For the latest standardized performance and holdings of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPP, COPJ and NIKL. Past performance is no guarantee of future results.

AI Boom: A Test for the Energy Grid

It’s no secret that artificial intelligence (AI) is integral to our future. AI has been a catalyst fueling this year's stock market rally. Seven of the nine largest companies in the S&P 500 Index are tech and AI-related stocks, which have helped propel the Index to record highs in July.

AI impacts multiple facets of the economy, from healthcare to retail to manufacturing and beyond. AI simulates human intelligence using computer systems powered by advanced machine learning algorithms. These computer systems are housed in data centers, which require massive amounts of electricity to operate, affecting the demand for all elements of power. The availability of various elements contributing to the creation and dissemination of power will greatly impact the fulfillment of the planned AI buildout. Additional considerations include energy and water availability, technology, regulatory issues, supply chains and raw materials.

Data Centers Rely on Critical Materials

Data center creation, maintenance and powering incorporate critical materials, including uranium, lithium, nickel and copper. With these materials expected to face long-term supply deficits and demand increasing in various markets, keeping up with this rapidly evolving sector will present both challenges and opportunities.

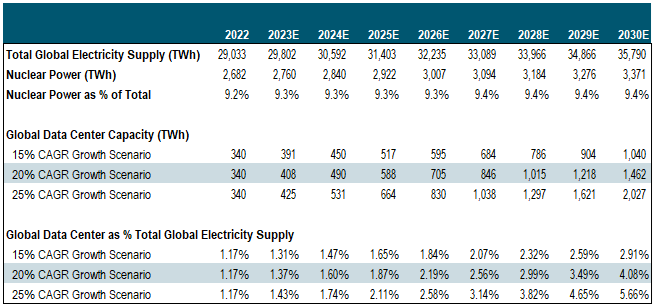

Data centers have historically been used for traditional cloud computing but are now also being used for AI. Due to this, data center electricity consumption in the U.S. is poised to triple its 2022 level, reaching 390 TWhs (terawatt hours) by 2030.1 Globally, data centers’ electricity demands are forecasted to grow 258% from 2023 to 2030. Therefore, the electricity demand from global data centers is expected to increase from 1.2% of global electricity supply to 4.1%.2

Figure 1. Data Centers and the Global Electricity Supply (2022-2030E)

Source: Source: IEA.org, World Energy Outlook 2023.

AI data centers require much more electricity for computing (40%), cooling (40%), and other IT infrastructure (20%), and chatbots like ChatGPT require about 10 times the energy as a Google search.3

Due to the amount of electricity used by data centers, there is a drive to make them sustainable. Hyperscalers (large-scale data centers) such as Google, Apple and Meta have committed to using only carbon-free energy by 2030. Digital technology innovation in data centers has increased power efficiency and helped offset some of the massive demand. However, throughout the lifecycle of a data center, 85% of the carbon impact comes from its operations.4

Cash Pours into Data Center Development

In the largest deal of its kind, Microsoft recently inked a deal with Brookfield Asset Management for more than $10 billion to develop renewable energy capacity to help power data centers. Under the agreement, Brookfield will deliver 10.5 gigawatts of renewable energy to Microsoft between 2026 and 2030 in the U.S. and Europe. Google has also invested billions in data centers over the last several years, bringing its current total to 23 data centers in 15 states. Amazon Web Services recently acquired a 960-megawatt nuclear-powered data center in Pennsylvania from Talen Energy.

In total, $22 billion has been invested in data centers worldwide thus far in 2024 (as of May), following $36 billion invested in 2023.5 NVIDIA CEO Jensen Huang predicts that companies could spend up to $1 trillion over the next four years to upgrade and expand data center infrastructure to meet the growing demand from AI applications.6 Essentially synonymous with the term “AI”, NVIDIA is a pioneer of GPU-accelerated computing and is one of the “Magnificent Seven” – the world’s largest tech businesses.

Uranium: Essential to Nuclear Power

As AI capabilities expand, there is a growing need for stable power sources to fuel data centers, and nuclear power plants are ideally suited to meet this demand. They offer sustainable and reliable energy that aligns with global clean energy and climate goals while providing ample cooling capabilities for servers. Nuclear facilities can provide robust and stable power for the high-demand loads of AI servers and offer necessary cooling resources, making them ideal power sources for data centers.

Global data center power consumption is forecast to nearly double from 460TWh in 2022 to just over 800TWh by 2026.7 As tech giants pledge to use more renewable energy to power their data centers, they are turning to nuclear energy, with uranium being an essential component.

Small modular reactors (SMRs)8 are also becoming a major focus in data center development. In October 2023, SMR maker NuScale Power Corporation and data center infrastructure provider Standard Power joined forces to develop a 2GW nuclear-powered data center facility.

Lithium and Nickel: Powering Data Center Batteries

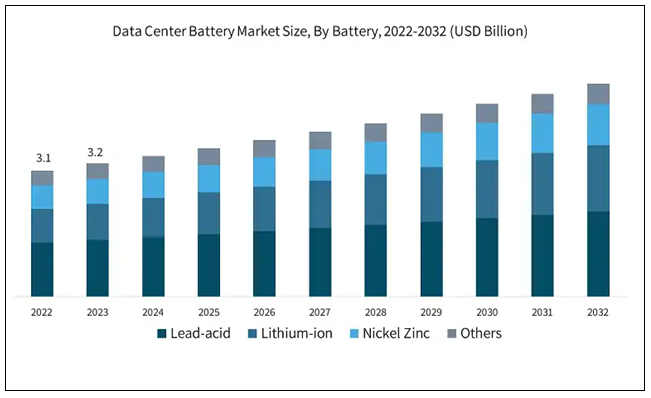

Data centers require battery backups during periods when they may not have excess energy. While they have traditionally relied on uninterruptible power supply (UPS) backup systems, data centers are now turning to server rack battery backup units.

In addition to lithium-ion batteries, which can reduce the occupied area by 50-80%, many companies are now looking at nickel-zinc battery chemistry. This combination of metals provides a much denser battery that takes up less space, which is at a premium inside these data centers. The battery can also operate at a much higher temperature, so these data centers can significantly reduce their cooling costs.

Figure 2. Data Center Battery Market Size

Source: Global Market Insights.

Copper: The Grounding Force of Data Centers

As data centers’ AI capabilities grow, so does the need for copper-intensive electrical equipment to efficiently handle increased power densities and reduce operational costs. Given their electricity needs, a rise in the number of data centers will likely lead to ancillary copper demand from other power sources, like grid, wind, solar, storage batteries, etc.

Copper’s superior electrical and thermal conductivity properties enable it to handle extensive power and cooling demands. Copper is in the components of the data center, such as power distribution, grounding, interconnections, and incremental electricity generation.

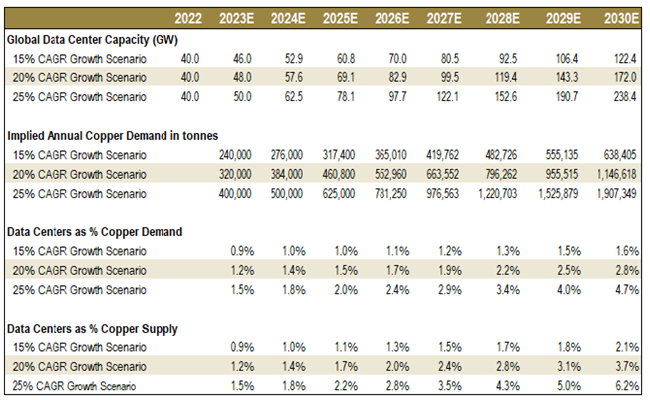

By 2030, under the median scenario, the amount of copper required could reach about 1.1 million metric tons annually, representing roughly 2.8% of global demand. According to BloombergNEF (BNEF), in 2024, copper is already projected to be in deficit by one million tons, not including AI data center demand. In other words, data center demand for copper is a new demand shock element for copper markets already in a structural deficit.

Figure 3. How Data Centers Could Affect the Copper Markets (2022-2030E)

Using 40 Tons of Copper per MW Intensity

Sources: BNEF Copper Transition Metals Outlook 2023, JP Morgan – Copper & AI: The Coming Wave. Past performance is no guarantee of future results.

Realizing lithium’s role in the energy transition, the U.S., Canada and the European Union have added lithium to their critical minerals lists. This designation makes it easier for companies to apply for grants and subsidies that support the lithium and EV industries.

AI and Data Centers: The Sky is the Limit

The full scale of AI and the growth of data centers have yet to be realized, but they are likely to continue to develop rapidly. This energy-hungry sector will contribute substantially to increasing electricity demand and the growing need for critical materials crucial for the power supply. Many of these critical materials are in short supply. We believe having access to the miners who produce critical materials can potentially offer rewarding investment opportunities.

Footnotes

| 1 | Boston Consulting Group, the Impact of Electricity |

| 2 | International Energy Agency, World Energy Outlook 2023. |

| 3 | Data centers will likely provide boost to nuclear energy, says Cameco CEO. |

| 4 | How Data Centers Are Driving The Renewable Energy Transition. |

| 5 | $22bn invested in data centres so far in 2024 with the United States and Europe attracting highest levels of investment. |

| 6 | Data Center Dynamics. (2024, February 14). Nvidia CEO Jensen Huang predicts data center spend will double to $2 trillion. |

| 7 | IEA Electricity Report 2024 |

| 8 | Small modular reactors (SMRs) are advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit, which is about one-third of the generating capacity of traditional nuclear power reactors. |

| 9 | APC by Schneider Electric: Estimating a Data Center's Electrical Carbon Footprint. |

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

Diversification does not protect against loss. The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.