Sprott Precious Metals Report

Central Banks Flex Gold Market Muscle

Key Takeaways

- Central banks and investment funds emerged as two distinct players shaping the gold market in the first half of 2023, albeit with contrasting approaches. Banks are strategic and less price-sensitive in pursuing long-term goals, while funds tend to demonstrate short-term trading behavior.

- Gold is reverting to its historical role as a significant reserve asset as central banks seek to diversify reserves amid geopolitical uncertainties. Gold offers stability, autonomy and a hedge against currency fluctuations in an evolving global monetary landscape.

- Gold’s strategic value may likely increase as central banks build up gold holdings to support their reserve management strategies and hedge against inflation.

- Secular inflation will likely persist as deglobalization and reshoring of supply chains substitute high-cost domestic production for low-cost outsourced manufacturing.

- The gold bullion price rose 5.23% in the first half of 2023 despite competition from a euphoric equity market. Central bank buying drove demand, offsetting bearish pressure from gold investment funds.

Performance as of June 30, 2023

| Indicator | 6/30/2023 | 5/31/2023 | Change | Mo % Chg | YTD % Chg | Analysis |

| Gold Bullion1 | $1,919.35 |

$1,962.73 |

($43.38) |

(2.21)% | 5.23% | Drift down on stock market FOMO ("fear of missing out") |

| Silver Bullion2 | $22.77 |

$23.49 |

($0.71) |

(3.03)% | (4.93)% | Consolidating along rising 200 moving average |

| NYSE Arca Gold Miners (GDM)3 | 836.38 | 858.10 | (21.72) | (2.53)% | 3.83% | Back to the support level |

| Bloomberg Comdty (BCOM Index)4 | 101.48 | 97.96 | 3.51 | 3.59% | (10.04)% | Bounce from mini-selloff at the end of May |

| DXY US Dollar Index5 | 102.91 | 104.33 | (1.41) | (1.36)% | (0.59)% | Range trade YTD |

| S&P 500 Index6 | 4,450.38 | 4,179.83 | 270.55 | 6.47% | 15.91% | Full on FOMO |

| U.S. Treasury Index | $2,223.10 | $2,239.92 | ($16.82) | (0.75)% | 1.59% | Narrow range YTD on rate expectations |

| U.S. Treasury 10 YR Yield* | 3.84% | 3.64% | 0.19% | 19 BPS | (0.03) BPS | Narrow yield range since Q4 2023 |

| U.S. Treasury 10 YR Real Yield* | 1.61% | 1.47% | 0.14% | 14 BPS | 0.04 BPS | Approaching recent highs |

| Silver ETFs** (Total Known Holdings ETSITOTL Index Bloomberg) | 746.43 | 748.98 | (2.55) | -0.34% | -0.34% | Mostly flat YTD |

| Gold ETFs** (Total Known Holdings ETFGTOTL Index Bloomberg) | 92.62 | 94.16 | (1.54) | (1.64)% | (1.21)% | FOMO related selling |

Source: Bloomberg and Sprott Asset Management LP. Data as of June 30, 2023.

*Mo % Chg and YTD % Chg for this Index are calculated as the difference between the month end's yield and the previous period end's yield, instead of the percentage change. BPS stands for basis points. **ETF holdings are measured by Bloomberg Indices; the ETFGTOTL is the Bloomberg Total Known ETF Holdings of Gold Index; the ETSITOTL is the Bloomberg Total Known ETF Holdings of Silver Index.

Year-to-Date Review

Spot gold fell $43.38 per ounce (a decline of 2.21%) in June to close the month at $1,919.35. For the first six months of 2023, the gold bullion price increased $95.33, or 5.23%. This was despite the euphoria in the equity markets, with the S&P 500 Index returning 15.91% in the first half, its second-best start to a year since 2000. Gold's first-half strength also defied rate-hike expectations, a flattish U.S. dollar and net gold selling from CFTC (Commodity Futures Trading Commission)7 and ETF8 holders. Gold gained largely because central bank buying more than offset a generally bearish outlook among investment funds.

Central banks use gold as a strategic asset to maintain stability, diversify reserves and enhance monetary autonomy.

The surge in the equity markets occurred in the face of recession concerns, a flat earnings outlook, rising expectations of a terminal rate for U.S. Federal Reserve rate hikes, a regional banking crisis and political stress over the U.S. debt ceiling. Hedging behavior by investment funds fueled the stock market's rise. Investment funds had built up substantial left-tail9 hedges to protect against losses from the potential banking crisis, debt ceiling default and hard-landing scenario for the U.S. economy. As each anticipated crisis was averted, the investment funds unwound their hedges, which triggered capitulation (or "stop-in”) buying. The resulting market surges and light positioning snowballed into "fear of missing out" (FOMO) trades among investors. We believe that while the probability of a U.S. recession in the coming year remains high, the opportunity cost of being underexposed in a surging market has become much more significant.

The bearish sentiment that was anticipated in the first half of 2023 did not occur for several reasons: 1) as potential risks faded, realized volatility collapsed, causing massive buying from systematic funds; 2) an earnings recession failed to materialize; 3) U.S. Federal Reserve (Fed) actions to protect bank depositors reaffirmed the "Fed put"10 despite interest rate hikes; and 4) the promise of artificial intelligence (AI) sparked an equity bull market. Despite the exuberance, market breadth is exceptionally narrow — the narrowest in decades — making markets vulnerable. A large amount of cash is sitting on the sidelines, but high valuations and the expectation of higher interest rates for a longer period will likely act as constraints.

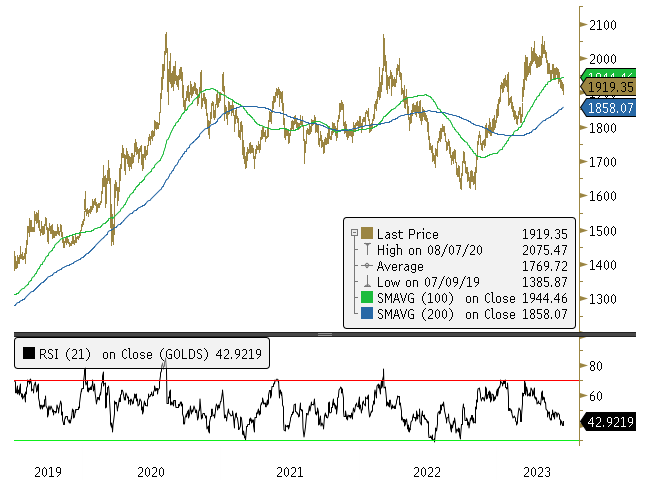

Gold Bullion: Tale of Two Hands

Gold prices held up well in the first half of 2023 despite the frothy state of the equity markets and renewed rate-hike expectations and CFTC/ETF selling. Gold has remained above its 200-day moving average and bounced off the 61.8% Fibonacci retracement level.11 At the same time, CFTC gold non-commercial long positioning has been range-bound and short positions have collapsed to three-year lows. All indicate a corrective or profit-taking action within a longer-term bull trend (Figure 1).

Gold price dynamics in the first half of 2023 can be seen as a battle between two market players: central banks and investment funds. Central banks (and sovereigns) are large entities with a long-term, strategic approach to owning gold. They are not overly sensitive to price fluctuations and tend to buy gold during periods of weakness or pullbacks. They are the strong hands in the market. Investment funds (including speculative traders and retail investors) are price sensitive and short term in focus. They tend to react quickly to market variables rather than focusing on long-term goals and are quick to take profits when prices rise. They are the weak hands in the market.

Central banks are the main drivers of long-term gold prices.

Each gold market player has a different level of price sensitivity. The investment funds chase prices while central banks remain price agnostic. Over the long term, as gold prices reach higher levels, we can expect investment funds (especially retail and speculators) to chase those prices and propel them even higher. Central banks, however, have historically demonstrated a lack of price sensitivity.

We believe that central banks are now the main drivers of the long-term price of gold, while investment funds are the main drivers of short-term price swings. Since mid-2022, central bank buying has been substantial (~three times higher than its 10-year average) and comparable to levels last seen in the 1970s. (Please note: Data on central bank buying is limited and the sample size is small.)

We consider the current dynamic in the gold market, i.e., gold passing from the weak hands of investment funds to the strong hands of central banks and sovereigns, to be a positive long-term factor. We consider it bullish when CFTC speculators are bearishly positioned because it raises the potential for a mean-reverting bear squeeze11 and a subsequent rise in the gold price.

Figure 1. Bullion Holds Up Despite the Bears (2019-2023)

Source: Bloomberg. Data as of 7/2/2023. Gold bullion spot price, U.S. dollar/oz, with 100-day and 200-day moving averages. RSI = relative strength indicator, a momentum indicator that measures the speed and magnitude of price changes to evaluate overvalued or undervalued conditions. The area above the red line indicates buying pressure or overbought conditions, while the area beneath the green line indicates selling pressure or oversold conditions. Included for illustrative purposes only. Past performance is no guarantee of future results.

Central Banks Emerge as Strategic Force in Global Gold Market

As geopolitical tensions rise and the global monetary landscape evolves, central banks and sovereigns need to diversify their reserve currency holdings. In the past year, gold has re-emerged as a significant asset in this changing paradigm, providing stability, diversification and a hedge against currency fluctuations. In our view, we are in the early stages of a trend that will see gold grow in importance and shape reserve currency dynamics in the face of rising geopolitical uncertainties.

The Urge to Diversify

The U.S. dollar (USD) remains the world's primary reserve currency, but countries including Russia and China are actively reducing their dollar dependency. Nations not aligned with the U.S., or with policy conflicts, are also seeking alternatives. Gold has become a preferred alternative among central banks due to its liquidity, historical role as a reserve asset and status as "outside money” (i.e., not under the control of a state or monetary regime). Holding physical gold gives central banks and their governments complete control over that portion of their monetary base, unlike U.S. dollar reserves held in outside banking systems controlled by another state, which are subject to potential risks. The freezing of Russia's foreign exchange reserves by Western countries is a stark reminder of this vulnerability and shows how the U.S. dollar can be weaponized.

While the U.S. dollar is expected to retain its reserve status, central banks (especially the more vulnerable ones) are moving to diversify their reserve assets and accumulate alternative currencies, like the Chinese renminbi (RMB), euro (EUR) and Indian rupee (INR). As more commodity transactions are invoiced in these currencies, the increased sizeable holdings and liquidity of these currencies will become a viable option for diversification for central bank reserve holdings.

Central banks will increasingly seek outside money, and we believe gold is the most prominent and liquid option.

China in particular has promoted using the RMB as a trade and reserve currency. However, the RMB has limited liquidity, operates within a closed capital system, has a soft peg to the U.S. dollar and is limited to the purchase of Chinese goods. China provides swap lines to bypass these limitations and has opened the gold window at the Shanghai Gold Exchange to allow holders to convert excess offshore RMB into gold. This mechanism is not a "gold standard" per se but uses gold at the margin to help trading partners normalize trade surpluses/deficits with China to repatriate capital.

Central banks recognize gold as a strategic asset to protect economic stability and enhance monetary autonomy. As the world becomes more multi-polar and trust between central banks diminishes, the desirability of "inside money" (money controlled by a state authority) declines. Central banks will increasingly seek outside money, and gold is the most prominent and liquid option with the greatest ability to cross central bank blocs.

Gold's importance as a strategic reserve asset is expected to persist and gather momentum as countries navigate the shifting geopolitical landscape. Central banks increasingly recognize gold's intrinsic value, stability, and role in diversifying holdings. Gold's role in shaping reserve currency dynamics may likely continue to evolve.

By the Numbers: Central Banks are the Gold Market Leviathans

Central banks are the more dominant player in the gold market, given that gold investment funds hold approximately 1.6% of the reserves held by central banks.

The IMF (International Monetary Fund) estimates that gold represented just 7% of estimated central bank reserves at the end of 2021. Moves to increase these gold holdings make central banks the price setters for gold. For example, large-scale central bank gold buying over the nine months from Q3 2022 through Q1 2023 amounted to 1,092 tonnes or ~0.50% of total central bank reserves. China could be another gold price driver as it invoices more of its commodity trade in RMB and needs to build gold reserves for convertibility. Both demand vectors are big enough to have a major market impact and, unlike demand from gold investment funds, are price insensitive and strategic.

Reckoning with Inflation

For 30 years, inflation was relatively tame, but it has taken on renewed significance in recent years. We doubt the world can revert to the 2% inflation regime of the “great moderation” of the early 1990s to 2020 (Figure 2). The reasons include the trend to deglobalization as the world becomes more multi-polar, as well as the reshoring of U.S. industrial production and supply chains.

The process of transitioning from a low-cost to high-cost wage environment and rapidly building up a new manufacturing base, especially as the U.S. labor market remains tight, we believe will be highly inflationary. In addition, the U.S. is rolling out a new energy infrastructure built around green energy while engaged in an economic war with the world's second-largest economy and a proxy war with Russia. All wars (whether hot, cold or economic) are inflation, commodity- and capital-intensive. With all these secular inflationary forces at play, the notion that central banks can use short-term interest rates to achieve steady-state 2% inflation we believe is highly doubtful, and we believe central banks are well aware of this.

Core Inflation Sticks Around

The latest headline U.S. consumer price index (CPI) report of 4.0% yr/yr inflation for May shows a cooling of overall inflation primarily due to a drop in energy prices. However, the core measure (which excludes energy and food prices) indicates that inflation remains high at 5.3% and has been above 5% for 18 months, well above the U.S. Federal Reserve’s 2% inflation target. While progress has been made in reducing inflation, we are nowhere near price stability. Underlying price pressures remain challenging, especially in the housing and labor markets, and could pressure the Fed to tighten monetary policy in the coming months if relief does not arrive soon.

Central bankers worldwide are facing challenges as their efforts to combat high inflation through interest rate hikes are taking longer than anticipated or simply not working. Many now believe policy may need to remain restrictive for longer to achieve inflation goals. In the EU, overall inflation has slowed as disruptions caused by the war in Ukraine slowly diminish, but core prices have not cooled. The European Central Bank is expected to announce another rate hike next month. The central banks of England, Canada, and Australia have all resumed rate hikes in the face of persistent inflation despite a year of aggressive rate increases. The Bank of Japan is the only major central bank that has maintained an easy policy despite experiencing higher inflation.

Figure 2. End of the Great Moderation: U.S. Core CPI Inflation (1960-2023)

Source: Bloomberg. US CPI Urban Consumer less food and energy, year-over-year percentage change, not seasonally adjusted (referred to as “core inflation”). Data as of 7/10/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Nearly two generations of investors and bankers have not seen a high-inflation environment and the financial crises it can cause. This is thanks to 30 years of liquidity provisioning and quantitative easing by central banks, which mitigated systemic financial crises and narrowed risk premia in credit markets. A high-inflation environment is a much bigger challenge. Any liquidity measures that a central bank takes to address financial market stress would also exacerbate inflation, embed inflationary expectations, and may likely set the stage for the next crisis. Based on history, future financial crises caused by these persistent and complex secular inflation drivers will not be quickly resolved—certainly not by central banks injecting liquidity and providing balance sheet support.

All Roads Lead to Gold

As central banks navigate geopolitical uncertainty and inflationary pressure. It is an effective hedge against reserve holdings of currency and sovereign debt are highly vulnerable to inflation. Gold has a long historical record as a store of value and a safe-haven asset. Central banks are again using gold as a strategic asset to maintain stability, diversify reserves and enhance monetary autonomy.

Footnotes

| 1 | Gold bullion is measured by the Bloomberg GOLDS Comdty Spot Price. |

| 2 | Silver bullion is measured by Bloomberg Silver (XAG Curncy) U.S. dollar spot rate. |

| 3 | The NYSE Arca Gold Miners Index (GDM) is a rules-based index designed to measure the performance of highly capitalized companies in the Gold Mining industry. |

| 4 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index distributed by Bloomberg Indices. |

| 5 | The U.S. Dollar Index (USDX, DXY, DX) is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. |

| 6 | The S&P 500 or Standard & Poor's 500 Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 7 | Positioning of speculative investors in the U.S. gold futures markets as reflected in the weekly commitment of traders report from the Commodity Futures Trading Commission (CFTC), a U.S. government agency. This is used as an indicator of market sentiment for gold. |

| 8 | Refers to gold held by exchange traded funds (ETFs) that invest in gold bullion. |

| 9 | In a statistical distribution, the lowest values are clustered at the lower far left section (left tail) of the distribution bell curve. If the distribution depicted investment returns, these would represent the most severe losses. |

| 10 | The “Fed put” is the widely held assumption by financial market participants that the U.S. Federal Reserve will automatically step in to support markets in a financial crisis. |

| 11 | Source: Investopedia. Fibonacci retracement levels are horizontal lines that indicate where support and resistance are likely to occur. They are based on Fibonacci numbers. Each level is associated with a percentage. The percentage is how much of a prior move the price has retraced. The Fibonacci retracement levels are 23.6%, 38.2%, 61.8% and 78.6%. While not officially a Fibonacci ratio, 50% is also used. The indicator is useful because it can be drawn between any two significant price points. |

| 12 | A bear squeeze (or short squeeze) is a sudden change in market conditions that forces traders to buy back assets to cover short positions (sales made with borrowed assets). This increases demand and pushes up prices. |

Important Disclosures

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only market makers or “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.