For the latest standardized performance and holdings of Sprott Uranium ETFs, please visit the individual website pages: URNM and URNJ. Past performance is no guarantee of future results.

Key Takeaways from May

- Uranium markets surged in May, with spot prices up 5.51% and term prices steady at $80/lb, as policy shifts and strong fundamentals signaled potential repricing.

- Uranium miners gained 16.22% in May, turning positive for the year; juniors rose 14.20%.

- Bold U.S. Executive Orders and legislation mark the most comprehensive federal support for nuclear in decades, boosting the uranium outlook.

- AI-driven power demand is driving real investment in nuclear, supporting plant lifespans and new capacity through long-term offtake deals.

Performance as of May 31, 2025

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

5.51% | 10.29% | -2.39% | -20.06% | 14.38% | 16.29% |

|

Uranium Mining Equities |

16.22% | 16.00% | 0.42% | -25.72% | 9.02% | 28.26% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 |

14.20% | 13.39% | -3.34% | -34.71% | 0.42% | 27.77% |

|

Broad Commodities (BCOM Index) 4 |

-0.93% | -2.69% | 1.24% | -2.92% | -8.69% | 9.49% |

|

U.S. Equities (S&P 500 TR Index) 5 |

6.29% | -0.37% | 1.06% | 13.52% | 14.41% | 15.94% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 5/31/2025. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Performance Overview: Uranium Market Regains Footing

Uranium markets roared back to life in May, powered by a decisive acceleration in U.S. nuclear energy policy and renewed confidence in the industry. While year-to-date performance remains muted, the recent rally underscores uranium’s potential to reprice when sentiment aligns with the market’s persistently strong fundamentals.

Spot uranium rose 5.51% in May, its second consecutive month of plus 5% gains. This strong performance reestablished the market’s upward momentum after a frustrating start to the year.1 Term prices remained firm at $80/lb, underscoring supply discipline, a prioritization of long-term pricing over short-term volume, and the structural supply deficit underpinning the uranium market.

Uranium miners rebounded, underscoring their catch-up potential as sentiment turns.

A key contributor to the improved price action was the resurgence of the carry trade, which helped provide liquidity and bring spot and term markets into closer alignment. This renewed activity has effectively reestablished an underlying price support for the uranium spot market, supporting stability and confidence. Carry traders serve a vital role in price discovery, helping bridge the gap between current pricing and future expectations, and enhancing transparency and efficiency in the physical market.

Uranium’s price recovery catalyzed a powerful rally among miners, which posted a 16.22% gain, turning slightly positive on a year-to-date basis.2 Junior uranium miners also rallied, up 14.20% in May3, but remain underwater year-to-date (YTD). This sharp equity rebound points to the sector’s leverage to increases in the spot price and catch-up potential, especially as investor sentiment begins to recover. For context, uranium equities are up 42% since the YTD low on April 7, 2025.2

Despite the turbulence in 2025, uranium markets have shown resilience, with underlying fundamentals remaining firmly intact. May’s performance highlights how quickly sentiment can improve when prices stabilize and policy tailwinds become more visible.

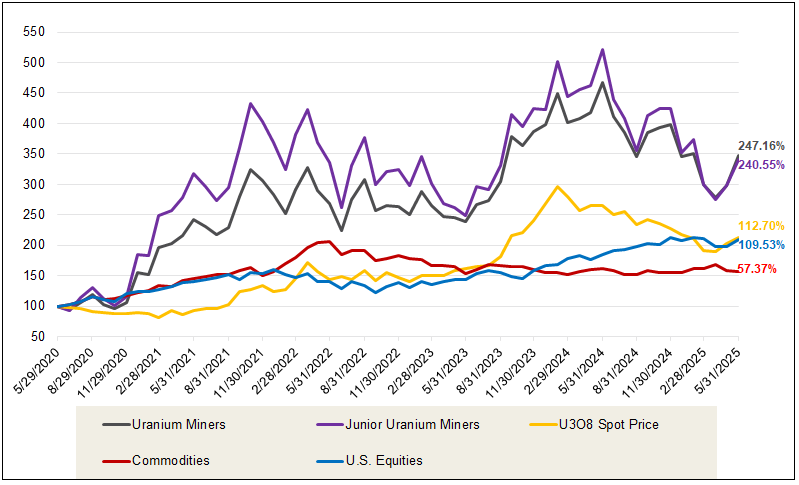

Looking at longer-term performance, uranium and uranium miners have meaningfully outpaced equities and broader commodity benchmarks over the past five years (Figure 1). The resilience is underpinned by a structural supply deficit, inelastic demand and growing policy tailwinds. With momentum now rebuilding and U.S. energy policy expanding vastly in both scale and scope (throughout the value chain including U.S. Nuclear Regulatory Commission (NRC) reform, expediting permitting, etc.), the next leg of the cycle may be shaped by renewed utility contracting and the accelerated buildout of future demand through life extensions, uprates, restarts and new builds.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (5/31/2020-5/31/2025)

Source: Bloomberg and Sprott Asset Management. Data as of 05/31/2025. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); Junior Uranium Miners are measured by the Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJT™ Index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; and Commodities are measured by the Bloomberg Commodity Index (BCOM). Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Sprottlight: U.S. Nuclear Policy Energizing Uranium

U.S. policy clarity finally arrived in May, and nuclear energy emerged as a clear winner. The surprise passage of the House’s sweeping budget bill, the “One Big Beautiful Bill Act,” and coordinated executive actions marked a critical shift in U.S. nuclear policy. While many clean energy subsidies were rolled back, nuclear energy retained and strengthened its support, removing uncertainty and setting the stage for investment.

The One Big Beautiful Bill

In May, the U.S. House of Representatives passed the “One Big Beautiful Bill” (OBBB), a sweeping 1,000+ page package that dramatically reshapes U.S. energy and tax policy.6 While the bill still faces hurdles in the Senate and is not yet law, its passage signals a clear legislative intent to pare back broad-based clean energy subsidies while broadening support for nuclear energy as the backbone of American electricity.

U.S. policy is decisively elevating nuclear energy—establishing a long-term tailwind for uranium markets.

OBBB proposes a near-total repeal of the technology-neutral tax credits introduced under the Inflation Reduction Act (IRA). These credits, cornerstones of clean energy project finance, would be eliminated for any project not already under construction within 60 days of enactment or placed in service by December 31, 2028. With current grid interconnection delays and permitting lags, the bill would effectively disqualify a wide range of wind, solar and battery projects currently in planning stages, exacerbating financing challenges already faced by non-nuclear developers.

Nuclear, however, is a clear exception and beneficiary within the OBBB:

- Eligibility: Nuclear expansion projects and advanced nuclear projects retain access to IRA tax credits but must now begin construction by the end of 2028 and accelerate sourcing requirements. Though this forces the timeline to accelerate for eligibility, it still provides a significantly longer runway than other technologies. Further, it helps to foster a domestic uranium supply chain at the expense of reliance on Russia and China.

- Transferability: While the bill removes the ability to sell tax credits for most clean energy types, nuclear projects are still allowed to do so. This is especially helpful for developers of new or advanced reactors, as selling the credits is an easier source of capital.

- Clarity: By affirming continued support for nuclear, the OBBB helps clear prior uncertainty that had delayed utility contracting and reactor development decisions.

These provisions are especially consequential given the current landscape. While renewables face mounting headwinds, from grid interconnection bottlenecks to elevated financing costs, nuclear now stands out with continued federal support.

This shift could prove pivotal for uranium markets. The OBBB, even in draft form, strengthens the thesis by making nuclear the survivor in a retrenched subsidy environment. Additionally, utilities had delayed uranium contracting due to a range of uncertainties—including how the potential repeal of parts of the Inflation Reduction Act would be implemented. Should the bill, or even key parts of it, advance through the legislative process, it would mark a structural advantage for nuclear buildout, boosting the long-term demand outlook for uranium fuel and providing clarity for utilities to resume contracting.

Trump's Executive Orders

On May 23, 2025, President Trump signed four sweeping Executive Orders to revitalize the U.S. nuclear sector, from uranium mining and fuel production to reactor deployment and global exports. These directives represent the most ambitious nuclear policy framework in decades, with implications for national security, AI infrastructure, energy independence and industrial revitalization.

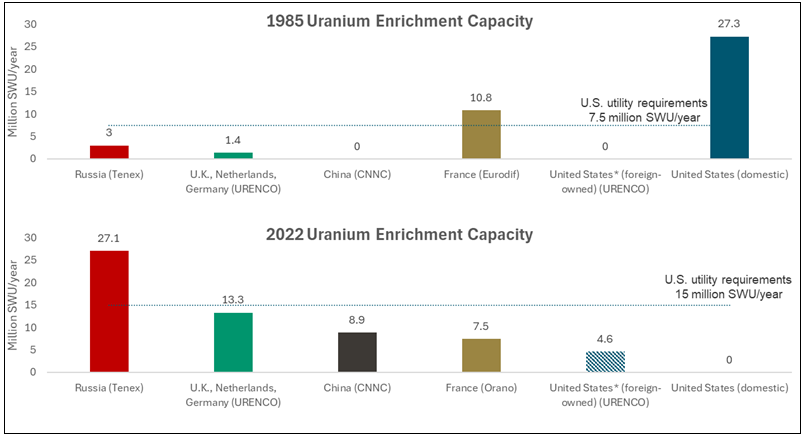

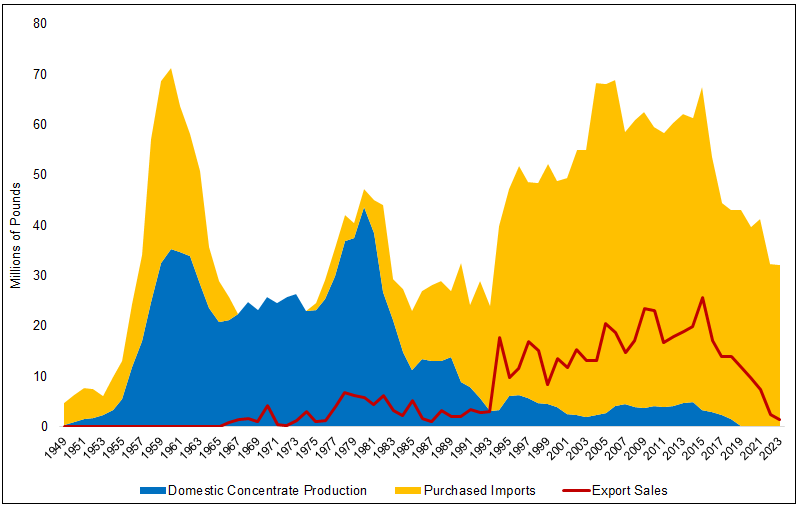

These efforts build on the earlier declaration of a national emergency over the U.S.’s dependence on enriched uranium from adversarial nations, notably Russia and China, invoking the Defense Production Act to accelerate domestic uranium mining, conversion and enrichment. The U.S. has gone from the world’s dominant uranium enricher in 1985 to having zero domestically owned enrichment capacity (see Figure 2). The U.S. has also lost almost the entirety of its uranium mine production (see Figure 3).

Figure 2. The Loss of U.S. Nuclear Fuel Leadership

Source: 2022 data from World Nuclear Association Nuclear Fuel Report 2023. 1985 data from the Congressional Budget Office. Centrus Energy Corp.

* The only remaining enrichment plant physically located in the U.S. is controlled by URENCO, a European-owned corporation.

The policy initiatives are holistic in nature with each Executive Order targeting the nuclear value chain:

1. Reinvigorating the Nuclear Industrial Base

This executive order7 leverages the Defense Production Act to restore a secure, domestic nuclear fuel cycle. Key directives include (among more):

- Within 120 days: The Department of Energy (DOE) must develop a plan to expand U.S. uranium conversion and enrichment capacity. Mining activities had already been addressed in the executive order “Immediate Measures to Increase Domestic Mineral Production.”

- Within 240 days: A comprehensive strategy is required for managing spent fuel and enabling advanced fuel cycle technologies like reprocessing and commercial recycling.

- The DOE is instructed to contract with U.S. fuel fabrication facilities and secure voluntary agreements with miners to procure low-enriched uranium (LEU), used for most commercial nuclear reactors, and high-assay low-enriched uranium (HALEU), used for advanced reactor technologies.

- Loan guarantees and federal procurement preferences will prioritize projects that restart closed plants or complete delayed reactors.

- The DOE is tasked with enabling 5 GW of increased power outputs (uprate) at existing plants and beginning construction on 10 large reactors by 2030.

2. Reform of the Nuclear Regulatory Commission (NRC)

The second executive order8 targets the NRC, long viewed as a bottleneck to new reactor deployment:

- “Seek to facilitate the increased deployment of new nuclear reactor technologies and expand American nuclear energy capacity from around 100 GW today to 400 GW by 2050.”

- New deadlines will limit the NRC to 18 months for new reactor approvals and 12 months for license renewals.

- NRC cost recovery will be capped, limiting how much the NRC can charge a nuclear project applicant for its licensing services.

- A full overhaul of licensing rules is required within 18 months, including modernization of environmental reviews and standardization of approvals for small modular reactors (SMRs) and microreactors.

- The NRC is also directed to reconsider its reliance on the Linear No-Threshold (LNT) radiation model, potentially lowering the regulatory burden for radiation exposure.

3. Reforming Nuclear Reactor Testing at the DOE

This executive order9 enhances DOE’s ability to test and fast-track new reactor designs:

- By July 2026, the DOE must create a pilot program for constructing and operating at least three new test reactors outside the National Laboratories.

- The DOE must designate qualified test reactors within 60 days and revise rules for them within 90 days.

- Streamlined environmental reviews will use existing categorical exclusions to speed up deployment.

4. Deploying Advanced Nuclear Reactor Technologies for National Security

The final executive order10 links nuclear deployment to national security and AI resilience:

- The domestic military base must operate a military reactor by 2028, and the Secretary of Defense shall propose legislation to support advanced reactor use on bases.

- The DOE must designate AI data centers as “defense critical” infrastructure and deploy nuclear capacity to support their energy needs.

- At least 20 metric tons of HALEU will be made available from government stockpiles for private-sector reactor projects, powering AI infrastructure at DOE sites.

- Export policy is also central. The U.S. State Department is tasked with negotiating at least 20 new Section 123 Agreements for peaceful nuclear cooperation and reducing export licensing barriers.

The U.S. is signaling a once-in-a-generation commitment to domestic uranium independence and advanced nuclear deployment.

Trump’s executive orders underscore the administration's goal of quadrupling U.S. nuclear capacity to 400 GWe (1,000 megawatts of electric power) by 2050, an aspiration far exceeding existing forecasts. Although no new funding has been legislated and the success of these directives depends on execution and sustained bipartisan support, the policy message is clear: nuclear is now recognized as critical infrastructure.

With the legislative momentum from the House’s energy bill, the executive orders point to a durable shift in federal posture, prioritizing long-term procurement visibility, streamlined regulation and domestic uranium security. As projects begin to align with this newly supportive environment, we believe the implications for uranium demand and domestic production from uranium miners could be profound.

Figure 3. U.S. Domestic Uranium Mine Production (1949-2023)

Source: U.S. Energy Information Administration (EIA) May 2025 Monthly Energy Review.

Uranium Market Implications

The latest wave of U.S. nuclear policy, combining sweeping Executive Orders with ambitious legislation, signals the most coordinated federal push toward nuclear energy in decades. For uranium markets, the implications are overwhelmingly constructive.

1. America’s nuclear ambitions quadrupled.

President Trump’s new policy target of 400 GW by 2050 represents a 4x increase from today’s 100 GW baseline, and far exceeds the IAEA’s forecast of 89–142 GW for all of North America.11 For uranium, this would imply a similar quadrupling of the U.S. reactor’s requirements of uranium, from nearly 50 M lbs of U3O8e to nearly 200 M lbs. This additional 150 M lbs of U3O8e would represent nearly doubling the world’s current total global U3O8 mine production, forecasted at 164 M lbs U3O8 in 2025 by UxC.

Whether demand materializes on this scale will depend on real-world execution, including siting, permitting, capital access and power grid buildout. However, these developments represent asymmetrically positive risk, introducing additional upside to uranium demand forecasts.

2. Direct support for uranium mining is taking shape.

For the first time under the current policy framework, a uranium mine, Anfield’s Velvet-Wood project, received U.S. approval in just 14 days. This demonstrates how quickly support for domestic supply can translate into tangible action.12 The project was permitted under Trump’s emergency energy declaration, reinforcing a shift toward uranium as a strategically vital input.

3. The executive orders expand the fuel cycle from mine to reactor.

The four executive orders, described by the White House as a push to “re-establish the U.S. as the global leader in nuclear energy,” include mandates to expand uranium mining, conversion, enrichment and recycling, streamline reactor permitting under the NRC, and accelerate testing and construction of next-generation nuclear reactors. These policies directly support greater front-end uranium demand, especially for U.S.-origin supply.

4. Regulatory overhaul makes uranium demand more visible.

Mandated deadlines, 18 months for new licenses and 12 months for renewals, reduce uncertainty around reactor builds and extensions. That clarity accelerates long-term contracting timelines, a critical lever for price formation in uranium markets.

5. Capital advantages bolster nuclear.

The House-passed bill would allow only nuclear projects to retain access to transferable tax credits, a provision stripped from renewables. This preferential treatment gives nuclear developers, especially smaller companies, a funding edge. For uranium, the takeaway is simple: More projects get built and sooner, with each new reactor adding demand to the cycle.

Together, these measures mark a strategic alignment of U.S. energy policy toward nuclear energy, with uranium playing an indispensable role. The alignment of regulatory reform, security imperatives and new demand sources, from AI to defense to decarbonization, positions the U.S. as a nuclear leader and a core growth market for uranium over the coming decades.

Figure 4. America’s Nuclear Ambitions Quadruple its Required Uranium (lbs U3O8e)

Source: Reflects uranium required for nuclear generating capacities for the U.S. 2025 from the WNA Nuclear Fuel Report 2023. 2050 target is from The White House, Ordering the Reform of the Nuclear Regulatory Commission, 5/23/2025 and WNA, World Nuclear Power Reactors & Uranium Requirements, 6/3/2025.

Market Drivers: AI Demand, Shifting Sentiment and Tactical Tailwinds

A New Era of Demand

Power demand from data centers and AI workloads is no longer a theoretical concept; it’s continuing to drive real-world investment in nuclear energy. Meta Platforms signed a landmark 20-year deal to purchase 1,121 MW of baseload electricity from Constellation Energy’s Clinton nuclear plant in Illinois, beginning in mid-2027 when the plant’s existing zero-emission credits expire.13

Constellation will now invest in a 30 MW output upgrade and initiate relicensing, with plans to explore the construction of a second unit, potentially a small modular reactor (SMR), on the site. This deal follows another 20-year deal announced in September between Constellation and Microsoft to reopen Three Mile Island to support Microsoft’s AI efforts.14 These deals and others underscore a critical point: AI-linked power buyers are willing to backstop nuclear projects in ways traditional offtakers have not, offering visibility that could extend plant life and stimulate capacity growth.

This new pattern of demand support was echoed in Canada. Ontario approved the construction of its first SMR at the Darlington New Nuclear Project site, the province’s first new nuclear build in over three decades.15 The unit is expected to be online by 2030, enough to power 300,000 homes, reinforcing nuclear’s central role in jurisdictions already running mostly on clean baseload.

Pivots in Nuclear Policies

In a major reversal, Germany announced it would no longer oppose nuclear energy’s inclusion in EU clean energy rules, clearing the path for France and other states to fully integrate nuclear into the continent’s decarbonization frameworks.16 This is after only two years since Germany completed the shutdown of its last three nuclear power plants.

Momentum is spreading:

- Denmark declared plans to revisit its 40-year nuclear ban, citing clean energy security.17

- Spain, facing a major power blackout on April 28, has had debate intensify over its nuclear phaseout plans.18

This recalibration reflects the growing strategic value of nuclear, a reliable baseload, low-carbon source of energy resilience in a world increasingly shaped by electrification, heatwaves and supply chain risk.

Short Squeeze Dynamics

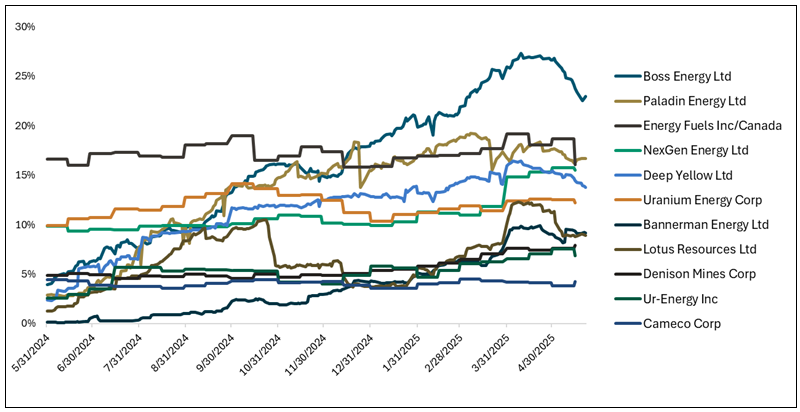

May’s uranium equity rally was supported by fundamentals and technical drivers, chiefly, a surge in short covering. As prices rebounded, short sellers were required to buy shares to cover their positions. They exacerbated price movements, particularly in heavily shorted Australian uranium names, among the most shorted on the ASX. For example, Boss Energy Ltd. gained 101% to May 27 as its short interest declined from its YTD high of 27% on April 9 (Figure 5). Though short interest has come down in many names, it remains elevated, potentially leaving the door open for these dynamics to continue.

Figure 5. Short Interest as a % of Float

Source: Bloomberg. Short interest as a % of float as of 05/22/2025. Companies shown above are publicly-traded uranium miners shorted most frequently relative to their overall "float", or the number of regular shares the company has made available for public trading. There is no guarantee companies were or will be profitable.

Looking Ahead: Uranium’s Bull Market Marches On

As we move into the summer months, the uranium market enters what has historically been a quieter seasonal window. However, with term contracting still well below replacement levels, the sector appears primed for a renewed push, particularly with the World Nuclear Association (WNA) Symposium approaching in September. The WNA publishes its Nuclear Fuel Report every two years and is set to release it at this year’s conference. The last report had served as a key sentiment catalyst following an upward revision in long-term demand forecasts. Given the scale of recent policy developments, utility actions and project restarts, a further upward revision is a real possibility and could reignite investor attention.

Beyond seasonality, the fundamental setup is growing more compelling:

- Reactor demand is rising, from life extensions, restarts and capacity uprates to aggressive buildouts in China and a growing SMR pipeline globally. The demand base is expanding in both size and duration.

- Primary supply remains fragile. Operational shortfalls, permitting delays and geopolitical risks continue to plague major producers. Supply discipline has become the norm, not the exception. Further, dependence on junior restarts is rising. 2025 will be the second consecutive year where the market leans heavily on smaller producers to try to address the gap. Further production shortfalls could accelerate price pressure.

- Secondary supply has dwindled. Inventories are now at the lower end of utility targets, offering little buffer should procurement accelerate or production disappoint.

- Incentive prices are moving higher. Producers like Cameco are holding firm, while others like Deep Yellow have deferred investment and are awaiting more attractive pricing.

- Contracting remains behind the curve. Term volumes are still trailing replacement needs, and we are deep into a cycle that cannot address long-term demand without greater utility participation.

Uranium’s structural deficit continues to deepen, setting the stage for the next leg of the bull market.

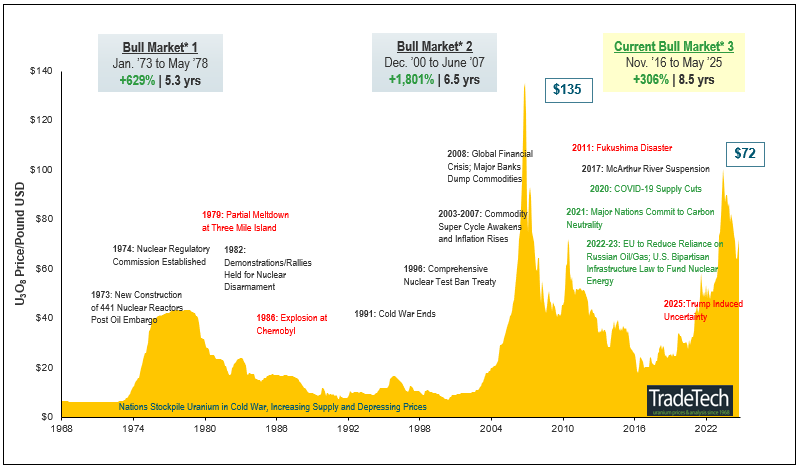

In our view, these conditions collectively support the next leg of the bull market. With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 6).

Figure 6. Uranium Bull Market Continues (1968-2025)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets when prices generally rise. A “bear market” refers to a condition of financial markets when prices are generally falling.

Source: TradeTech Data as of 5/31/2025. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

Diversification does not protect against loss. The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.