Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

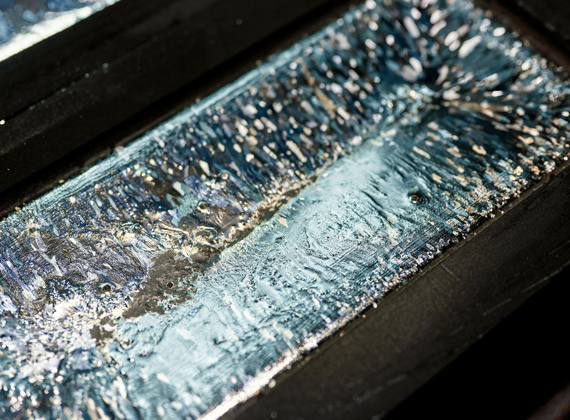

Sprott Uranium Report

Uranium’s Mid-Year Momentum

Uranium spot prices jumped nearly 10% in June and uranium miners surged, supported by renewed inflows and global pro-nuclear policy momentum. With AI data centers adding a long-term demand driver, we believe uranium’s structural bull case remains intact.

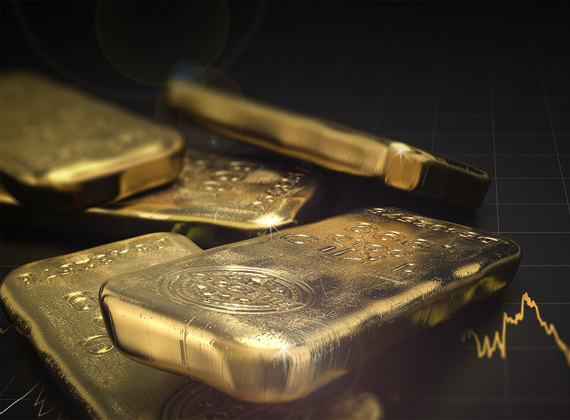

Sprott Precious Metals Report

Gold and Silver Bull Run Continues

Gold and silver have been strong performers in 2025, with both metals up over 25% YTD as global instability drives demand for safe haven assets. Central banks are shifting away from the U.S. dollar, while silver’s breakout suggests a potential supply squeeze ahead.

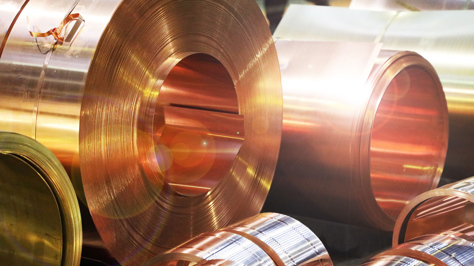

Sprott Copper Report

Copper’s Bullish Setup Strengthens

Copper is surging toward $10,000 per ton as plunging inventories and unexpected supply disruptions expose the market’s tightness. Easing tariff tensions and rising electrification demand are driving bullish sentiment. We believe copper may be heading toward a structural repricing.

Special Report

Building an Electrified World: The Strategic Role of Critical Materials

As the world races to electrify, demand for critical materials like uranium, copper, silver, lithium and nickel is climbing. These metals are foundational to nuclear power, consumer electronics and high-performance batteries — making them indispensable to meeting rising global energy demand.

Sprott Uranium Report

Uranium’s Bull Market Reawakens

Uranium is back in focus as U.S. nuclear policy accelerates and AI-driven energy demand sparks renewed investor interest. With uranium prices and miners showing strength in May, our outlook remains bullish as fundamentals tighten and sentiment shifts.

Sprott Precious Metals Report

Gold Gains Ground as Faith in the Dollar Erodes

Gold continues its rally as fading confidence in U.S. fiscal policy and the U.S. dollar drives demand for real assets. As we publish, silver is breaking out above $35, supported by structural supply deficits, renewed investor interest and mounting macroeconomic pressures.

Sprott Uranium Report

Uranium Regains Momentum

Uranium is regaining strength, with spot prices rebounding and momentum returning thanks to renewed utility contracting, tariff clarity and strong long-term fundamentals. The resurgence of the carry trade, rising AI-driven energy demand and China’s ongoing nuclear buildout are reinforcing uranium’s role as a strategic, supply-constrained asset.

Sprott Precious Metals Commentary

A Shaky U.S. Dollar Boosts Gold’s Role as an Alternative Reserve Asset

Gold is gaining prominence as a reserve asset due to a weak U.S. dollar and declining U.S. financials, reaching record highs while equities and bonds fell. We believe this positions gold as a potential anchor for a multi-asset reserve system. Given silver’s correlation to gold, we believe its monetary value will reassert itself in time.

Sprott Uranium Report

Is Uranium’s Bull Market Over?

Recent market events have put pressure on uranium, but we continue to believe in the resilience and long-term bullish outlook for physical uranium and uranium mining equities. Our positive outlook is supported by uranium's growing structural supply deficit and global policy support for nuclear power.

Sprott Gold Report

The Return of Exter’s Inverted Pyramid

Gold has been rising on strong official sector demand, fueled by concerns over the U.S. dollar and global instability. While Western investors have focused on potentially overvalued stocks, gold and mining equities offer potential upside as other assets struggle.

Sprott Copper Report

Copper’s Record-Setting Rally and Reversal on U.S. Tariffs

Copper prices reached record highs in March, driven by tariff fears and U.S. demand. Despite recent market volatility, copper remains a strategic asset with strong long-term fundamentals, supported by rising global energy demands and U.S. policy shifts.

Sprott Q1 Precious Metals Report

Gold's Strength Amid a Crisis of Confidence

Gold's record-breaking rally in Q1 2025 reflects mounting investor anxiety over stagflation, policy volatility and a fraying global economic order. U.S. tariffs and policy unpredictability have elevated the risk of stagflation, fueling demand for gold as the lone liquid safe-haven asset. We also believe silver is potentially poised to break out.

Sprott Uranium Report

Tariffs, Tensions and the Uranium Opportunity

We see market volatility as an opportunity, with uranium’s spot price offering an attractive entry point for investors. Despite Trump tariff policy and geopolitical uncertainties, uranium’s strong long-term fundamentals—supply deficits and rising nuclear demand—remain intact.

Special Report

GBUG and The Case for Active Management

Sprott Asset Management has launched GBUG which seeks long-term appreciation through value-oriented, contrarian investing. Sprott's active management team looks to capitalize on the wide dispersion of returns within the mining sector and the potential for silver to catch up to gold's rise.

Sprott Critical Materials Monthly

Critical Materials Markets Shake Off DeepSeek Disruption and U.S. Policy Rollbacks

Critical materials showed resilience in January amid global volatility. We take a deep dive into China's growing leadership in clean technology investments, the disruptive impact of DeepSeek's AI model and the implications of U.S. policy changes on the energy transition and critical materials supply chains.

Sprott Uranium Report

Uranium Markets Trumped by Uncertainty

The uranium markets experienced volatility in January, with prices dipping despite strong miner performance. Key factors included the emergence of the Chinese AI model DeepSeek and the return of the Trump administration.

Sprott Gold Report

Recalibrating Our Crystal Ball

Gold was a strong performer in 2024, gaining 27.22% to end the year at $2,624.50, fueled by geopolitical tensions, central bank purchases and bond market struggles. These strong gains occurred with negligible participation or interest from investors in North America or Europe. Key catalysts for a gold rally could include stock or cryptocurrency downturns, bond market disruptions or a U.S. dollar reset.

Silver Report

Silver's Impressive Strength in 2024

We believe that silver continues to offer a compelling investment opportunity due to its unique market dynamics. For investors, a diversified portfolio that balances physical assets and mining equities may offer exposure to silver's stability as a store of value and its growth potential as a critical industrial metal.

Special Report

The Uranium Miners Opportunity

We believe uranium mining equities are poised for growth as demand for nuclear power increases, driven by AI data center needs and electricity demand. Geopolitical shifts, such as Russia’s export restrictions, and global pledges to triple nuclear capacity by 2050 highlight supply chain importance. This creates a compelling case for uranium miners, which are supported by strong market fundamentals.

Important Disclosures

An investor should consider the investment objectives, risks, charges, and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only market makers or “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.