Key Takeaways

Short-Term Volatility in Uranium Prices

The uranium market has experienced short-term challenges, including price declines and exogenous market influences such as geopolitical tensions and economic concerns. However, these issues are set to be overcome by strong long-term fundamentals, including supply uncertainty from key producers like Kazakhstan and Russia.

Long-Term Bullish Outlook

Despite recent market corrections, uranium and uranium-related equities have outperformed other asset classes over the long term. The U3O8 uranium spot price has risen significantly over the last five years, and continued supply-demand imbalances suggest that the bull market for uranium could have further room to grow.

Tax Hikes Weaken Incentives

Kazakhstan, the world’s largest uranium-producing country, announced a surprise tax increase on uranium, which has multiple implications.

Supply Uncertainty and Contracting Challenges

There are growing uncertainties in uranium supply, notably from production cuts in Kazakhstan, political instability in Niger and potential export restrictions from Russia. Term contracting has slowed as utilities adjust to higher prices and U.S. sanctions on Russian-enriched uranium, leading to concerns about future supply security.

Potential Entry Point for Investors

Lower uranium prices may represent an attractive entry point for long-term investors. With global uranium supply lagging behind demand, the market will likely see higher prices in the future as utilities are forced to secure long-term contracts to meet their needs.

Performance as of August 31, 2024: Average Annual Total Returns

| Asset | 1 MO* | 3 MO* | YTD* | 1 YR | 3 YR | 5 YR |

|

U3O8 Uranium Spot Price 1 |

-7.62% | -11.62% | -13.31% | 30.25% | 34.68% | 25.57% |

|

Uranium Mining Equities (Northshore Global Uranium Mining Index) 2 |

-10.20% | -26.13% | -13.21% | 13.18% | 14.77% | 29.23% |

| Uranium Junior Mining Equities (Nasdaq Sprott Junior Uranium Miners Index TR) 3 | -12.83% | -31.78% | -15.73% | 7.73% | 6.40% | 27.62% |

|

Broad Commodities (BCOM Index) 4 |

-0.38% | -6.70% | -2.59% | -9.38% | 0.04% | 4.52% |

|

U.S. Equities (S&P 500 TR Index) 5 |

2.43% | 7.39% | 19.53% | 27.14% | 9.38% | 15.91% |

*Performance for periods under one year is not annualized.

Sources: Bloomberg and Sprott Asset Management LP. Data as of 8/31/2024. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

Short-Term Noise Overshadows Long-Term Growth Prospects

The uranium market's price action, both in the spot market and among miners, has been frustrating for much of the last few months. Uranium miners, in particular, have been reacting to exogenous factors, despite ever-strengthening fundamentals. Recently, they have been hit by broad-based selling, reflecting growing concerns about slowing economies, sluggish central bank responses, and rising geopolitical risks in the Middle East. The market is also reacting to political uncertainty in the U.S., particularly regarding how energy policies may evolve. While nuclear energy and uranium have enjoyed bipartisan support in the U.S. over the past few years, with Republican administrations typically being more pro-nuclear, the overall uncertainty is making investors uneasy. Finally, there has also been a price correction in the uranium spot market, contributing to the recent market stagnation and prompting investors to sit on the sidelines.

Despite recent performance, we believe this overhang is beginning to lift as investors refocus on uranium's strong long-term fundamentals. Supply uncertainty continues to increase with Kazakhstan slashing production, Russia contemplating retaliatory uranium export bans, and the ongoing political situation in Niger (see below for more detail). After a subdued start to the year, term contracting may increase as we enter a seasonally stronger period.

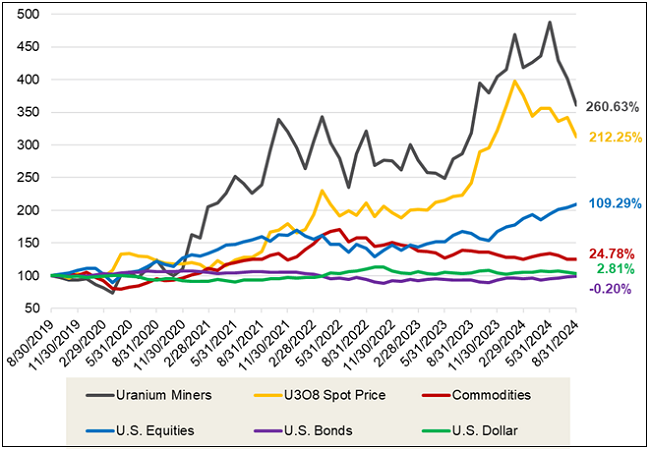

Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities. For the five years ended August 31, 2024, the U3O8 spot price has risen a cumulative 212.25% compared to 24.78% for the broader commodities index (BCOM), as shown in Figure 1.

Figure 1. Physical Uranium and Uranium Stocks Have Outperformed Other Asset Classes Over the Past Five Years (08/31/2019-08/31/2024)

Source: Bloomberg and Sprott Asset Management. Data as of 08/31/2024. Uranium Miners are measured by the Northshore Global Uranium Mining Index (URNMX index); U.S. Equities are measured by the S&P 500 TR Index; the U308 Spot Price is from TradeTech; U.S. Bonds are measured by the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU); Commodities are measured by the Bloomberg Commodity Index (BCOM); and the U.S. Dollar is measured by DXY Curncy Index. Definitions of the indices are provided in the footnotes. You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

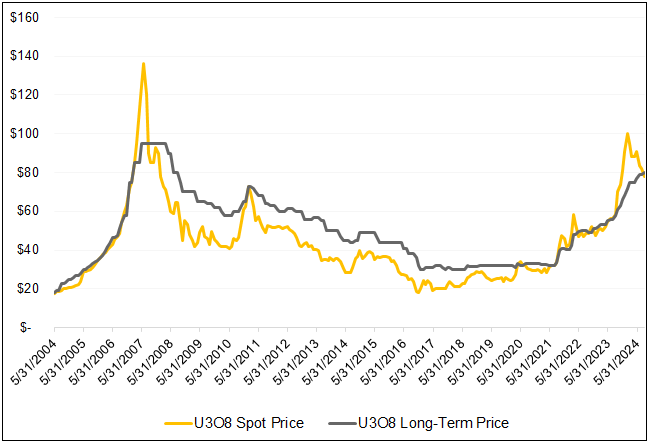

Term Prices Increases, More Contracting to Come, and Waiver Process Clarity

While the uranium spot price has stabilized, finding support around $80 per pound, the uranium term price has continued its upward climb (Figure 2). Increasing 17.65% YTD, the term price has now surpassed the spot price as of August's end, bringing the market back into contango. This may provide further support for the spot price and incentivize contracting activity in the near term, as buying uranium now and holding it becomes cheaper than paying an inflation-adjusted minimum floor price.

Figure 2. U308 Spot Price vs. Long-Term Contract Price Over the Past Five Years

Source: Bloomberg and UxC. Data as of 08/26/2024. U3O8 Spot Price is measured by the UxC Uranium U3O8 Spot Price (UXCPU308 UXCP Index), and U3O8 Long Term Price is measured by the UxC Uranium U3O8 Long-Term Price (UXCPULTM UXCP Index). You cannot invest directly in an index. Included for illustrative purposes only. Past performance is no guarantee of future results.

As macro noise dissipates, i.e., with the Federal Reserve’s recent 50 basis points cut, we believe the market will refocus on uranium industry-specific factors. While the uranium demand-supply imbalances continue to prove to be ubiquitous, with increasing supply uncertainties from Kazakhstan and Niger, uranium term contracting volumes have been soft. Utilities have been adjusting to a significantly higher uranium pricing environment over the past 12 months, and the implementation of U.S. sanctions against Russian enriched uranium has been going on since mid-August. We believe these two factors have caused a temporary slowdown in the term contracting cycle. Thus far in 2024, utilities have only contracted 45 million pounds of U3O8, well below the rate to achieve replacement rate contracting. In the short term, utilities can draw down their inventories or allow uncovered future requirements to expand, but they will eventually have to replace their consumed inventories.

Evidently, the industry has not reached replacement rate contracting. Even last year, when this reached 161 million pounds of U3O8 equivalent (the highest in a decade), much of this was attributable to a large one-time 40 million lb purchase by Ukraine. Without this, the industry would still not have reached a replacement rate and is withdrawing from inventories.

As Tim Gitzel, CEO of Cameco Corp. (Cameco), said on their last earnings call, “Contracting can be delayed/deferred, but it can’t be avoided”. With term prices increasing and ex-China inventories waning, utilities may be forced to accept that the higher uranium prices may endure into the future, or we believe, increase, and therefore be incentivized to contract further.

A main impediment to their return, however, has been the waiver process. With the U.S.’s Prohibiting Russian Uranium Imports Act taking effect in August, Russian-enriched uranium imports to the U.S. are now banned, initiating the eventual severance of roughly $1 billion in trade and 24% of the U.S.’s 2023 enriched uranium supply. However, utilities may apply for waivers that authorize the importation of uranium to certain aggregate limits and up until 2027 if the Secretary of Energy determines that there is no alternative viable source of uranium to sustain the continued operation of a U.S. nuclear reactor or if the importation of Russian-produced uranium is in the national interest. Until recently, The waiver application process was unclear and has distracted U.S. utilities' attention, and some waivers have been granted.

Centrus Energy Corp. (Centrus), an American supplier of nuclear fuel and services, applied for the first waiver request applications covering August 11, 2024, to the end of 2027. The U.S. Department of Energy (DOE) has issued a waiver allowing it to import low-enriched uranium from Russia “for deliveries already committed by the Company to its U.S. customers in years 2024 and 2025", thereby deferring a decision on 2026 and 2027. The approval to only receive uranium for existing customers and for only 2024/2025 showcases the urgency the U.S. aims to sever U.S. dependence on Russia and to bolster its domestic nuclear fuel supply chain.

Further, Russia controls 5% of the world's uranium mine production, 29% of conversion and 44% of enrichment capacity. As such, utilities have focused on the most susceptible elements of the supply chain first and then cascade their attention downwards (from enrichment services to conversion to procuring U3O8). Consequently, we believe price action may follow a similar path to when Russia invaded Ukraine and enrichment and conversion services spiked before U3O8. Notably, uranium enrichment and conversion prices have increased YTD as opposed to the U3O8 spot price decline.

Russia Contemplates Retaliatory Export Ban

Procuring uranium and related services may have never been more paramount. Though the Western world is trying to wean itself off of Russian uranium as quickly as possible, they are still partially dependent. Accordingly, when Russia’s President Vladimir Putin stated on September 11 that Russia should consider restricting uranium exports, uranium miners jumped.

“Please look at some types of goods that we supply in large quantities to the world market. Supplies of a number of goods to us are limited - maybe we should also think about certain restrictions? Uranium, titanium, nickel. In some countries strategic reserves are being created, and some other measures are being taken. But in general, if this will not harm us ... I am not saying that we need to do this tomorrow, but we could think about certain restrictions on deliveries to the foreign market not only of the goods that I have named, but also of some others.”6

Ultimately, if this were to happen, it would create a massive supply shock to the market. This does, however, increase the emphasis on removing reliance on Russia, especially enrichment services. To this end, Orano USA announced that it will build a multi-billion-dollar enrichment facility in Tennessee.7 This also follows Western enricher's announcements of capacity expansions, but all of this additional capacity will likely not come online for 2-3 years. As such, the Western enrichment industry's lack of excess capacity may likely need to be accounted for with a shift from underfeeding to overfeeding (using more UF6 as feedstock to produce more enriched uranium). The scale of this shift is not insignificant, given that underfeeding had created the largest equivalent uranium mine in the world.

Kazakh Production Slash

NAC Kazatomprom JSC (Kazatomprom), the world’s largest uranium-producing company, revised its 2025 production target downward by 17%, resulting in a shortfall of 14 million pounds, or 9% of the world’s mine supply of uranium.8 Given that they are contractually obligated to produce at least 80% of subsoil usage contracts, this denotes almost the largest production cut they could have set guidance at. The company has faced significant obstacles in its production plans, casting doubt on its ability to ramp up output.

Production shortfalls are not a new phenomenon for Kazatomprom. Most notably, their 2024 guidance was reduced by nine million pounds, or 14% lower in February of this year, equivalent to 6% of the world’s mine supply of uranium. On August 1, they did increase 2024 production guidance by 3 million pounds, or 6%.9 Uranium markets reacted negatively to the news, despite this being still well under initial production guidance and the industry being in an omnipresent shortfall, until they reduced their 2025 production reduction guidance a few weeks later. Zooming out for a longer-term perspective, the world’s largest and lowest-cost uranium supplier, Kazatomrpom, has missed production targets for the past four years as the uranium spot price has risen considerably. Additionally, Kazatomprom’s cost of sales has been rising significantly, 38%, in their last operational update, which will likely push the global cost curve for uranium higher.

Cameco, Kazatomprom’s partner in the Inkai joint venture, also reported a 20% decline in H1 production from their joint venture. We believe these production issues are not likely to be easily remedied. Access to sulfuric acid remains a significant uncertainty for future production, with the company's sulfuric acid plant has been delayed from 2026 to 2027. Further, construction delays in bringing new projects online have pushed full production timelines to 2027. Kazatomprom’s inventories have also been waning, marking a 30% drop in the last six months.

Moreover, the government of Kazakhstan’s surprise tax increase for uranium from 6% to 9% in 2025 and a two-tier Mineral Extraction Tax (MET) on both uranium production and U3O8 prices provide less incentive for Kazatomprom to increase production (see last month’s commentary for more details). It may also bolster the uranium process and feed into the company’s “value over volume” strategy. For the past few years, Kazatomprom has adopted a value-over-volume philosophy, a supply discipline achieved by prioritizing the price of products/services instead of volume growth.

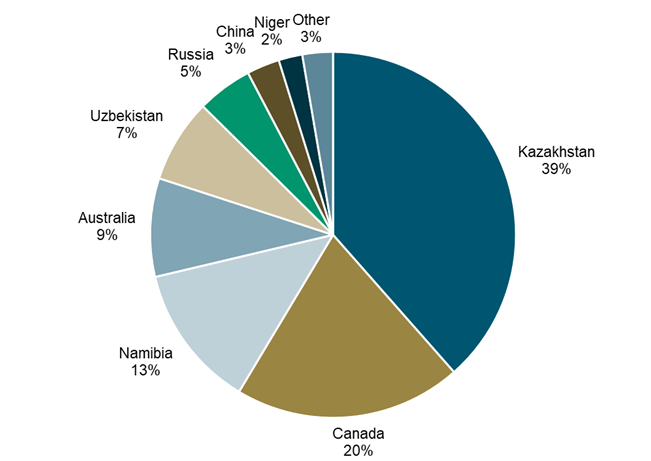

Kazakhstan is responsible for 39% of the world’s uranium supply, with Kazatomprom (KAP) as the state-controlled company overseeing the majority of uranium projects in the country. As the largest global uranium producer, KAP's output surpasses the next biggest producer, Cameco, by more than double. Consistent production shortfalls provide a greater uncertainty to future supply’s ability to meet increasing demand and provide a greater urgency for term contracting for utilities to meet their uncovered uranium requirements. This may be especially true for Western utilities, as Kazakhstan, Russia, and Niger uranium sales increasingly shift to the East.

Figure 3. Largest Uranium-Producing Countries

Source: UxC LLC as of 12/31/2023.

Potentially Attractive Entry Point

We believe the recent correction in the spot uranium price and the miners may represent an attractive entry point in the ongoing bull market. A longstanding primary supply deficit and renewed interest in nuclear energy highlight the real challenges to bring the market back into balance. With no meaningful new supply on the horizon for three to five years, we believe this bull market has further room to run. While last year’s multi-year record in long-term uranium contracting was celebrated, the overall numbers disguise a bifurcated market. Some utilities are well covered, while others have ignored the powerful market signals and failed to adapt their procurement strategies to the new market realities.

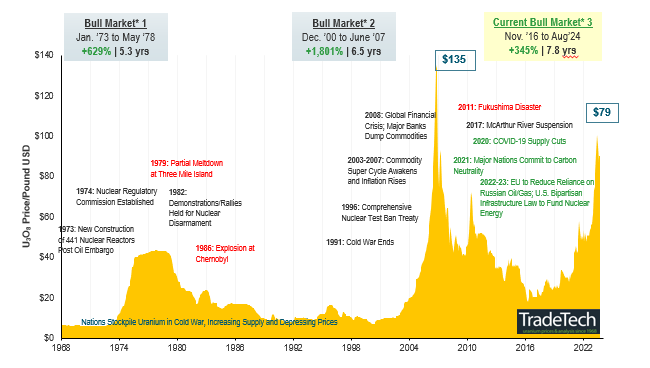

With global uranium mine production well short of the world’s uranium reactor requirements, the supply deficit building over the next decade, and near-term supply inhibited by long lead times and capital intensity, we believe that restarts and new mines in development are critical. The uranium price target as an incentive level for further restarts and greenfield development is a moving target, and we believe that we will need higher uranium prices to incentivize enough production to meet forecasted deficits. Over the long term, increased demand in the face of an uncertain uranium supply may likely continue supporting a sustained bull market (Figure 4).

Figure 4. Uranium Bull Market Continues (1968-2024)

Click here to enlarge this chart.

Note: A “bull market” refers to a condition of financial markets where prices are generally rising. A “bear market” refers to a condition of financial markets where prices are generally falling.

Source: TradeTech Data as of 08/31/2024. TradeTech is the leading independent provider of uranium prices and nuclear fuel market information. The uranium prices in this chart dating back to 1968 is sourced exclusively from TradeTech; visit https://www.uranium.info/.

Footnotes

| 1 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 2 | The North Shore Global Uranium Mining Index (URNMX) was created by North Shore Indices, Inc. (the “Index Provider”). The Index Provider developed the methodology for determining the securities to be included in the Index and is responsible for the ongoing maintenance of the Index. The Index is calculated by Indxx, LLC, which is not affiliated with the North Shore Global Uranium Miners Fund (“Existing Fund”), ALPS Advisors, Inc. (the “Sub-Adviser”) or Sprott Asset Management LP (the “Adviser”). |

| 3 | The Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) was co-developed by Nasdaq® (the “Index Provider”) and Sprott Asset Management LP (the “Adviser”). The Index Provider and Adviser co-developed the methodology for determining the securities to be included in the Index and the Index Provider is responsible for the ongoing maintenance of the Index. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 5 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 6 | Source: World Nuclear News, Russia to consider restricting uranium exports, Putin says. |

| 7 | Source: World Nuclear News, Orano to build enrichment facility in Tennessee. |

| 8 | Source: World Nuclear News, Kazatomprom lowers 2025 uranium production expectations. |

| 9 | Source: Kazatomprom, Kazatomprom 2Q24 Operations and Trading Update. |

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.