For the latest standardized performance and holdings of Sprott Uranium ETFs, please visit the individual website pages: URNM and URNJ. Past performance is no guarantee of future results.

Key Takeaways

- Uranium Markets Correct: Uranium markets experienced a correction in February; this followed a rapid run-up and, in our view, represents a healthy pause in the ongoing uranium bull market.

- Kazatomprom & Cameco Walk Back Production: Kazatomprom walked back planned production increases for 2024 and provides no guidance for 2025. Cameco (the world's largest public uranium producer) reported 2023 production slightly below revised guidance (17.6 million pounds attributable), with unchanged production planned for 2024 (22.4 million pounds).

- Positive Government Support: Continued support by global governments for nuclear energy has bolstered the outlook for uranium markets and miners.

Performance as of February 28, 2024: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

| U3O8 Uranium Spot Price 1 | -6.41% | 17.17% | 3.85% | 86.03% | 50.71% | 27.68% |

| Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 | -10.69% | 3.57% | 0.80% | 51.22% | 26.89% | 29.69% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | -11.43% | 4.59% | 5.26% | 47.53% | 21.33% | 28.56% |

| Broad Commodities (BCOM Index) 4 | -1.89% | -5.02% | -1.97% | -8.91% | 4.27% | 3.50% |

| U.S. Equities (S&P 500 TR Index) 5 | 5.34% | 11.98% | 7.11% | 30.45% | 11.90% | 14.75% |

*Performance for periods under one year are not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 1/31/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Uranium Retracement from Recent Highs

Uranium markets pulled back in February, with the U3O8 uranium spot price declining 6.41%, from US$101.08 to $94.60 per pound.1 Uranium miners and junior uranium miners also sold off, falling 10.69% and 11.43%, respectively.2,3 This retreat follows a historic rapid run for the uranium spot price, which increased nearly 80% in seven months from July 2023 to January 2024. We believe the February price action marks a natural and healthy pause in the current uranium bull market.

Before retreating to the current price, February saw the uranium spot price hit a recent high of $107. Subsequently, a pause in buying activity has lowered trading volumes in the spot market. Prices were also negatively impacted by reports of profit taking by hedge funds. Despite this, the uranium spot price remains at levels not seen in 16 years, and the recent weakness does not indicate deterioration in the market’s strong underlying fundamentals, which are characterized by a structural supply deficit.

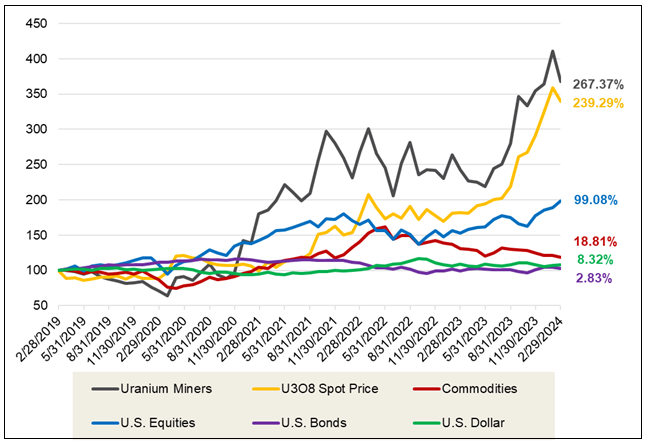

Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended February 29, 2024, the U3O8 spot price has risen a cumulative 239.29% compared to 18.81% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (02/28/2019-02/29/2024)

Sources: Bloomberg and Sprott Asset Management. Data as of 02/29/2024. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

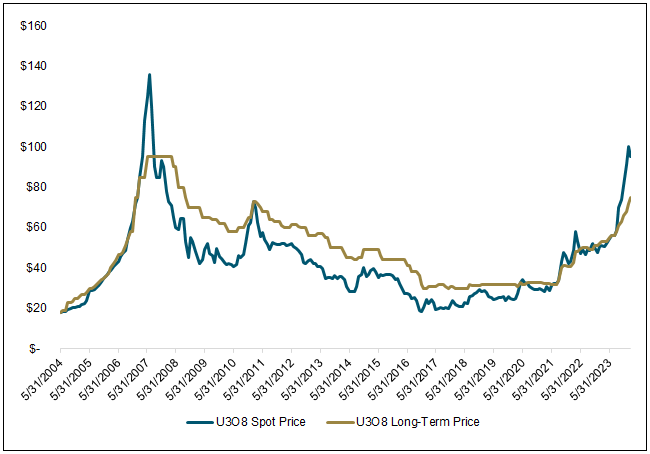

Uranium Long-Term Contract Price Reaches 15-Year High

Although the uranium spot price provides a good indication of how the commodity is performing in the short term, it is not the only measure of the health of uranium markets. The spot market accounts for a smaller portion of the activity in the uranium market than the term market. This segment of the market is dominated by utilities looking to secure future supplies of uranium for nuclear power plants through contracts on future sales. And unlike the recent pullback in the spot market, the long-term contract price of $75 is at a level not seen since 2008 (as shown in Figure 2), and contract ceilings have reached $120 per pound. This indicates strong future demand for uranium.

Figure 2. U308 Spot Price vs. Long-Term Contract Price (2004-2024)

Sources: Bloomberg and UxC. Data as of 02/29/2024. U3O8 Spot Price is measured by the UxC Uranium U3O8 Spot Price (UXCPU308 UXCP Index); and U3O8 Long Term Price is measured by the UxC Uranium U3O8 Long-Term Price (UXCPULTM UXCP Index). You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

All Eyes on the Miners

The uranium market was jolted on February 2 after NAC Kazatomprom JSC (Kazatomprom), the world’s largest producer of uranium, confirmed they would not meet their previously announced 2024 production increase (14% reduction in production guidance). We believe this provides a strong signal to the market of the challenges to bring additional supply to market, irrespective of the higher uranium price.

KAZ 2024 production cut is a strong signal of the supply challenges being faced in bringing additional supply to market.

Canadian-based Cameco Corporation, one of the world’s largest uranium producers, released its 2023 results in February. The earnings call provided both financial results and future operational guidance, and is closely watched by investors for insights and uranium market signals.

Cameco reported uranium production for 2023 at 17.6 million pounds, slightly below guidance that had already been revised lower in September 2023.6 Cameco announced unchanged production guidance for 2024 at 18 million pounds for both its Cigar Lake and McArthur River mines. Positive news included extending the estimated mine life of Cigar Lake to 2036, converting 73 million pounds from resources to reserves at Cigar Lake, and evaluating the expansion of McArthur River to 25 million pounds of capacity. While these potential production increases will help address the uranium supply deficit, they will not likely have an impact until many years from now.

Cameco also highlighted a significant shift in the uranium market, with term contracting increasing from 124.6 million pounds of U3O8e in 2022 to 160.8 million pounds of U3O8e in 2023. This represents the highest global contracting rate in over a decade and nears "replacement rate contracting," which aims to meet annual nuclear reactor fuel needs. Long-term contracting figures could climb further, as the previous cycle's peak was 250 million pounds. Notably, Cameco also indicated that it has never been this early in the contracting cycle with prices as high as they are today. Finally, investors reacted negatively to Cameco downplaying the importance of the spot market, which many view as critical for pricing signals and transparency and where sellers and buyers meet continuously to contract.

Multinational Orano SA (headquartered in France), a privately owned major uranium miner, also released a production update in February. Orano is the majority owner of SOMAÏR, which mines uranium in Niger. Orano announced that uranium processing had slowly restarted at SOMAÏR in February after receiving some required reagents.7 Operations had been disrupted for several months due to the coup d'état in Niger in July 2023 and resulting border closures inhibiting the importation of these reagents. The situation in Niger is still developing, and Orano continues to face logistical challenges with both accessing the required reagents and exporting uranium.

Junior Uranium Miners Step Up

Canadian uranium exploration and development company IsoEnergy Ltd announced the recommencement of operations at its Tony M uranium mine in Utah, targeting first production in 2025. This restart coincides with Energy Fuels Inc.'s revival of its White Mesa Mill in Utah, with which IsoEnergy has a toll milling agreement. The Tony M mine boasts full permitting and prior production history, having operated during 1979-1984 and 2007-2008. Though classified as a small mine, it yielded nearly one million pounds of U3O8 (yellowcake uranium) across these periods. IsoEnergy's announcement adds to the growing trend of junior uranium miners reviving dormant projects, capitalizing on a potential rise in uranium prices.

Fueled by rising uranium spot prices, several junior uranium mining companies are taking notice, even if trading volumes remain modest. Unlike established producers, many junior miners have not yet sold their production forward under long-term contracts. This could position them to reap significant rewards if uranium prices continue to climb.

Growing Supply Uncertainties

Recent headlines on uranium mine restarts mask an important fact: Current uranium mine supply is significantly below the world’s uranium reactor requirements. Furthermore, the secondary supplies (predominantly commercial inventories) that have filled in the gap historically are no longer available for sale. We believe further setbacks to uranium supply may reenergize the uranium markets, especially given lingering geopolitical considerations. Most recently, France and Mongolia made headlines with the delay of their $1.6 billion uranium mining deal.8 France is the world’s third-largest uranium consumer, and rising tensions with the East may have jeopardized the deal. Mongolia is landlocked between Russia and China, and Russia has become increasingly opposed to Western influence on its neighbors. The deal was set to be signed at the end of 2023, with France noting that it could provide Mongolia with “the means to benefit from greater strategic sovereignty” in the face of “two extremely powerful neighbors.” A canceled deal would represent another hit to Orano, but an agreement is not likely until after France’s and Mongolia’s June elections.

U.S. efforts to diminish reliance on Russia represent another geopolitical risk to uranium markets. A hearing entitled “Going Nuclear on Rosatom: Ending Global Dependence on Putin’s Nuclear Energy Sector” was scheduled for February 15 but then was postponed. The Prohibiting Russian Uranium Imports Act (the Act) passed the U.S. House in December and is still pending a vote in the Senate. The Act would limit imports of Russian supply to 2027 and ban them after that. However, Tenex, a Russian state-owned uranium company, has warned American customers that if this Act were to pass, Russia might preemptively bar exports of its supply to the U.S., further exacerbating supply uncertainty, especially in the U.S.9

Steady Flow of Positive Nuclear Energy News Supports Sector

We believe that governments' continued support for nuclear energy helps bolster the uranium market and uranium miners. The most recent developments include:

- China: Continues to showcase exemplary long-term demand for nuclear. The Chairmen of China National Nuclear Corporation (CNNC) stated that the country can add as many as 10 reactors per year.10

- Japan: Added uranium to its critical minerals list, allowing the allocation of more funds and resources for uranium-related research.11 This furthers the country's U-turn in nuclear policy, where it has restarted 11 reactors and has another 16 at various stages in the process of restart approval.

- South Korea: Has fully reversed its nuclear phase-out policy and expanded its program. Bloomberg reported recently that the country may need to increase nuclear energy for 45% of the electricity supply.12 Currently, nuclear power accounts for about 30% of the country's electricity consumption, and South Korea still relies on fossil fuels for 60%.

- United States: Continued its push for domestic enrichment capabilities by unveiling a bill with $2.7 billion earmarked for the industry.13 The funds are part of a broader plan to buy domestically produced enriched uranium.

- Canada: Issued its first nuclear-inclusive green bonds.14 At C$4 billion, the debt raises funds to support the nuclear power sector and paves the way for similar issuances from companies. The issuance showcases that nuclear is, in fact, “green”.

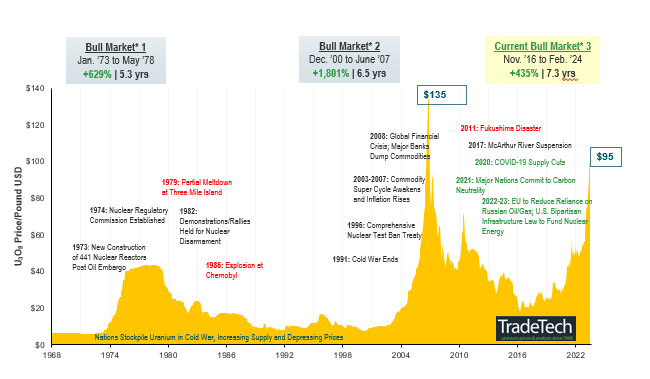

Potentially Attractive Entry Point

We believe uranium's recent pullback from the triple digits may be an attractive entry point in the overall uranium bull market. A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. With no meaningful new supply on the horizon for three to five years, we believe this bull market has further room to run. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and adapted their procurement strategies to the new market realities.

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 2).

Figure 3. Uranium Bull Market Continues (1968-2024)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 02/29/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 are sourced exclusively from TradeTech; visit https://www.uranium.info/. Included for illustrative purposes only. Past performance is no guarantee of future results.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Source: Cameco Reports 2023 Fourth Quarter Results. |

| 7 | Source: Orano 2023 Annual Results. |

| 8 | Source: Bloomberg, France’s $1.6 Billion Uranium Deal With Mongolia Faces Delays. |

| 9 | Source: Bloomberg, Russia Uranium Supplier Warns US Clients to Brace for Export Ban. |

| 10 | Source: Bloomberg, China Able to Accelerate World’s Fastest Nuclear Power Expansion. |

| 11 | Source: Mining.com, Japan adds uranium to critical minerals list. |

| 12 | Source: Bloomberg, Korea Sees Need for More Nuclear Power Plants to Hit Net Zero. |

| 13 | Source: Bloomberg, US Reactor Fuel Makers Get $2.7 Billion Boost in Funding Bill. |

| 14 | Source: Bloomberg, Canada Sells First Bond in Program That Allows Nuclear Finance. |

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

Diversification does not protect against loss. The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.