Performance as of September 30, 2022

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR |

|

U3O8 Uranium Spot Price1

|

-8.66% | -4.27% | 14.59% | 12.14% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index)2 |

-16.17% | 14.67% | -9.21% | -7.96% |

Source: Bloomberg and Sprott Asset Management LP. Data as of September 30, 2022.

*Performance for periods under one year not annualized.

September: A Harsh Run of Losses for Most Asset Classes

Most asset classes experienced substantial drawdowns in September and the uranium markets were no exception. U.S. equity markets suffered their largest monthly decline since March 2020 (the S&P 500 fell 9.21%). Broad commodity markets faced their second-largest monthly drawdown since March 2020 (the Bloomberg Commodity Index [BCOM] dropped 8.35%). The U.S. bond market posted its biggest monthly drop since February 1980. For uranium, the U3O8 spot price fell 8.66% in September, physical uranium's largest monthly decline since March 2019. Uranium miners followed suit, losing 16.17%, posting their worst monthly performance since the inception of the North Shore Global Uranium Mining Index in June 2017.3

September's weak performance belies the strong fundamentals of uranium markets.

U.S. dollar (USD) strength was the primary factor for September's negative performance results. Higher-than-expected inflation data forced bond yields to rise (especially real yields) and pushed the USD higher. On September 21, the Federal Reserve ("Fed") raised interest rates by 75 basis points (bps) for the third time in a row this year, bringing its total hikes to 300 basis points year-to-date. The Fed continues to restate its commitment to monetary tightening to fight rising inflation until it is on a sustainable path lower toward the Fed’s 2% long-term target. The Fed's ramped-up tightening activity, combined with low market depth and liquidity, strongly contributed to September's poor market results.

Figure 1. The Fed Hike Rates 300 bps in 2022

|

Federal Open Market Committee (FOMC ) Meeting Date |

Rate Change (BPS - Basis Points) |

Federal Funds Rate |

|

September 21, 2022 |

+75 |

3.00% to 3.25% |

|

July 27, 2022 |

+75 |

2.25% to 2.50% |

|

June 16, 2022 |

+75 |

1.50% to 1.75% |

|

May 5, 2022 |

+50 |

0.75% to 1.00% |

|

March 16, 2022 |

+25 |

0.25% to 0.50% |

Source: Bloomberg and https://fred.stlouisfed.org/.

Taking the Long View on Performance

September's poor showing for uranium mining equities is worth reviewing in the context of a longer period. For example, during the third quarter of 2022, the Northshore Global Uranium Mining Index managed to buck the general market downtrend with a 14.67% increase, which compares to the 4.88% drop in the S&P 500 Index. It is also worth noting that the fundamentals of the uranium market continue to strengthen, spurred by growing acceptance among global governments that nuclear power supports the world's energy transition from dependence on fossil fuels and helps ensure higher energy security.

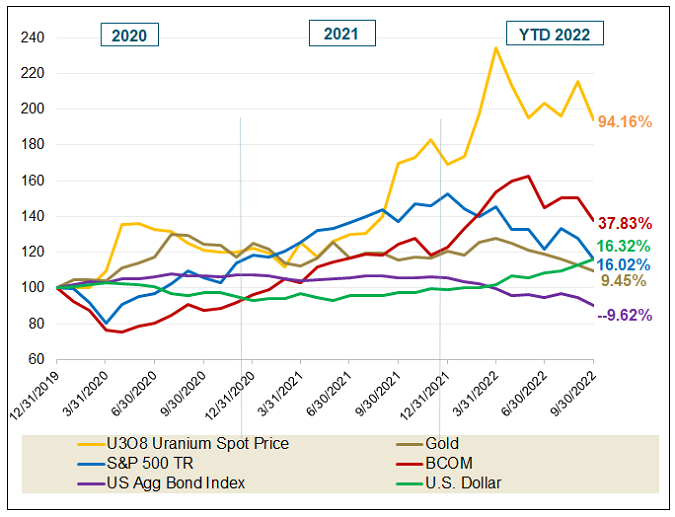

As shown in Figure 2, the U3O8 uranium spot price has almost doubled in value since the beginning of 2020, posting a total gain of 94.16% from January 1, 2020, to September 30, 2022, surpassing the performance of many other asset classes.

Figure 2. Uranium Outperforms Other Asset Classes in the Short-Term (2020-2022)

Source: Bloomberg and Sprott Asset Management. Data as of 9/30/2022. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is measured by a proprietary composite of U3O8 spot prices from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Agg Total Return Value Unhedged USD Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (LLCBCOM); and the U.S. Dollar is measured by DXY Curncy Index. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Global Sentiment Towards Nuclear Power Continues to Improve

Europe's current energy crisis continues to underscore the importance of nuclear energy and uranium, especially given the uncertainty of Russia as an ongoing energy provider. The European Union's (EU) sentiment toward nuclear power runs the gamut, from France's full embrace of nuclear power (providing 75% of the country's electricity and ranking as the world's largest producer) to Germany's rejection of nuclear power with its plan of a "nuclear exit", its phase-out response following the 2011 Fukushima accident in Japan.4 Both countries, however, were in the headlines in September. French President Emmanuel Macron confirmed that he intends to expand nuclear power with six to eight new power plants planned. Germany announced — while stressing that it would not reverse its phase-out decision — that it would extend the life of two of the remaining three reactors to create an "energy reserve".,5,6

As the Russia-Ukraine war continues, Europe's reliance on Russia as an energy provider grows increasingly problematic. On September 22, multiple leaks were found in two giant Nord Stream natural gas pipelines from Russia to Germany.7 Incidents like these are helping galvanize the political will and public support needed to expand the acceptance of nuclear energy. In addition, several international reports were released in September, reiterating the growing need for nuclear power in the global energy transition movement. The International Atomic Energy Agency issued a report (Energy, Electricity and Nuclear Power Estimates for the Period up to 2050) that noted, "total electrical generating capacity is expected to increase by about 23% by 2030 and then double by 2050".4 The United Nations Economic Commission for Europe released its report, Carbon Neutrality in the UNECE Region, which highlights a significant need for investment in nuclear energy, stating, "there are innovative ways to produce low- and zero-carbon energy, including renewable energy technologies, hydrogen, fossil fuels with carbon capture, carbon capture use and storage, and nuclear power."8

Energy Shortages and Rocketing Prices Support Uranium's Bullish Outlook

September's weak performance belies the strong fundamentals of uranium markets. Year-to-date as of September 30, U3O8 conversion and enriched uranium prices have all significantly appreciated for both short- and long-term purchase contracts. We believe that the current demand for uranium conversion and enrichment, coupled with a shift away from Russian suppliers, supports higher U3O8 uranium spot prices, ultimately benefiting uranium miners.

Faced with the prospects of energy shortages and rocketing costs, many governments are turning to nuclear energy to provide reliable, affordable baseload energy. Positive news headlines about the growing acceptance of nuclear power have been abundant. Japan's Prime Minister Fumio Kishida announced recently that Japan wants to restart seven nuclear reactors by next summer, will explore the development and construction of innovative next‐generation reactors and will consider extending the life of existing nuclear reactors. The South Korean government noted on August 30 that it planned to increase its percentage of total energy creation from nuclear to near 33% from a previous mid‐term plan of 25%. The U.S. extended the life of the Diablo Canyon nuclear power plant, passed the Inflation Reduction Act, which will subsidize nuclear power plants' revenue if power prices were to fall and announced a plan to buy $4.3 billion in enriched uranium from domestic producers. In the EU, nuclear energy was included in the EU taxonomy and Germany has reversed several plant closures. Finally, the Group of Seven (G7) released a statement on reducing reliance on nuclear goods from Russia. These developments will likely bolster greater investment in nuclear energy, physical uranium and uranium miners.

We believe the uranium bull market remains intact despite the strong negative macroeconomic environment. Over the long term, increased demand in the face of an uncertain uranium supply will likely support a sustained bull market. For investors, uranium miners have historically exhibited low/moderate correlation to many major asset classes, potentially providing portfolio diversification.

Footnotes

| 1 |

The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 |

The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 |

Equity markets are measured by the S&P 500 TR Index, broad commodity markets are measured by the Bloomberg Commodity Index, and the bond market is measured by the Bloomberg US Aggregate Total Return Value Unhedged USD. U3O8 spot price data source is TradeTech LLC. The indices data source is Bloomberg. |

|

4 |

Source: The International Atomic Energy Agency Report - Energy, Electricity and Nuclear Power Estimates for the Period up to 2050. |

|

5 |

Source: Energy Central - Macron wants to expand renewable energy production 'twice as fast'. |

|

6 |

Source: The New York Times - Breaking Taboo, Germany Extends Life of 2 Nuclear Reactors. |

|

7 |

Source: The New York Times - Mysterious Blasts and Gas Leaks: What We Know About the Pipeline Breaks in Europe. |

|

8 |

Source: United Nations Economic Commission for Europe - Carbon Neutrality in the UNECE Region. |

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.