stability, stubbornly high inflation and rising geopolitical risks. Against this backdrop, we believe gold should perform well, even if the U.S. debt ceiling disaster is averted.

Sprott Critical Materials Monthly

Nationalization and Surging M&A Highlight Secular Strength

The long-term secular growth outlook for energy transition materials got several boosts in April, despite tepid performance for the month. Chile's decision to nationalize its lithium reserves reinforces the metal's role as a global strategic economic asset. M&A activity has heated up in the copper mining sector with lofty bids, including Glencore's $23 billion rejected offer for Teck Resources at a 20% premium.

Sprott Critical Materials Monthly

How Deglobalization is Changing the Dynamics of Securing Critical Minerals

Commodity prices weakened in March in reaction to financial system stress and recession fears. As deglobalization accelerates, unfettered access to critical minerals is not likely to last. The old system of free and fair access to commodities, including critical minerals, is moving toward one marked by interregional competition, and unstable availability and pricing. China has moved aggressively to acquire critical minerals in the past 20, but we believe the West has near-unmatched capabilities and is a formidable competitor.

Sprott Precious Metals Report

Gold Bulls Run Faster as Fed Tackles Banking Crisis

In March, gold posted its highest monthly close since July 2020 and rounded out a solid Q1 2023 gain of 7.96%. Gold is now up 21.38% from last autumn's low (9/26/22) following the most aggressive central bank purchases in decades and gold investment flows catalyzed by the U.S. banking crisis. We are very optimistic given that many significant long-term bullish macro factors for gold have become stronger, while some shorter-term cyclical gold bearish factors have faded.

Sprott Critical Materials Monthly

Has the Next Commodities Supercycle Begun?

February saw energy transition materials/critical minerals markets correct, but the secular story remains strong. As the global energy transition "arms race" heats up, the drive to secure supply is fast becoming more important than price. All signs indicate the 40-year bond bull market has likely ended and the next great secular bull market in commodities has begun.

Sprott Precious Metals Report

First Gold Dip Since Central Bank Buying Spree

Gold fell in February, closing the month at $1,827 in a correction characterized by a stall in buying, but not selling. Since gold's autumn 2022 low of $1,622, global central banks have been buying gold at record rates; more than three times their long-term averages. The current scale of central bank buying is massive — an annualized rate of 1,724 tonnes vs. an average of 512 tonnes over the past decade. Central bank gold purchases as a percentage of global gold demand have also tripled to 34% from their average of 11% over the past several years.

Sprott Critical Materials Monthly

Critical Materials Start 2023 With a Bang

We believe we are in the early stages of an energy transition materials secular bull market and favorable supply-demand dynamics are likely going forward. The upward revision in global growth, the timing effect of the China credit impulse and the surprise ending of China's zero-COVID policy have provided a tailwind for the metals market. For energy transition metals, we see this as a cyclical boost on top of the robust secular demand that is in play.

Sprott Precious Metals Report

2023 Top 10 Watch List

This year’s top 10 list offers Sprott’s thoughts on what will likely drive markets in the coming year and decade, from a macro perspective and the vantage of our asset classes: Precious Metals and Energy Transition Materials. We believe the global clean energy transition will grow more urgent as energy markets continue re-ordering and energy security becomes synonymous with national security. The signposts point to a commodity-intensive, inflationary and capital-intensive decade where energy transition materials and precious metals will become far more valued than in the prior market regime.

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.