For the latest standardized performance and holdings of Sprott Uranium ETFs, please visit the individual website pages: URNM and URNJ. Past performance is no guarantee of future results.

Key Takeaways

-

Uranium Market Consolidation: At the end of 2024, the uranium spot price has stabilized between $70 to $80 per pound after a significant 88.54% increase in 2023. This phase indicates a healthy correction within a bullish market cycle.

-

Miners' Catch-Up: Uranium miners have shown improved performance, catching up to gains in the spot price.

-

Long-Term Contracting Trends: Long-term uranium contract prices point to higher uranium prices as contract ceilings reach $130 per pound.

-

Geopolitical Impacts and Demand: Geopolitical tensions and supply uncertainties persist, influencing uranium supply dynamics. Despite these challenges, global demand remains robust, driven by nuclear reactor restarts and new builds, supporting a sustained bullish outlook for uranium.

Artificial Intelligence and the Need for Electricity

Global electricity demand is estimated to increase by 169% by 2050.1 Surging energy consumption in the East is driven by the urbanization and industrialization of developing countries, while the rise of artificial intelligence (AI), data centers, electrification and reshoring is driving demand in the West.

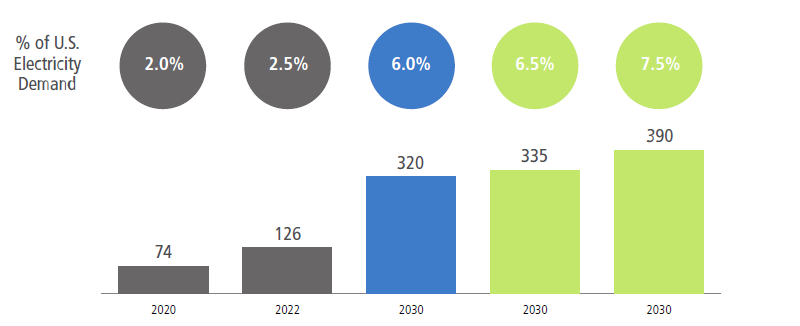

Figure 1. Data Center Electricity Consumption in the U.S. is Growing (TWHS)2

Source: Boston Consulting Group, the Impact of Electricity. Data as of 12/31/2024.

Globally, data centers’ electricity demand is forecasted to grow 258% from 2023 to 2030.3 Growing demand from global data centers is expected to increase from 1.2% of global electricity supply to 4.1%.4 AI data centers require much more electricity for computing, cooling and other IT infrastructure compared to traditional data centers because of:

- Higher computational demands from complex algorithms and large datasets

- Increased workloads and demand for real-time data from continuous, intense computational workloads running 24/7

- Densely packed servers requiring significant power for cooling requirements

To support the growth of AI, Silicon Valley is increasingly turning to nuclear energy. Firms like Google, Amazon and Microsoft have signed deals to purchase power from nuclear energy providers.5 The benefits of such arrangements are twofold. First, data centers will have access to the reliable baseload power provided by nuclear energy to run their energy-intensive operations. Second, nuclear energy is one of the cleanest forms of energy, and by going nuclear, tech companies can still progress toward their corporate net zero carbon emissions pledges, even as their energy footprints expand.

Why Uranium Miners?

We believe we are in the early stages of a sustained uranium bull market. An already positive outlook was given an additional boost at the COP28 conference in December 2023, where more than 20 nations agreed to triple nuclear energy capacity by 2050. The pledge grew to 31 countries after the COP29 conference in November 2024. Uranium miners stand to benefit from the growing acceptance of nuclear energy.

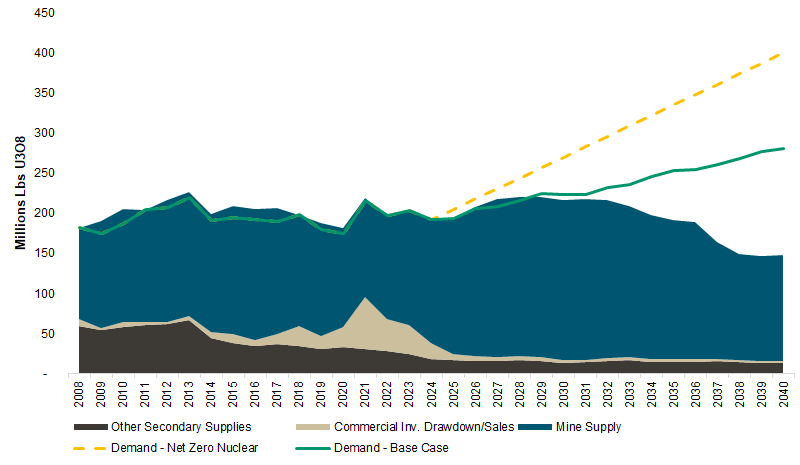

We anticipate that the uranium supply-demand imbalance will continue through at least 2040. Demand for uranium may outstrip supply and reach a cumulative deficit of nearly 700 million pounds by 2040. The uranium market may see a cumulative deficit of 1.7 billion pounds when factoring in global net zero pledges.

Figure 2. Uranium Supply and Demand Estimates (2008-2040E)

Source: UxC and Cameco Corp. Data as of 12/31/2024.

Higher uranium prices and more investment in uranium miners are needed to reduce the expected supply shortfall and meet current and future demand. Our focus is on uranium miners, which are upstream in the supply chain. Miners may be less susceptible to some geopolitical risks and may benefit as Western governments seek to secure critical supply chains by incentivizing domestic expansion for uranium miners.

In November 2024, Russia imposed restrictions on the export of enriched uranium to the U.S. This development has the potential to meaningfully impact downstream nuclear companies, such as utilities and enriched uranium importers, as Russia controls about 44% of global uranium enrichment capacity.6

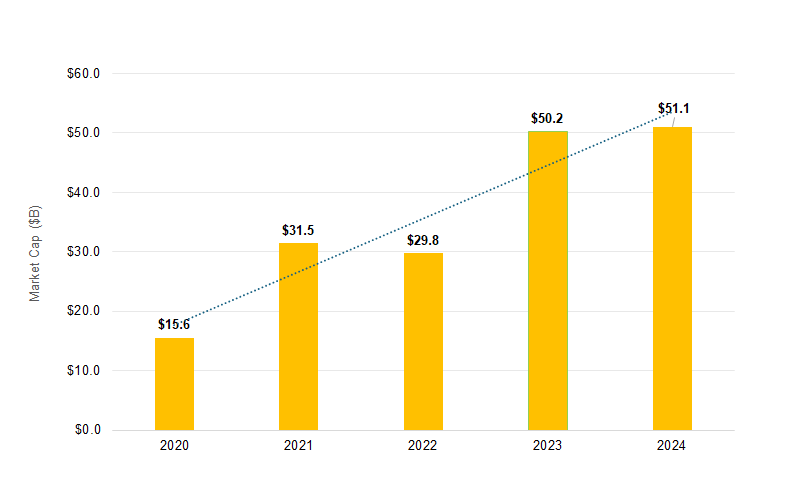

Figure 3. Uranium Miners' Market Capitalizations Have Grown with Increased Investment7 (2020-2024)

Source: Indxx and Bloomberg. Data as of 12/31/2024.

Source: Indxx and Bloomberg. Data as of 12/31/2024.

2025 May Provide an Attractive Entry Point for Uranium Miners

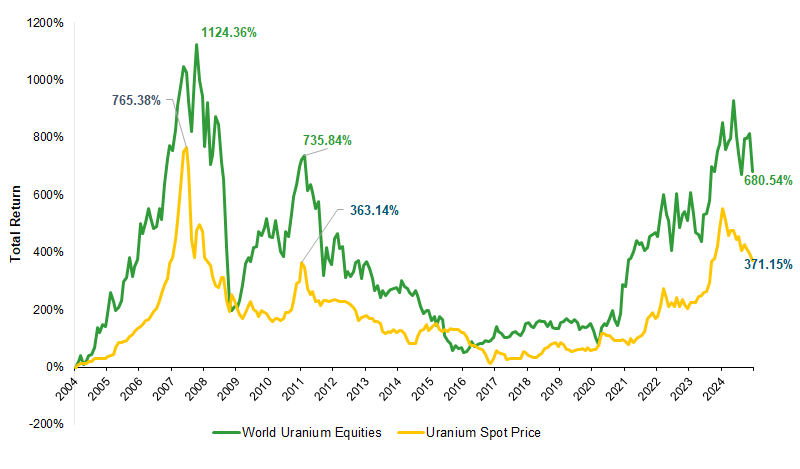

After years of growth, uranium miners took a healthy pause amidst the broader uranium bull market. Off recent highs, spot uranium prices spent much of 2024 between $80 and $90 per pound before moving lower to $70 to $80 in Q4. Uranium miners tend to offer leverage to the price of uranium (see Figure 4), outperforming in rising markets while underperforming in falling markets. However, as a group, uranium miners showed resiliency in 2024, having outperformed the spot market.

Figure 4. Uranium Miners vs. Spot Uranium (2004-2024)

Source: Bloomberg and TradeTech LLC. Data from 12/31/2003 to 12/31/2024. World Uranium Equities measured by URAX Index, which tracks the performance of stocks globally that conduct business with uranium. URAX and Uranium Spot denominated in U.S. dollars.

Despite the bull market pause, the underlying fundamentals for uranium improved with positive support from technology companies, accelerating supply and demand constraints, and continued advancement on the political front. Among market developments in 2024 were:

- The ban of importing Russian-enriched uranium by the United States by no later than 2027. This action was met with a preemptive Russian ban on exporting enriched uranium to the United States.

- The announcement of plans to restart the Palisades Nuclear Plant in Michigan8 and Three Mile Island in Pennsylvania.9

- Talen Energy’s announcement of its sale of a nuclear-powered data center to Amazon.10

- Meta’s requests for proposals to identify nuclear energy developers to help the company meet its AI innovation and sustainability objectives.11

We believe 2025 may represent an attractive buying opportunity for investors amid increasingly positive fundamentals.

Sprott Uranium Miners ETF (Ticker: URNM)

URNM provides focused pure-play12 exposure to uranium mining equities. Pure-play companies devote at least 50% of their assets to the uranium mining industry, including mining, exploration, development and production of uranium, holding physical uranium, owning uranium royalties or engaging in other non-mining activities supporting the uranium mining industry.

- Only13 U.S.-listed ETF to provide targeted pure-play exposure to senior and junior uranium miners and physical uranium

- Aggregate weight of 82.5% of the index is assigned to uranium miners, explorers, developers and producers

- An aggregate weight of 17.5% of the index is allocated to entities that hold physical uranium, uranium royalties or other non-mining assets

- Traditional market portfolios may provide very little, if any, exposure to uranium miners. Investors may consider adding URNM to existing portfolios to:

- Diversify energy exposure traditionally allocated to the oil and gas sector

- Provide growth potential as part of a thematic or growth allocation

URNM Is Part of the Sprott Critical Materials Suite of ETFs

Footnotes

| 1 | Source: IEA World Energy Outlook 2024 Net Zero Emissions Scenario. |

| 2 | Source: Boston Consulting Group, the Impact of Electricity. |

| 3 | Source: International Energy Agency, World Energy Outlook 2024. |

| 4 | Source: International Energy Agency, World Energy Outlook 2024. |

| 5 | Source: Reuters, Microsoft deal propels Three Mile Island restart, with key permits still needed. |

| 6 | Source: Reuters, Russia restricts enriched uranium exports to the United States. |

| 7 | Source: Indxx and Bloomberg, as of 10/31/24. |

| 8 | Source: The New York Times, U.S. Approves Billions in Aid to Restart Michigan Nuclear Plant. |

| 9 | Source: Reuters, US nuclear regulator kicks off review on Three Mile Island restart. |

| 10 | Source: NuclearNewswire, Amazon buys nuclear-powered data center from Talen. |

| 11 | Source: Meta, Accelerating the Next Wave of Nuclear to Power AI Innovation. |

| 12 | The term “pure-play” relates directly to the exposure that the Fund has to the total universe of investable, publicly listed securities in the investment strategy. |

| 13 | Based on Morningstar’s universe of Natural Resources Sector Equity ETFs as of 12/31/2024. |

Important Disclosures

Important Disclosures

The Sprott Funds Trust is made up of the following ETFs (“Funds”): Sprott Gold Miners ETF (SGDM), Sprott Junior Gold Miners ETF (SGDJ), Sprott Critical Materials ETF (SETM), Sprott Uranium Miners ETF (URNM), Sprott Junior Uranium Miners ETF (URNJ), Sprott Copper Miners ETF (COPP), Sprott Junior Copper Miners ETF (COPJ), Sprott Lithium Miners ETF (LITP) and Sprott Nickel Miners ETF (NIKL). Before investing, you should consider each Fund’s investment objectives, risks, charges and expenses. Each Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

This material must be preceded or accompanied by a prospectus. A prospectus can be obtained by calling 888.622.1813 or by clicking these links: Sprott Gold Miners ETF Prospectus, Sprott Junior Gold Miners ETF Prospectus, Sprott Critical Materials ETF Prospectus, Sprott Uranium Miners ETF Prospectus, Sprott Junior Uranium Miners ETF Prospectus, Sprott Copper Miners ETF Prospectus, Sprott Junior Copper Miners ETF Prospectus, Sprott Lithium Miners ETF Prospectus, and Sprott Nickel Miners ETF Prospectus.

The Funds are not suitable for all investors. There are risks involved with investing in ETFs, including the loss of money. The Funds are non-diversified and can invest a greater portion of assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund.

Exchange Traded Funds (ETFs) are bought and sold through exchange trading at market price (not NAV) and are not individually redeemed from the Fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns. "Authorized participants" may trade directly with the Fund, typically in blocks of 10,000 shares.

Funds that emphasize investments in small/mid-cap companies will generally experience greater price volatility. Diversification does not eliminate the risk of experiencing investment losses. ETFs are considered to have continuous liquidity because they allow for an individual to trade throughout the day. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses, affect the Fund’s performance.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member.

ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.