For the latest standardized performance and holdings of Sprott Active Gold & Silver Miners ETF, please visit the individual website page: GBUG. Past performance is no guarantee of future results.

Sprott Active Gold & Silver Miners ETF

Sprott Asset Management recently announced the launch of an actively managed gold and silver miners ETF (on 2/20/25). Sprott Active Gold & Silver Miners ETF (Nasdaq: GBUG) is the only1 active ETF focused on providing exposure to gold and silver miners. The Fund aims to provide long-term appreciation and is value-oriented and contrarian.

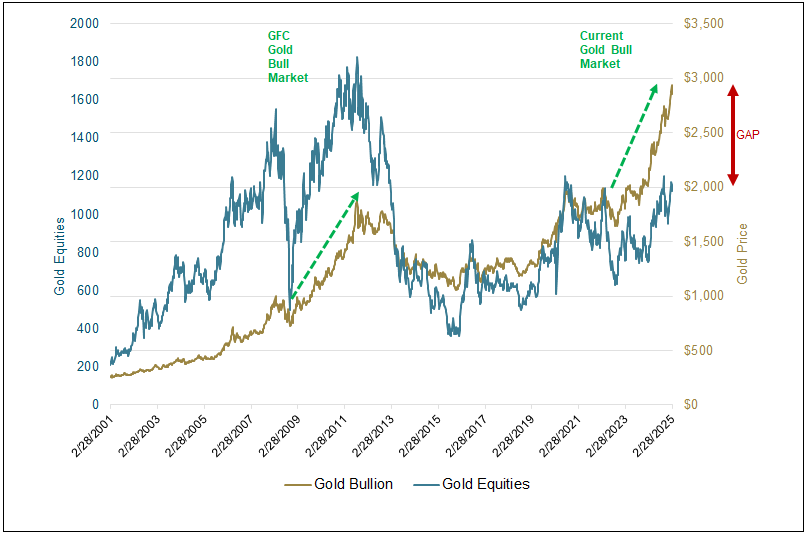

We believe active management using a team of portfolio managers will help identify what we view as large differences in relative and absolute performance within the gold and silver mining sectors. Gold and silver mining equities may offer significant upside potential because we believe they are undervalued relative to the strong advance of gold bullion prices over the past year, in which the metal price rose 27.22%. Earnings estimates for the NYSE Arca Gold Miners Index have increased by 60% and 80% since April 2024, but mining stocks gained 10.64% for the full year in 2024, posting less than half of gold bullion’s rise.

Year to date as of March 24, 2025, gold bullion has moved significantly, gaining 14.73% and reaching new price highs above $3,000 per ounce. At the same time, gold mining equities are playing catch up and have climbed 31.61% YTD.

Gold Mining Equities Offer Catch-Up Potential

We believe mining equities offer considerable “catch-up potential” relative to the strong advance of the yellow metal. As noted by Rosenberg Research (“I’ve Been a Miner for a Heart of Gold,” 2/7/2025):

“With a forward P/E ratio at 12x and annualized earnings growth for the next three years at 38%, the PEG ratio (forward P/E to earnings growth) works out to be just 0.3x. For reference, a PEG ratio of less than 1x is considered cheap, (and) between 1-2x is considered reasonable.”

Figure 1. Gold Miners May Provide an Attractive Investment Opportunity (2000-2025)

Source: Bloomberg as of 2/28/2025. Gold is measured by the GOLDS Comdty Spot Price and gold equities by the NYSE Arca Gold Miners Index (GDMNTR).2 You cannot invest directly in an index. Past performance is no guarantee of future results.

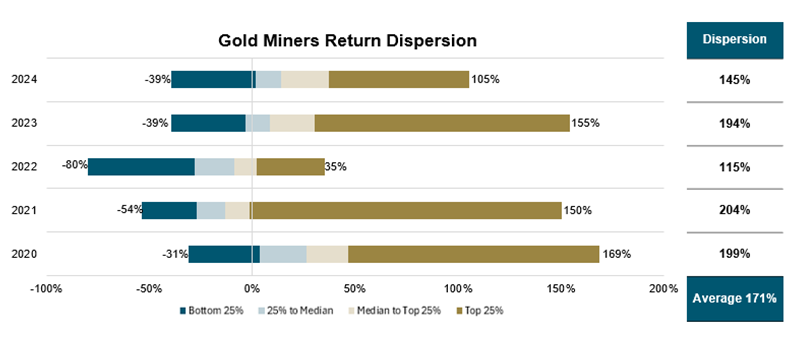

While the composite return for gold mining equities in 2024 was a (more than) satisfactory 10%, there has been substantial dispersion within the group, with many individual stocks faring considerably better or worse. In our view, the wide variance in outcomes, measured at 145% in 2024, suggests an excellent opportunity for stock picking and active management.

Figure 2. Gold Miners: A Wide Dispersion of Returns

Source: Bloomberg and FactSet as of 12/31/2024. Gold Miners represent the GDMNTR and the constituents of GDX ETF,3 which tracks GDMNTR.

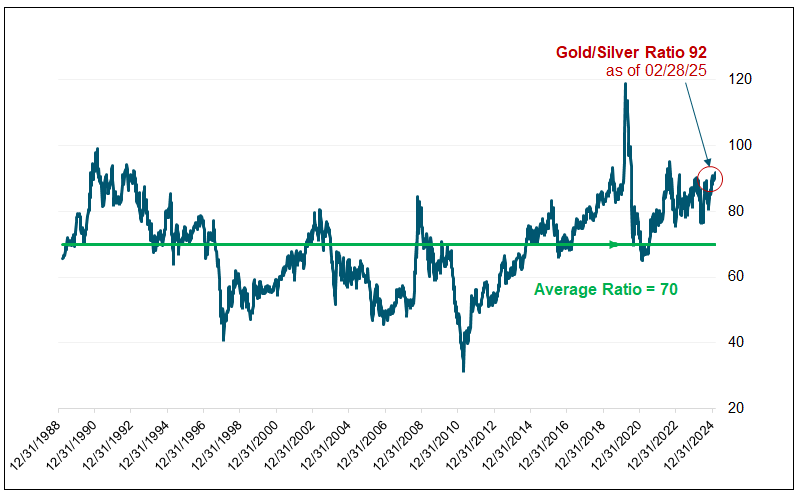

Silver Has Yet to Match Gold’s Rise

Silver miners offer a different form of catch-up opportunity. Although silver bullion gained more than 20% in 2024, boosted by its duality as a precious and industrial metal, it remains undervalued relative to gold bullion. On average, gold has historically been priced at 70 times the price of silver. With the gold-silver ratio currently at 92, silver is priced at a discount to gold. Furthermore, according to the Silver Institute, the ratio of silver to gold mined was 7:1 as of 2022, meaning that seven tons of silver were mined for every one ton of gold. This ratio is low relative to historical averages and indicates the growing difficulty in finding new sources of silver. Most high-quality surface silver deposits have been discovered and exploited. With the silver market in deficit for the last five years and industrial demand rising, this could be an optimal time to enter this space.

Figure 3. Silver May Be Undervalued Relative to Gold (1988-2025)

Source: Bloomberg as of 2/28/2025. The silver spot price is measured by the Silver Spot USD/Troy Ounce. *The gold/silver ratio is a measure that indicates how many ounces of silver are needed to purchase one ounce of gold. It is calculated by dividing the current spot price of gold by the current spot price of silver.

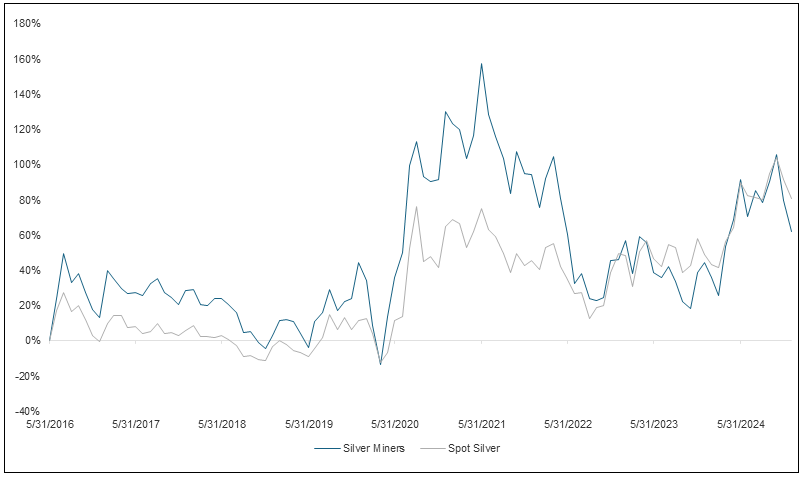

It is worth noting that silver miners have been tracking more closely with the underlying metal in recent history and have outperformed in the recent bull market (see Figure 4). Given the demand-supply dynamics and macro backdrop for physical silver—silver supply has been flat since 2015 despite rising demand—investors may want to consider an investment that provides access to silver miners to gain exposure to the sector.

Figure 4. Silver Equities Have Recently Outperformed Physical Silver During Bull Markets (2016-2024)

Source: Bloomberg as of 12/31/2024. The silver spot price is measured by the Silver Spot USD/Troy Ounce. Silver miners are measured by Nasdaq Junior Silver Miners Total Return Index (NMFSMT), which tracks the performance of small-cap companies engaged in silver mining and exploration. A “bull market” refers to financial market condition when prices are generally rising. A “bear market” refers to financial market conditions when prices are generally falling.

Sprott’s Distinctive Active Management Approach

Because these sectors generally trade at historically inexpensive valuations, significant investment opportunities have the potential to be identified from anticipating takeovers, corporate restructuring, and strategic investments by financial players outside of the gold and silver mining sectors.

The Sprott investment process digs into individual company fundamentals at a granular level. Our team, with a combined 100 years of specialized leadership in precious metals investments, continuously discusses important developments and assesses individual portfolio positions.

Our research process evaluates multiple factors, including management capability, share ownership and incentive compensation, corporate governance, asset quality, balance sheet and income statement analysis, geopolitical exposure, progress in meeting strategic objectives, individual mine geology and economics, capital budgets and both existing and prospective cash flow generation.

Figure 5. Sprott’s Boots on the Ground

The Sprott team of geologists and mining engineers conducts technical reviews of up to 30 site visits annually to assess asset potential, identify challenges, and explore geologic opportunities. Senior Portfolio Manager Maria Smirnova is featured on the left and Senior Portfolio Manager Justin Tolman is featured on the right. Countries have included Australia, Bolivia, Brazil, Cambodia, Canada, Colombia, Cote D’Ivoire, Guatemala, Mexico, Morocco, Nicaragua, Papua New Guinea, Peru, Spain, Senegal and the U.S.

Our team has diverse experience and important complementary skill sets, including understanding capital markets, financial statement analysis, mining economics (including all aspects of ore extraction and processing), geology and host country political landscapes.

We engage with management at multiple levels, including the Board of Directors, Senior and mid-level executives and managers of local mines. Our ongoing dialogue is enhanced by frequent site visits. Over the past 12 months, we have visited mines in Australia, Papua New Guinea, the Democratic Republic of Congo and South Africa.

The Moment May Be Opportune

We believe the launch of our actively managed ETF comes at a particularly opportune moment. Gold has broken out to reach all-time highs for multiple reasons, including demand for a safe haven investment, fallout from tariffs and fear of a global trade war. Gold mining stocks have barely participated in what appears to be a regime change for the metal. Silver continues to have rising demand and stagnant supply and may be undervalued relative to gold.

| 1 | Based on Morningstar’s universe of Precious Metals Sector Equity ETFs as of 2/19/2025. |

| 2 | GDMNTR is a market capitalization-weighted index that tracks the performance of publicly traded companies involved in gold mining and exploration. |

| 3 | VanEck Vectors® Gold Miners ETF (GDX®) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the GDMNTR. |

Important Disclosures & Definitions

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the funds, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF is new and has limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.