Silver on the Move

Silver bullion prices have shown significant strength in 2024, with the silver spot price gaining 21.46% for the 12 months ending December 31, climbing from $23.65 to $28.90 per ounce.

Several key factors have bolstered silver this year, including strong industrial demand in the face of persistent supply deficits and increased investment interest amid economic uncertainty. Here, I explore silver's unique properties and the factors influencing its demand, supply and potential as an investment, both in the form of bullion and silver mining equities.

The Silver Market Is Relatively Small

At approximately $30 billion annually, the silver market is relatively small compared to other commodities like copper and gold. This smaller market size makes it inherently more volatile, with even minor shifts in supply or demand having an outsized impact on price. For 2024, global silver demand is expected to rise 1% year-over-year to 1.21 billion ounces, the second-highest year on record.1 Silver's volatility is partly attributed to its dual role. This volatility offers both risk and potential reward, presenting a unique opportunity for investors.

Silver’s Unique Dual Role

Silver, known for its versatility, plays a unique dual role as a precious metal and an industrial commodity. Silver holds a distinctive position among commodities due to this dual status. As an industrial metal, silver is vital for applications in electronics, solar energy and electric vehicles. As a precious metal, it functions as a store of value and inflation hedge. It also holds a unique place in history as one of the oldest forms of currency, along with gold and bronze, and it was the standard currency unit from 3000 BC until 1873.

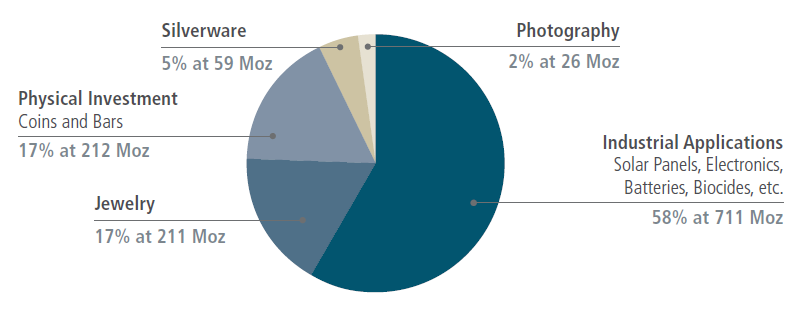

Figure 1. Industrial Uses Dominate Silver Demand

Source: Metals Focus, Silver Institute. Data as of 2024. The Silver Institute: World Silver Survey 2024. Included for illustrative purposes only.

Dual Demand Drivers: Industrial Use and Investment Demand

Industrial applications now account for roughly 55% of global silver demand, with renewable energy applications being particularly impactful. With solid growth in 2024, silver industrial demand is on track to eclipse 700Moz for the first time.2 Solar technology, electric vehicles (EVs), 5G networks and consumer electronics all bolster silver demand, making it an essential material for innovation and the transition to clean energy technologies.

Solar energy, for example, consumes more than 200 million ounces annually, or about 20% of total silver demand, as silver's conductive properties make it essential for photovoltaic cells.3 The global solar industry grew 76% in 2023 and is forecasted to grow another 34% in 2024.1 Longer term, the solar industry has grown at a rate of 27% annualized since 2015.4 The Silver Institute reported a 158% increase in silver demand for solar panels from 2019 to 2023, with an additional 20% growth anticipated in 2024.

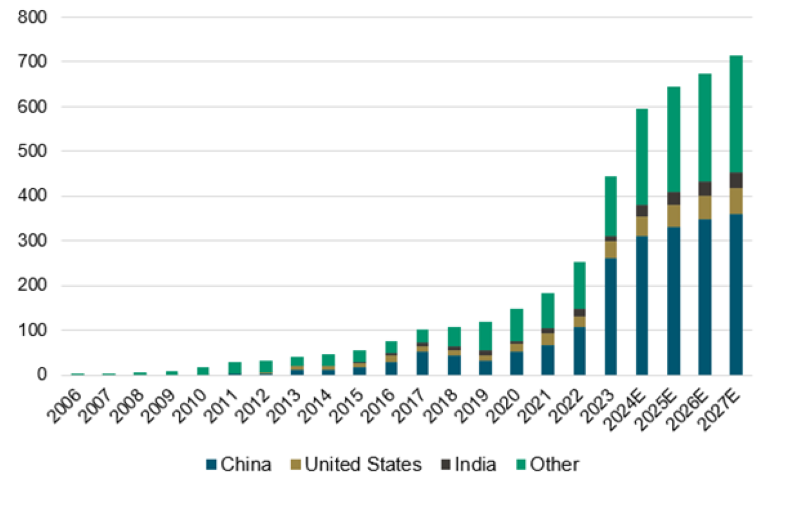

Installation of Solar Power Is Growing Rapidly

China's increasing silver consumption in the solar sector and renewable technologies has driven much of the recent demand surge. Solar now accounts for 16% of silver demand compared to 6% in 2015.5 New technologies may contribute to growth as the market shifts to more silver-intensive solar cells to receive higher efficiency in converting sunlight to electricity.

Figure 2. Solar Annual New Additions (GW)

Source: BloombergNEF, October 4, 2024.

The investment demand for silver also remains significant. As an alternative to gold, silver is viewed as a hedge against fiat currency devaluation and as a store of value. In times of economic uncertainty and when interest rates are declining, the silver price tends to increase. Exchange-traded funds (ETFs), silver coins and bars are popular ways to invest in silver, though this component of demand is often more volatile than industrial usage.

Figure 3.

Silver’s Role as a Critical Mineral Driving Innovation

Solar panels, electric vehicle components and 5G technology all depend on silver, a demand expected to increase as nations ramp up efforts to reduce carbon emissions. Silver's electrical conductivity, antibacterial properties and scarcity make it highly valuable in various technologies, especially those supporting decarbonization efforts. The widespread adoption of AI is also driving demand, due to a need for upgrades and replacements.

The electrification of the world is really providing a boon to silver - Michael DiRienzo, Chief Executive of the Silver Institute.

Despite its essential role in renewable energy and electronic applications, silver is notably absent from most national critical mineral lists, including the U.S.6 and Canada. We would advocate for silver's recognition as a critical mineral due to its role in green infrastructure. Solar technology alone is forecasted to grow substantially, with projections indicating an increase in silver demand as newer solar panel designs use more silver per unit. Given silver's strategic role, its exclusion from critical mineral lists is a potential oversight in policies supporting clean energy transitions.

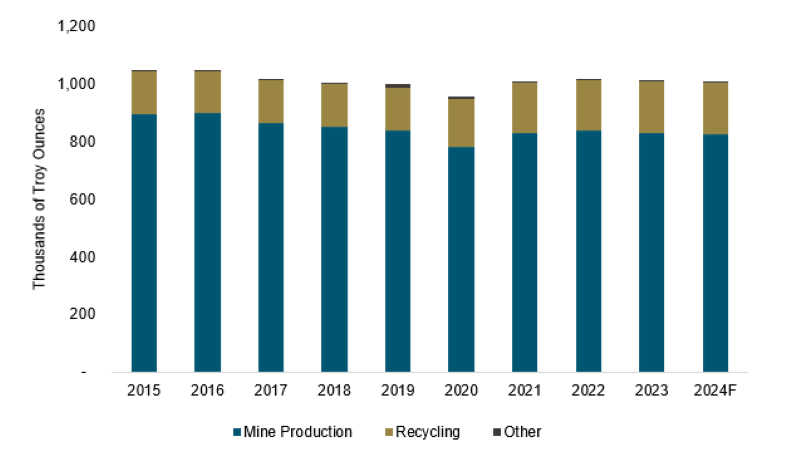

Silver Supply Constraints and Production Stagnation

Silver supply has faced challenges over the past decade, remaining largely stagnant even as demand has steadily risen. The global silver supply has not significantly increased since 2014, leading to a supply deficit, and silver inventories have been falling as shown in Figure 4. The Silver Institute projects a 1% decline in supply in 2024, emphasizing that without new mine discoveries or expansions, silver production may struggle to meet growing demand.

Figure 4. Silver Supply

Source: BloombergNEF, October 4, 2024.

Mining operations worldwide have faced challenges such as declining ore grades, higher production costs and limited exploration success. Silver is often a byproduct in the mining of other metals including lead, zinc, copper and gold; pressure on or closure of these mines can heavily impact silver supply. Several large silver-producing regions have reported lower-than-expected outputs, with mining companies focusing on maintaining production rather than increasing it. These supply constraints are likely to contribute to ongoing supply-demand imbalances, which could support silver prices in the long term.

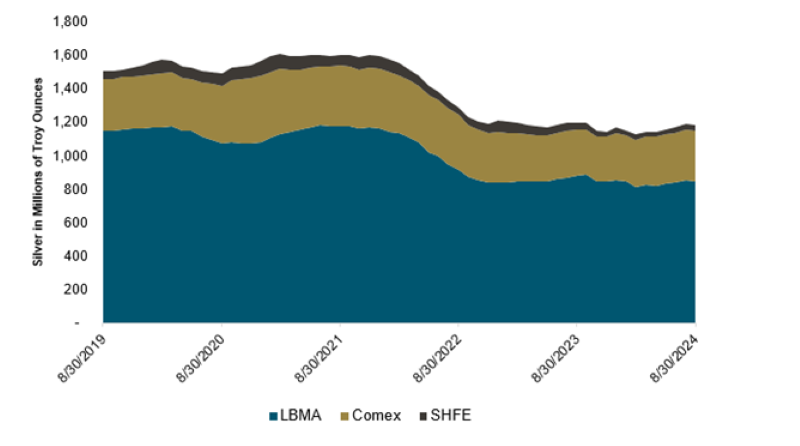

Figure 5. Silver Inventories Have Been Falling

LBMA represents the London Bullion Market Association, COMEX represents the Commodity Exchange of CME Group, and SHFE represents the Shanghai Futures Exchange. Source: Bloomberg and LBMA as of 8/31/2024. The silver spot price is measured by Silver Spot USD/Troy Ounce. You cannot invest directly in an index.

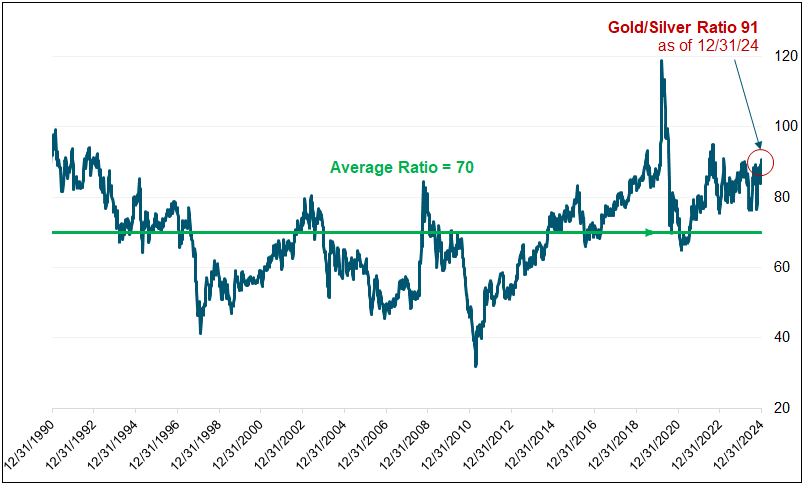

The Gold-Silver Ratio and Price Potential

The gold-silver ratio, a metric comparing the price of gold to silver, has averaged around 70:1 since the late 1980s. Currently, this ratio has widened considerably, reaching levels above 85:1. This indicates that silver is currently undervalued relative to gold.

Figure 6. The Gold/Silver Ratio

Source: Sprott Asset Management LP, Bloomberg. Data as of 12/31/2024. The gold-silver ratio is an expression of the price relationship between gold and silver, and indicates the number of ounces of silver it takes to equal the value of one ounce of gold.

For silver to reclaim historical parity with gold, it would need to close the price gap, likely leading to an appreciation in silver's value. Inventory depletion, as seen in recent years on major exchanges like the London Bullion Market Association (LBMA),7 supports the argument for potential silver price increases. As these inventories decline and industrial demand grows, the gold-silver ratio may adjust to reflect silver's increasing scarcity and demand profile.

Figure 7. Silver Has Yet to Catch Up to Gold

Source: Bloomberg. Data as of 11/30/2024.

Silver Investment Strategies and Portfolio Allocation

Investors looking to incorporate silver into their portfolios may benefit from a diversified approach, combining physical silver and exposure to silver mining companies. Investment strategies often recommend allocating a percentage of assets to physical silver for stability and mining stocks for growth potential. Mining equities offer exposure to silver prices with additional operational leverage, appealing to investors seeking the potential for higher returns.

Mining exploration companies, though higher risk than silver bullion, play a crucial role in meeting future supply needs by discovering new reserves. Silver companies are vital to exploration activities, offering investors a unique growth opportunity. By balancing physical silver with equities, investors have the potential to leverage silver's dual role as an industrial and investment asset, capitalizing on both stability and potential growth.

Due to the small size of the silver market, even minor increases in investment flows can significantly impact silver equities, especially among smaller- and mid-capitalization companies. This potential is an appealing characteristic for investors willing to engage in a smaller but responsive asset class.

Our Bullish* View on Silver

We believe that silver continues to offer a compelling investment opportunity due to its unique market dynamics. For investors, a diversified portfolio that balances physical assets and mining equities may offer exposure to silver's stability as a store of value and its growth potential as a critical industrial metal.

Rising industrial demand from green technologies, coupled with limited supply growth, positions silver favorably in a rapidly changing economic landscape. Silver's undervaluation relative to gold and its strategic role in renewable energy applications adds to its appeal.

For centuries, silver has served as a trusted medium of exchange, and its value proposition endures today. Amidst concerns over fiat currency devaluation, we believe silver's inherent worth as a hard asset and reliable store of value positions it as an attractive option amid economic uncertainty. Furthermore, silver's versatile role in driving technological advancements—from renewable energy to cutting-edge electronics—underscores its dual appeal: a secure haven for investors and a catalyst for growth, poised to thrive alongside emerging innovation.

*Note: "Bullish" refers to a “bull market,” which is a condition of financial markets where prices are generally rising. In contrast, a “bear market” refers to a condition of financial markets where prices are generally falling.

Footnotes

| 1 | Source: The Silver Institute, Global Industrial Demand on Track for a New Record High in 2024. |

| 2 | Source: Metals Focus Precious Metals Weekly. Issue 584. |

| 3 | Source: The Wall Street Journal, Why Silver Is Having a Golden Moment. |

| 4 | Source: BloombergNEF, October 4, 2024. |

| 5 | Source: Metals Focus, Silver Institute. The Silver Institute: World Silver Survey 2024. |

| 6 | Source: U.S. Geological Survey Releases 2022 List of Critical Minerals. |

| 7 | Source: Numismatic News, Silver Inventories Plummet at LBMA and COMEX. |

Investment Risks and Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered. Diversification does not eliminate the risk of experiencing investment losses.

Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice.