Sprott Critical Materials Monthly

Nationalization and Surging M&A Highlight Secular Strength

- View Critical Materials April 2023 Performance Table

-

For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Key Takeaways

- The long-term secular growth outlook for energy transition minerals received a boost in April as Chile moved to nationalize its lithium reserves and Glencore made a $23 billion offer for Teck Resources at a 20% premium over the market price (which Teck rejected).

- The structural forces of deglobalization are fueling resource nationalism. Chile has the world's largest lithium reserves and is the second-biggest lithium producer, so its decision to nationalize lithium will reverberate with current and future producers.

- High-quality metal mines in good jurisdictions are more valuable than the market acknowledges. In April, strategic investors made bids for copper miners in Canada and Australia at premiums that ranged from 18% to 50%.

- The strategic and economic value of commodity reserves is rising faster than other financial assets. The ratio of copper prices to U.S. Treasury prices, for example, has shaped a multi-year bull triangle and could be on the verge of a massive breakout.

- Despite the strength of the long-term secular growth story, base metal prices were generally weak in April on economic uncertainty, financial stress and disappointment with China's recovery.

Critical Minerals April Performance

The Nasdaq Sprott Energy Transition Index fell 2.80% in April to close at 922.26. It was a mixed month that featured volatile critical mineral prices, divergent equity markets and recession concerns weighing on commodities against the backdrop of long-term bullish news.

Positive news that supported the long-term bull case for metals included Glencore's $23 billion bid for Teck Resources and Chile's nationalization of its lithium resources. But short-term unfavorable market conditions also weighed on mineral prices, leaving the Nasdaq Sprott Energy Transition Materials Index in a consolidating, sideways-trading pattern that has persisted for the past year (see Figure 1).

Base metal prices fell as the long-awaited recovery in Chinese demand continued to disappoint the market. Traders had positioned for a sharp rebound in Chinese metals consumption after a year of COVID lockdowns, but this has not materialized. While China's consumer-driven recovery is on track to meet its overall growth target, industrial output remains below pre-pandemic levels and property investment continues to contract. China is signaling it may shift its focus from economic stimulus to strengthening its property market.

Playing into the sharp fall in lithium carbonate prices over the past six months are China's moves to slow home-based demand for EVs to allow domestic manufacturing to catch up. Unlike other nations, China's problem is that electric vehicle (EV) sales growth has been too fast. Limited EV infrastructure, lack of domestic critical metals production and constraints on grid connectivity are all issues that require attention.

Figure 1. Nasdaq Sprott Index Continues to Consolidate (2018-2022)

Source: Bloomberg. Nasdaq Sprott Energy Transition Materials Index (2013-2023). Data as of 4/30/2023. Moving average convergence/divergence is a trend-following momentum indicator that shows the relationship between two exponential moving averages (EMAs), calculated by subtracting the 26-period EMA from the 12-period EMA. Included for illustrative purposes only. Past performance is no guarantee of future results.

Chile Nationalizes its Lithium Resources

Chile’s president announced in April that the country would nationalize its lithium industry. Chile is the world's second-largest lithium producer and currently has the world's largest lithium reserves. In time, Chile will transfer control of the country's vast lithium mining operations to a state-owned company. This proposed National Lithium Company would lead future public-private investment to increase national production, attract new players and capital, expand the industry to be more environmentally conscious and take majority ownership of all new lithium developments. Chilean President Gabriel Boric clearly summed up Chile's position: "This is the best chance we have at transitioning to a sustainable and developed economy. We can't afford to waste it."

For anyone unfamiliar with Chile's place in mining, the country has consistently ranked in the top three global mining jurisdictions. Chile is known for its long mining history and political and economic stability, highly favorable investment climate and well-developed infrastructure. That a world leader in mining would nationalize its lithium reserves indicates a growing recognition of the secular bull case for lithium and its strategic and economic potential beyond merely being exported as a mined commodity.

Chile's decision to nationalize its lithium reserves reinforces the metal's role as a global strategic economic asset.

However, the move may harm Chile economically in the long term by reducing direct foreign investment because it offers the prospect of lower projected returns and minority ownership. Further, Chile's lithium production is almost all brine resource, and lithium investment capital has already been trending towards hard rock-hosted lithium development in Australia, Canada and the U.S. In addition, lithium royalties in Chile are the most expensive globally, with a marginal 40% royalty rate above $10,000/tonne LCE (lithium carbonate equivalent).

Recently, Chile has explored options for greater resource nationalism. A year ago, the Constitutional Assembly rejected Article 27, a proposal to overhaul the mining laws to give the state exclusive mining rights over lithium, rare earth minerals and hydrocarbons, and a majority stake in copper mines.

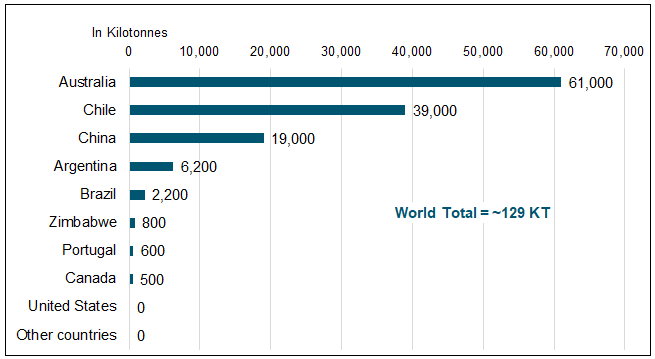

However, Chile's decision to nationalize its lithium resources will likely reverberate across most current and future producers. Chile is a dominant lithium producer and resource holder (see Figures 2 and 3). The U.S. Geological Survey estimates Chile has 9.3 million tonnes of lithium reserves, ~36% of world reserves. In 2022, Chile was responsible for 39,000 tonnes (or 30%) of global lithium production. Chile is the most significant country for copper reserves and production, accounting for ~21% of global copper reserves and 24% of global copper production, more than double the next-largest country, Australia.

Figure 2. World's Largest Lithium Reserves by Country 2022

Source: U.S. Geological Survey. Data as of 2022. Included for illustrative purposes only.

Figure 3. World's Leading Lithium Producers in 2022

Source: U.S. Geological Survey. Data as of 2022. Included for illustrative purposes only.

Deglobalization Drives Resource Nationalism

Chile's nationalization of its lithium resources is only the most recent example of how deglobalization is driving resource nationalism. This is another challenge for the energy transition and EV carmakers as they scramble to secure battery materials for their supply chains. Mexico nationalized its lithium reserves last year, and Indonesia banned nickel ore exports in 2020.

We expect more countries to follow the resource nationalism route to secure their share of the economic value from critical minerals. Sovereign global resource producers are increasingly focusing on long-term economic and strategic value rather than short-term commodity prices. This will likely lead to further resource nationalism and additional export restrictions. At the very least, expect more "mining reform" announcements.

We expect the U.S. and EU to expedite the environmental permitting process and provide financial incentives to speed up lithium development.

Many known lithium deposits located in politically friendly locales (e.g., the U.S. and Europe) are not currently in production. Chile's and Mexico's actions may accelerate resource development. We expect to see the U.S. and the EU expedite the environmental permitting process and provide financial incentives if needed to speed lithium development. Although it is in the early stages, lithium is trending toward becoming a critical metal with national security implications for many countries.

Continuing resource nationalization supports two major secular investment themes:

THEME 1: Financial market investors undervalue good mines in good jurisdictions. Good mines in good jurisdictions have strategic value beyond their financial valuation levels. This is not a new concept; investors learned this during the last commodity cycle in the early 2000s. Figure 4 shows the significant mining merger and acquisition (M&A) activity during the previous commodity cycle. Metal prices bottomed out in 2002 and investment flows increased dramatically into the mining sector by 2005. This was followed in 2006 by a series of acquisitions of quality mining assets in excellent jurisdictions. It was the late innings of that commodity cycle, and those assets sold at what can only be described as bargain prices. (Those of you who can remember these former mining giants may be shaking your heads in disbelief, wondering how these miners would be valued in today's world of deglobalization and geopolitical strife. Hint: much more!).

Figure 4. M&A Bargains During the Last Commodity Cycle

|

Year |

Company Acquired |

Acquirer |

Acquisition Price |

Main Commodity |

Main Geography |

|

2006 |

Inco Limited |

Vale S.A. |

$18 B |

Nickel |

Canada |

|

2006 |

Falconbridge Limited |

Xstrata Plc |

$19 B |

Nickel, Copper |

Canada, Norway, Australia |

|

2006 |

Naronda Inc. |

Xstrata Plc |

$7 B |

Copper, Zinc |

Canada, USA, Chile |

|

2007 |

Phelps Dodge Corporation |

Freeport-McMoRan Copper & Gold Inc. |

$26 B |

Copper |

USA, Chile, Peru |

|

2007 |

Alcan Inc. |

Rio Tinto Limited |

$38 B |

Aluminum |

Canada, USA |

Source: Sprott Asset Management.

THEME 2: The value of commodity reserves (economically and strategically) is increasing faster than other financial assets, such as sovereign bonds. Figure 5 shows how the copper to U.S. Treasury Index ratio is shaping a massive bullish triangle (or flag) formation. (We had a similar chart in our February 2023 Energy Transition Materials Monthly comparing the price of commodities to the U.S. Treasury Index.) Copper has drifted lower from the commodity cycle peak in 2011, but capital expenditures have been below the reinvestment rate needed to maintain productive capacity. It has proven challenging to increase copper mine output, prompting stepped-up M&A activity and warnings of a severe supply shortfall over the next decade. Growing concerns about a copper supply shortfall support a bullish outlook for critical EV metals. After the global financial crisis in 2008-2009, U.S. Treasuries received the most aggressive support ever extended by the U.S. Federal Reserve (i.e., multiple rounds of QE, ZIRP, NIRP, the Fed put16), culminating in the massive market top in 2020. Since then, nearly every macro driver has reversed in favor of commodities over U.S. Treasuries, including copper, as in this example.

Figure 5. Copper Forms a Bullish Flag (1990-2022)

Source: Bloomberg. Data as of 4/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Updates on Critical Materials

Lithium: Price Decline Slows

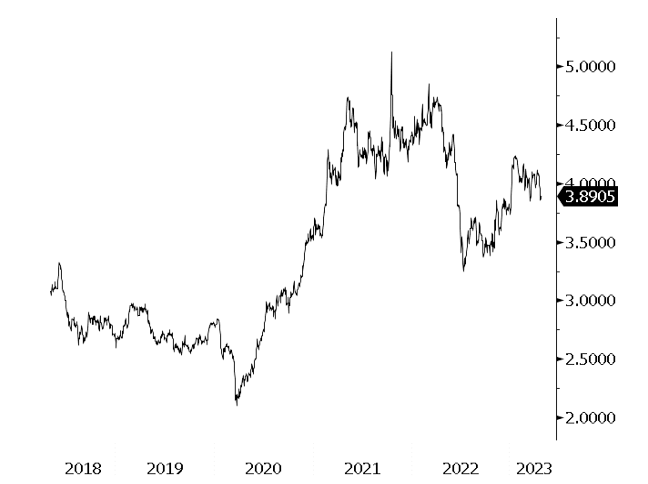

In April, the lithium carbonate spot price declined 23.14%, less than its fall in March. That said, the price is still elevated over historical levels, having risen 303.09% (more than 4x) over the past three years (see Figure 6). Lithium carbonate has been in free fall since the last quarter of 2022, but it turned around and posted a small gain in the final days of April.

The fall in lithium prices was triggered by the price being at unsustainable highs, coupled with weak seasonal demand. China and Europe stopped EV subsidies at the end of 2022, resulting in lower EV sales thus far in 2023. Given that EVs are the largest source of lithium demand, lower EV sales have hurt the lithium spot price. With lithium inventories low and the potential for downstream demand to pick up over the remainder of 2023, the lithium spot price is likely to find support. Longer term, the forecast for lithium demand vis-à-vis EV remains positive and we believe supply will not be able to keep pace with demand.

The long-term forecast for lithium demand is positive as supply is unlikely to keep pace with demand.

Chile’s plans to nationalize its lithium industry and bring companies under state control is likely to affect two of the largest lithium miners in the world, Sociedad Quimica y Minera de Chile SA (NYSE: SQM) and Albemarle Corporation (NYSE: ALB). SQM and Albemarle currently have production contracts that are set to expire in 2030 and 2043, respectively. Per its announcement to nationalize, Chile will not terminate existing contracts before expiration; however, if SQM and Albemarle were to keep full control of their operations for the entire length of their contracts, they risk losing the contracts once they end. Given the level of uncertainty, the share prices of both SQM and Albemarle fell on this news.

By contrast, lithium producers in Australia, the largest lithium-producing country in the world, performed positively in April (including Pilbara Minerals Ltd. and Allkem Ltd.). This signals a potential tailwind for the spodumene17 miners generally found in Australia versus the lithium producers with brine deposits in Chile.

Figure 6. Lithium Prices Rebound Slightly in April (2018-2023)

Source: Bloomberg. Lithium carbonate spot price, USD/lb. (2018-2023). Data as of 4/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Copper: Economic Fears Still Drag on Prices

The copper spot price fell 4.74% in April on negative macroeconomic sentiment and weak economic data. The simmering banking crisis signaled by the collapse of Silicon Valley Bank and Signature Bank, the emergency UBS buyout of Credit Suisse, and the rapid-fire sale of U.S. regional bank First Republic to JP Morgan Chase continue to create uncertainty.

Stress in the financial system paired with weaker-than-expected recovery in China and low growth in the U.S. (GDP below estimates) has dragged on copper prices. Copper prices are generally tied to economic growth due to its many uses within the global economy. As such, slowdown/recession fears by investors negatively affect copper prices. Longer term, copper is poised to benefit as inventories are still at historic lows (as discussed in our February 2023 Energy Transition Materials Monthly), energy transition demand is strong and supply will likely fail to keep up with demand (due to long lead times and declining ore grades globally).

Copper miners did better than lithium miners in April, with mining majors gaining 1.67% and junior miners gaining 3.99%. Increased M&A activity within the copper mining space has drawn investor interest. Copper miner Teck Resources Ltd. rejected multiple takeover offers from Glencore PLC. The most recent of these bids was for $23 billion, which was a 20% premium to the stock price. Teck's rejection demonstrates its management's belief in the long-term positive fundamentals of copper mining. (Teck also said it may spin off its coal business and focus on copper, noting that copper miners tend to trade at higher valuations than coal miners.)

Elsewhere, April saw the approval of BHP Group Ltd.'s $6.4 billion takeover of copper miner OZ Minerals Ltd. (OZL), a 49.3% premium to OZL's last closing price. Among junior copper miners, Hudbay Minerals Inc. made a deal to buy Copper Mountain Mining Corporation for $439 million, an 18% premium to its market price.

Figure 7. Copper Declines in April (2018-2023)

Source: Bloomberg. Copper spot price USD/lb (2018-2023). Data as of 4/30/2023. Included for illustrative purposes only. Past performance is no guarantee of future results.

Critical Materials: April 30, 2023 Performance

| Metric | 4/30/2023 | 3/31/2023 | Change | Mo % Chg | YTD % Chg | Analysis |

| Miners | ||||||

| Nasdaq Sprott Energy Transition Materials™ Index1 | 922.26 | 943.83 | (26.57) | (2.80)% | (1.24)% | April was a very wide return distribution month. Broader mining indices fell ~-7% on recession fears and slowing China stimulus. Copper mining indices surged on M&A activity. Energy transition-related mining indices returns were varied. Overall market breadth continued to worsen, pressuring small-cap illiquid equities further. |

| Nasdaq Sprott Lithium Miners™ Index2 | 965.59 |

988.79 | (23.19) | (2.35)% | 4.69% | |

| North Shore Global Uranium Mining Index3 | 2,376.39 | 2,391.23 | (14.84) | (0.62)% | (2.08)% | |

| Solactive Global Copper Miners Index4 | 144.81 | 142.42 | 2.38 | 1.67% | 11.14% | |

| Nasdaq Sprott Nickel Miners™ Index5 | 867.18 | 868.80 | (1.62) | (0.19)% | (4.71)% | |

| Nasdaq Sprott Junior Copper Miners™ Index6 | 991.96 | 953.87 | 38.09 | 3.99% | 15.56% | |

| Nasdaq Sprott Junior Uranium Miners™ Index7 | 900.53 | 923.58 | (23.05) | (2.50)% | (12.26)% | |

| Physical Materials | ||||||

| Lithium Carbonate Spot Price $/lb8 | 11.65 | 15.15 | (3.51) | (23.14)% | (65.90)% | Price bouncing off 76.4% Fibonacci level |

| U3O8 Uranium Spot Price $/lb9 | 53.85 | 50.70 | 3.20 | 6.32% | 4.93% | Bullish breakout from small flag |

| LME Copper Spot Price $/lb10 | 3.89 | 4.08 | (0.19) | (4.74)% | 2.54% | At $3.85 support level |

| LME Nickel Spot Price $/lb11 | 10.98 | 10.73 | 0.25 | 2.37% | (18.99)% | Advancing along uptrend support |

| Benchmarks | ||||||

| S&P 500 TR Index12 | 4,169.48 | 4,109.31 | 60.17 | 1.46% | 8.59% | SP500 rising on very narrow breadth led by mega-cap tech. DXY churning above major support while broader commodities and metal miners are pressured growth fears. |

| DXY US Dollar Index13 | 101.66 | 102.51 | (0.85) | (0.83)% | (1.80)% | |

| BBG Commodity Index14 | 104.31 | 105.51 | (1.20) | (1.13)% | (7.53)% | |

| S&P Metals & Mining Select Industry TR Index15 | 2,530.68 | 2,722.96 | (192.28) | (7.06)% | (0.82)% | |

Source: Bloomberg and Sprott Asset Management LP. Data as of April 28, 2023.

Past performance is no guarantee of future results. You cannot invest directly in an index.

- For the latest standardized performance of the Sprott Energy Transition ETFs, please visit the individual website pages: SETM, LITP, URNM, URNJ, COPJ and NIKL. Past performance is no guarantee of future results.

Footnotes

| 1 | The Nasdaq Sprott Energy Transition Materials™ Index (NSETM™) is designed to track the performance of a selection of global securities in the energy transition materials industry, and was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 2 | The Nasdaq Sprott Lithium Miners™ Index (NSLITP™) is designed to track the performance of a selection of global securities in the lithium industry, including lithium producers, developers and explorers; the Index was co-developed by Nasdaq® and Sprott Asset Management LP. |

| 3 | The North Shore Global Uranium Mining Index (URNMX) is designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry, which may include mining, exploration, development and production of uranium, or holding physical uranium, owning uranium royalties or engaging in other non-mining activities that support the uranium mining industry. |

| 4 | The Solactive Global Copper Miners Index includes international companies active in exploration, mining and/or refining of copper. The index includes a minimum of 20 and a maximum of 40 members. The calculation is done in USD as a total return index. Index adjustments are carried out semi-annually. |

| 5 | Nasdaq Sprott Nickel Miners™ Index (NSNIKL™) is designed to track the performance of a selection of global securities in the nickel industry. |

| 6 | Nasdaq Sprott Junior Copper Miners™ Index (NSCOPJ™) is designed to track the performance of mid-, small- and micro-cap companies in copper-mining related businesses. |

| 7 | Nasdaq Sprott Junior Uranium Miners™ Index (NSURNJ™) is designed to track the performance of mid-, small- and micro-cap companies in uranium-mining related businesses. |

| 8 | The lithium carbonate spot price is measured by the China Lithium Carbonate 99.5% DEL. Source Bloomberg and Asian Metal Inc. Ticker L4CNMJGO AMTL Index. Data converted to pounds and to USD with Bloomberg FX Rates. |

| 9 | The U3O8 uranium spot price is measured by a proprietary composite of U3O8 spot prices from UxC, S&P Platts and Numerco. |

| 10 | The copper spot price is measured by the LME Copper Cash ($). Source Bloomberg ticker LMCADY. Data converted to pounds. |

| 11 | The nickel spot price is measured by the LME Nickel Cash ($). Source Bloomberg ticker LMNIDY. Data converted to pounds. |

| 12 | The S&P 500 or Standard & Poor's 500 Total Return Index is a market-capitalization-weighted index of the 500 largest U.S. publicly traded companies. |

| 13 | The U.S. Dollar Index (USDX, DXY) is an index of the value of the U.S. dollar relative to a basket of foreign currencies. |

| 14 | The Bloomberg Commodity Index (BCOM) is a broadly diversified commodity price index that tracks prices of futures contracts on physical commodities, and is designed to minimize concentration in any one commodity or sector. It currently has 23 commodity futures in six sectors. |

| 15 | The S&P Metals & Mining Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS metals & mining sub-industry. |

| 16 | QE, ZIRP, NIRP and the “Fed put” are all terms for various forms of accommodative monetary policy. QE = quantitative easing, in which a central bank buys securities on the open market to reduce interest rates and increase money supply. ZIRP/NIRP = zero or negative interest rate policies, in which a central bank sets its short-term interest rate target close to or below 0%. The “Fed put” refers to the belief among investors that the U.S. Federal Reserve will always step in to ease monetary policy |

| 17 | Spodumene is a pyroxene mineral that is typically found in lithium-rich pegmatites. |

Important Disclosures

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only market makers or “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.